The mixed messages offered by the market in previous weeks have evolved into no messages.

In June, we've witnessed irrational interest rate reactions that led prices to chop about a contained range in an angry manner. Stock trends that once appeared directional lost their way (and participation). The pain trade played out and profiting options exhausted themselves into expiry. Related markets started making more independent decisions (stock lever detached) and equities eventually went numb (Zzzz).

NOW WHAT?

Headline writers are searching for viral content while fast money traders seek out the next fad.

This leads to lots of question asking and doubt raising. Is the Euro going to hit parity vs. the dollar? Does it really matter? What about oil demand? Is it the right time to be investing in advances in productivity (tech)? Should I keep principal parked in a high yield money market account? What about index rebalancing? How much lower can housing really go? Are we looking at the potential loss of an entire wealth class in America? What about National Security and War? Ugh. All in an election year!

The feeling of uncertainty is the only consistent theme in this marketplace. There is clearly no shortage of unidentifiable headline news risk. That's big picture though, in the short term the market is likely to remain numb...at least until the FOMC releases their policy statement at 2:15 on Wednesday afternoon.

The range range is on as stocks have/are losing early session strength. Traders continue to sell into rallies indicating there is a leash on upside potential. We have yet to see how far stocks could fall, but I'd target the 200 day moving average (1111) for a retest.

S&Ps are +7.75 at 1118.

The stock lever did reconnect today. Benchmark TSY yields, which lost a portion of their flight to quality bid after the Chinese decided to "Reform" their pegging policy, have benefited from equity side exhaustion. The 10yr note is currently bid -0-05 at 102-05 while yields are up only 2bps at 3.245%. The 10 year note touched 3.31% in early trading.

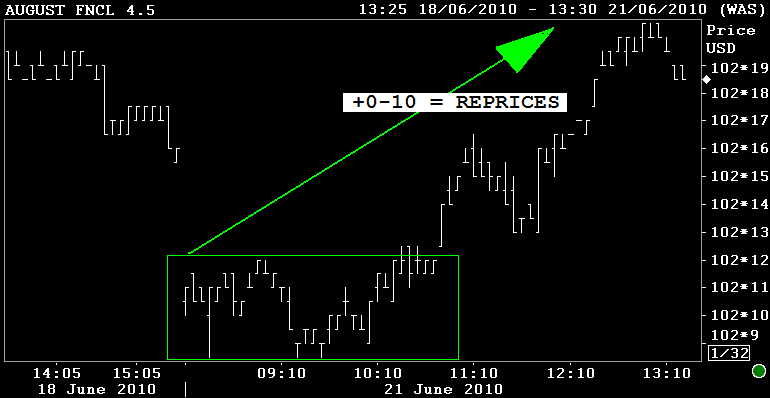

This has led the AUGUST FNCL 4.5 MBS COUPON on a 10 tick rally (10/32 or 0.3125). HOW MUCH RALLY DOES IT TAKE FOR LENDERS TO REPRICE FOR THE BETTER?

HERE COME THE REPRICES FOR THE BETTER

Reprices for the better are due.....