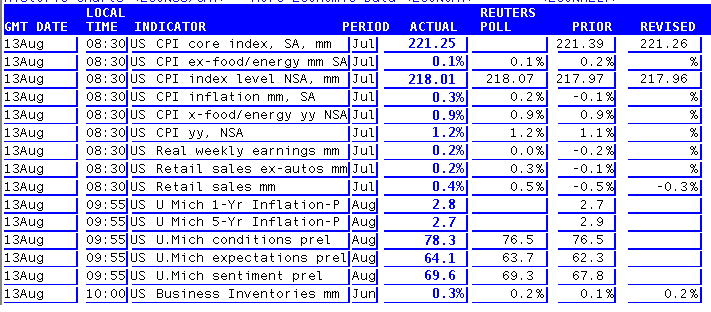

Treasuries are maintaining their bid and "rate sheet influential" MBS prices are higher after a barrage of economic data...

Below is a recap.

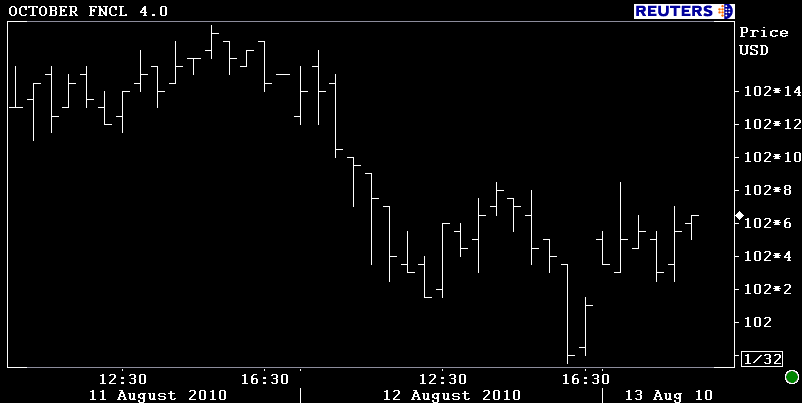

Most secondary desks have rolled over to October delivery coupons. The October FNCL 4.0 is up 0-05 at 102-06 and the FNCL 4.5 is +0-04 at 104-00. Yield spreads are wider.

The yield curve continues to get crushed (flatten). 2s/10s are 4bps flatter at 216bps. 2/30s are 6bps tighter at 334bps wide. 5s/10s are 3bps tighter at 124bps. 5s/30s are 5bps tighter at 242. 10s/30s are 2bps tighter at 118bps.

The 2.625% coupon bearing 10-year note is +0-11 at 99-09 yielding 2.708% (-4.2bps).

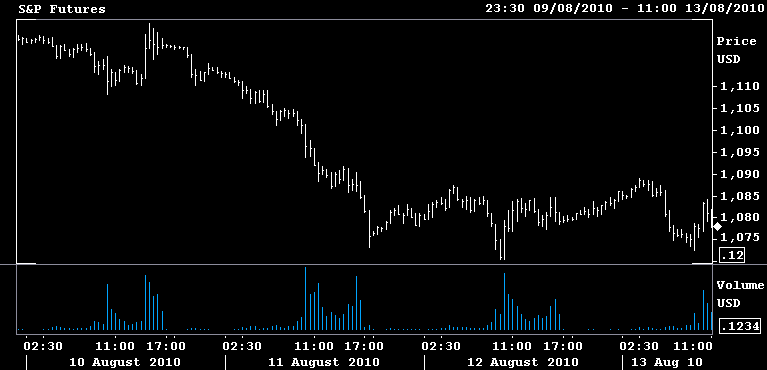

S&Ps have retraced through several layers of support over the last few days and have rejected retests of 1090 on multiple occasions. S&P futures are currently UNCH at 1079.25.

10s are holding their bid as it appears the overbought status of the flatter yield curve has yet to draw out enough profit taking to deter supportive"buying on the dips". This is a positive for folks who've gone long the long-end of the yield curve but might not mean much in mortgage rate world. Yesterday we witnessed a massive influx of loan supply on the street as originators locked in their pipeline, in size. Nearly $5bn in new production MBS was offered by originators with more than 75% of that paper in 4.0s.

3.5s are still illiquid but 4.25 is definitely available on rate sheets.

I haven't checked loan pricing today but I wouldn't be surprised to see a little extra margin baked into offers. This is a function of lock desks saying "WE'VE GOT OUR FAIR SHARE OF BUSINESS, WE'LL LET YOU KNOW WHEN WE NEED MORE PRODUCTION"

Plain and Simple: Primary/Secondary loan pricing spreads are wider and mortgage rates should be worse