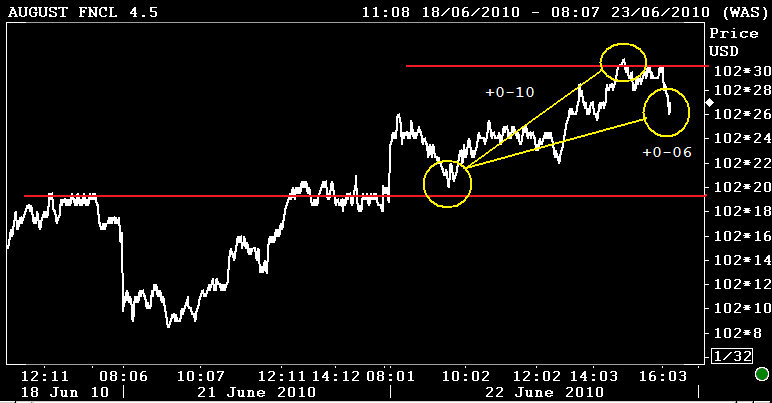

- JULY FNCL 4.5: +08 at 103-08 (103.250) AUGUST FNCL 4.5: +0-08 at 102-27 (102.844)

- Secondary Market Current Coupon: -5.5 bps at 3.918%

- CC Yield Spreads:+75.3bps/10yTSY. +79.7bps/10yIRS. WIDER vs. 5pm marks yest.

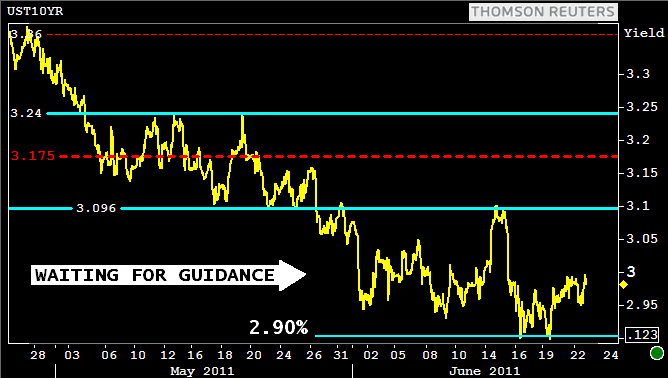

- UST10YR: +7.7bps at 3.17%. 2s/10s: 3bps FLATTER at 248.5bps

- S&P CLOSE: -1.61% at 1095.31. HIGH: 1118.10 LOW: 1095.00 WORST SECTOR: Energy -2.70%

- HOMEBUILDERS DOWN OVER 3.00%

Mortgages traded to new record price highs today. The low production volume origination environment continues to support favorable "rate sheet influential" MBS valuations. Although the August FN 4.5 MBS coupon traded 10 ticks off its lows of the day, the majority of lenders did not reprice for the better. Secondary is holding back about 25bps in rebate from rate sheets (plus whatever margin was already baked in...which applies to brokers and direct lenders).

The 10 year Treasury note was the best performer on the curve, declining 7.7bps all the way down to long standing 3.17% support. This is the outer limits of the recent range. If you "play the range until the range plays you"...you'd be looking to lock in the near future.

The S&P had a bad day. First it broke retracement support and then tested and broke 200 day moving average support. After running though two key technical levels, volume picked up into the sell off and S&Ps were left to find a floor, which was eventually hit when the closing bell rang. A retracement back to 1089 is possible. If this occurs tomorrow it would allow lenders to pass along some withheld bps to consumers. At that point I would be locking!

We can look at price action in one of two ways today...

- A Product of Excess Uncertainty: continued choppy behavior within a well-defined but wide range OR

- Double Dipper: We are experiencing the beginnings shift in global economic sentiment...sparked by a downturn in housing, weak June employment numbers, and earnings disappointments

If you are a supporter of the range bound perspective, you might view today's interest rate rally as a "buy the rumor, sell the news" pre-FOMC flight to safety. This would assume you felt TSYs were overbought and unlikely to break long term 3.17% resistance. You might also feel that stocks were "selling the rumor" so they could "buy the news" tomorrow. The rumor being a significant FOMC downgrade of housing or the labor market. Supporting this theory: stocks are still trading in low volume and the 10yr note didn't breakout of the recent range

If you're a "DOUBLE DIPPER", today's worse than expected Existing Home Sales print was another nail in the coffin of the global economy. You've probably been patiently waiting for the short covering led stock market glass rally to shatter. This camp speculates that the Fed will downgrade the housing market tomorrow by referencing "SHADOW INVENTORY" in the FOMC statement.

While option #2 seems like the most logical outcome, especially to frustrated housing professionals (even I am frustrated), I find it hard to believe the Federal Reserve will "cut off their nose to spite their face" and spook the markets with some bearish verbiage. More or less, given the government's recent rhetoric on housing and the NAR's "glass half full" spin on data, the Fed will probably sidestep the issue while finding a way to remind us all that the road to recovery is going to be LOOONG and ROCKY.

The statement I expect the Fed to share: There will be "ups and downs" but the world will move on because central bankers and government's around the world are working together to contain the crisis.

The strategy: look for stocks to open lower tomorrow morning and rally in the afternoon. If this happens and lenders pass along withheld pricing tomorrow morning, LOCK YOUR FLOATING LOANS or go for a floatdown.