A brief market wrap and a few observations heading into the weekend...

The October Delivery FNCL 4.0 went out -0-17 at 102-11. Rate sheet influential mortgages, which were trading at extreme oversold spread levels this week, performed well against Treasuries and swaps today, but huge price declines forced lenders to reprice for the worse, pushing mortgage rates higher. As would be expected, originator pipeline hedging picked up today. Over $3bn in new loan production was sold forward in the TBA market, mostly in 4.0 and 4.5 30 year paper.

While the damage seems dramatic, after the dust settled, you can see the FNCL 4.0 has landed right back in the middle of it's month long range.

Steep MBS price declines were a direct result of a correction in the long end of the benchmark yield curve. After spending the entire week trading at extreme overbought levels, 10s finally came back to Earth today, settling directly in the middle of the PANIC ZONE. Seriously, right in the middle!

Sell side volume was huge in the long end of the curve. I wouldn't necessarily describe this weakness as a shift in the bond market's bias (away from duration) as much as I would say accounts were doing a little position squaring before the weekend (balancing out positions after being WAY LONG). No one wanted to catch the falling knife (see crowded open interest at 125 strike in TY), especially not on a Friday.

The 10-year Treasury note went out -1-14 at 99-26 yielding 2.645% (+16bps). The long bond was the worst performer on the curve at -3-09 to 103-11 yielding 3.69% (+17.4bps). The 2s/10s curve was 12bps steeper at 208bps.

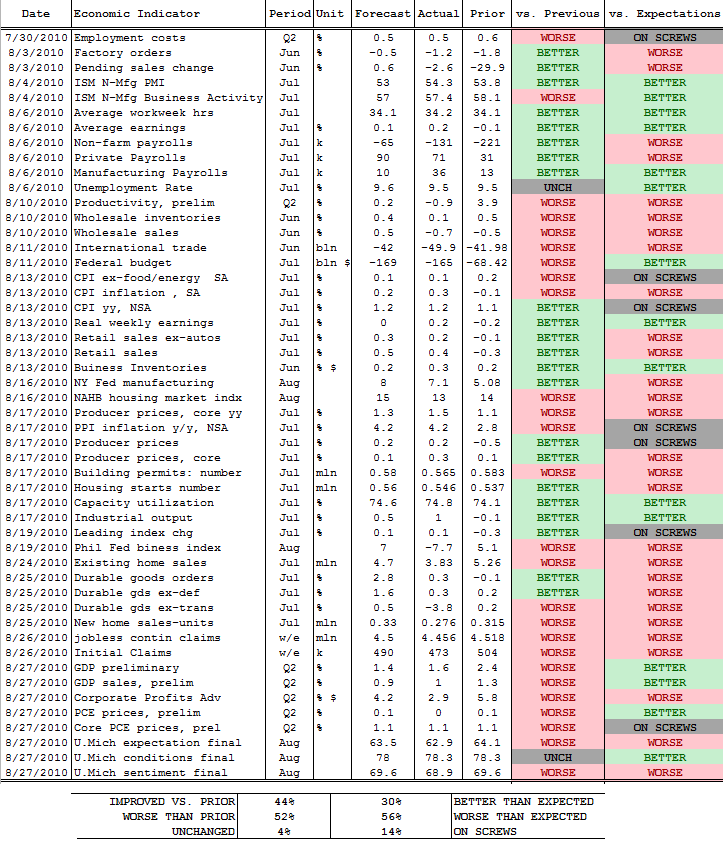

There has been much discussion about how bad economic data has been lately. Below is my econ screener. In the last month, 44% of releases have improved vs. the prior report while 52% have been worse and 4% have been unchanged. 30% of these reports have beaten the market's estimates while 56% have been worse than expected and 14% "on the screws".

Seems like we have a forecasting problem doesn't it?

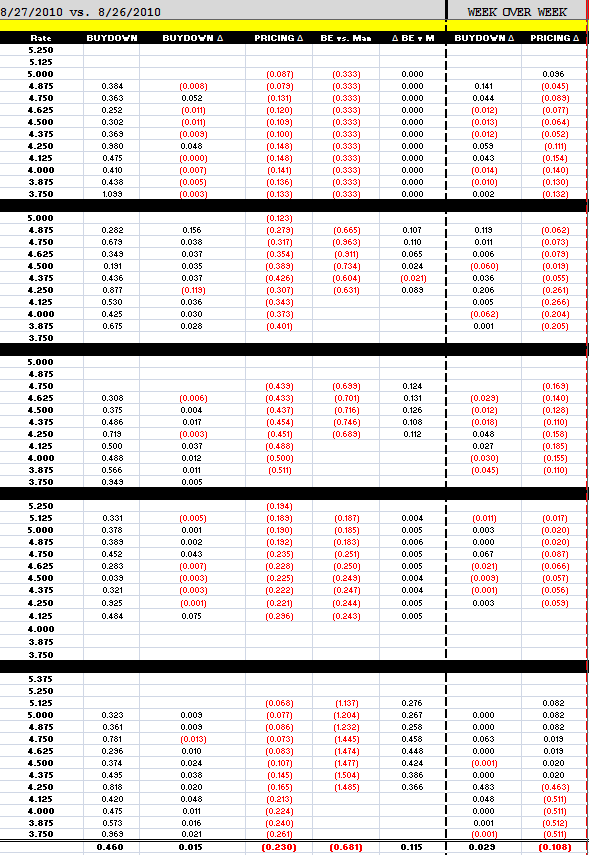

Reprices for the worse were reported across the board. On average loan pricing was 23bps worse on a day over day basis and 10.8bps worse on a week over week basis. The largest rebate reductions were applied to the base rates most folks are floating: 4.00 to 4.625%.

Yesterday was the best day to lock this week....

Enjoy your weekend....