- JULY FNCL 4.0: +06 at 101-15 (101.469) AUGUST FNCL 4.0: +06 at 101-04 (101.125)

- Secondary Market Current Coupon: -2.6 bps at 3.804%

- CC Yield Spreads:+85.1bps/10yTSY. +79.1bps/10yIRS. SPREADS WERE WIDER ALL DAY

- UST10YR: -7.1bps at 2.953%. 2s/10s: 4bps FLATTER at 235bps. 2YR NOTE=LEAST BEST PERFORMER AGAIN

- S&P CLOSE: -3.1% at 1041.24 HIGH: 1074.53 LOW: 1035.44 Financials: -3.88%

Let's review recent events.

As euro crisis contagion exhausted itself in May, stocks began to rise from long-term support levels. Short covering led to more short covering and stocks rallied all the way into quadruple witching day. This was not an originator friendly event as mortgage rates looked to be on the verge of 5.00%. However, bond traders were quick to sniff out stockside weakness (the stock rally was forced buying) and a flight to quality poured into benchmark Treasuries. Stocks were soon trending lower, and lower....and lower and Treasuries were on a tear that led "rate sheet influential" MBS coupons to new record highs.

Again. And Again. And Again.

Fast forward to today...

The S&P has abruptly hit a critical layer of support at 1040 and....

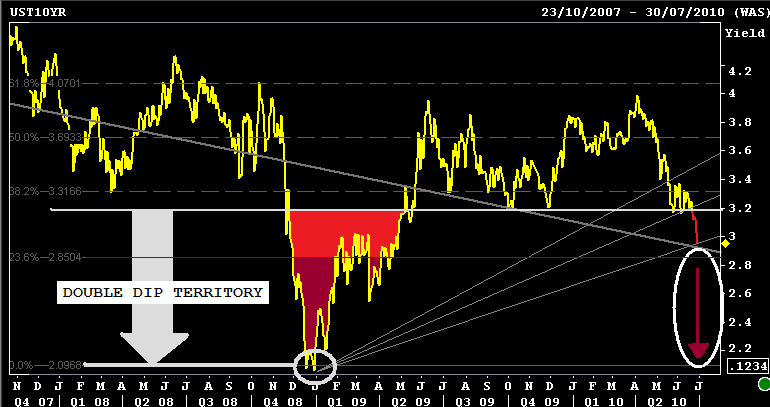

...the benchmark 10 year Treasury note yield is back below 3.00% for the first time since April 27th, 2009 and...

...we find ourselves being offered the most aggressive loan pricing of our lifetime (SEE IT HERE) as bond yields begin to form a double-dip pattern of their own.

I'm not ready to throw in the towel just yet though.

My point: Our long-term bias has been greatly clouded by a short-term repricing of risk. While "bumps in the road" are currently a significant hurdle of uncertainty, I am confident in the U.S.'s ability to innovate and produce profits. The Crisis of Confidence will eventually abate and the headline news risk discount that is currently priced into the market will go away with it (flight to safety). This may not happen in the next day the next month or even this summer...but it will happen. I still feel our economy is no longer searching for a bottom, the worst case scenario has been avoided and there are great opportunities to invest in the long run recovery of the United States.

I think we'll look back on this one day and say "Wow, I wish I could have bought some stock in XYZ company. It was so cheap back in 2010".

My strategy: Keep It Simple Stupid. To avoid adding to contagion, let's take in new developments one day at a time. No need to jump to BIG PICTURE conclusions just yet. Look for S&Ps to attempt a bargain buying rally off of 1040 tomorrow. Look for interest rates to take a breather from recent rallies.

Fear is the lack of faith. If you want a place in the sun, prepare to put up with a few blisters.