Good Morning. Happy Friday. Congrats to the Lakers. Go U.S.A beat Slovenia.

Although summer doesn't officially begin until Monday morning, it's gonna feel like the middle of August on Wall Street today. The econ calendar is empty and decision makers are already plotting their path toward an early exit, leaving the junior varsity squad to man the desk with explicit instructions to avoid being run over by heavy directional traffic.

This leaves the market feeling illiquid and susceptible to chopatility because it's quadruple witching day! Stock index futures, stock index options, stock options, and single stock futures all expire today. HERE IS THE CALENDAR

Typically quadruple witching days carry with them more price volatility as traders cover positions to avoid delivery, but this one might be different. We've already witnessed a massive short squeeze in equities and volatility as measured by the VIX (and implied bp vols) has been on the steady decline. With that in mind, the effects of expiration may be dulled today (more to come next week though).

The "evening doji star" we were watching for yesterday didn't play out but stocks sure did look like they wanted to go lower. This has been a consistent observation since the S&P broke the 200 day moving average and market participation plummeted. Notice how volume has steadily declined and the S&P started hitting lower highs and lower lows.

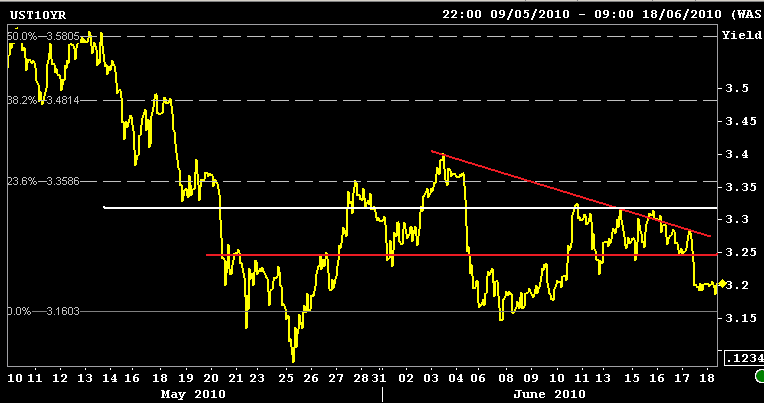

While stocks have been squeezed higher by forced buying and day trader tag-alongs, the interest rate market seems to be participating in economic reality. Yesterday, following more than one worse than expected econ flash, a flight to safety sent benchmark interest rates back to the lows of the recent range. The 10 year note rallied 20ticks to 102-20 and rising prices drove yields down 7.3bps to 3.191%. The long end of the yield curve was bought in size (higher volume in falling open interest).

The descending triangle we discussed yesterday morning played out nicely. The 3.50% coupon bearing 10 year note is currently -0-04 at 102-15, up 1.3bp in yield at 3.203%.

Despite a flatter yield curve and benchmark rate rally, mortgages saw a healthy bid yesterday. This follows a few days of price cheapening and spread widening so perhaps we could say the firm session was a function of short term strategizing? The rally was led by fast money buyers looking to take advantage of falling implied volatility but loan servicers and real money accounts were seen buying current coupon MBS. Supply and demand continues to favor the buyer as new loan production just ain't what it used to be...regardless of that I bet secondary is making a profitable spread on pricing right now as it seems fallout hasn't hurt pipelines. This allows secondary to go to the cash window and sell new loans at higher dollar prices and pocket a portion of the appreciations.

The FN 4.0 is UNCH at 100-05. The FN 4.5 is UNCH at 102-30. The secondary market current coupon is UNCH at 3.99% (I am still running 4.0s at 1 CPR even though they're in par territory). 103-00 is resistance for the FN 4.5.

This is from a post I wrote earlier this week. It still applies...

The EU crisis has made no real positive progress (only time will heal), oil is pooooouring into the Gulf of Mexico, the U.S. housing market is experiencing a horrible tax credit hangover, and the reality of a LONG SLOW ECONOMIC recovery is setting in around the world.

Yet...nothing stopped the S&P from testing and breaking the 200 day moving average.

Technically, it's been a slow slog higher, but stocks have finally crossed through that milestone and APPEAR to be building "momentum" on the surface. The only problem is there isn't much participation in the rally and and the equity market uptrend looks to have been primarily a function of SHORT COVERING ahead of options expiry today. The pain trade unfolded right before our eyes. The stock rally is made of glass.

While this paints a positive picture for interest rate watchers, that was then and this is now. Float boaters should be nervous about the stock short squeeze evolving into a quarter-end rally. If this does occur, nervous retail investors are not likely to reallocate their flight to safety positions (in the short end of the yield curve) into the risk game, but professional investors who've parked cash in the long end of the curve (yield grab) would be quick to exit those positions if stocks continued to trek higher (bear steepener). If this happens, "rate sheet influential" MBS prices would suffer and mortgage pricing would worsen.

Plain and Simple: the recent stock market rally has yet to grow legs of its own as forced buying has led the indexes higher. This leaves equities susceptible to a sell off. However, stock and bond markets are essentially trendless (range bound) and waiting for new guidance. So even though the build up in equities is not indicative of a strong shift in sentiment, if new money makes it way into risk markets in the next few sessions, the glass rally could evolve into something with a little more strength heading into quarter end (bake in strong earnings). If stocks do extend the recent rally, it would surely push the FN 4.5 back toward the 101 price handle and loan pricing would suffer as a result. Either way, energy is stored and we are due a directional move.

In terms of lock or float, although some lenders were holding back bps from best efforts loan pricing yesterday, reprices for the better were aggressive and mortgage rates were close to the best levels of the year. This gives you a small cushion to play with in the day's ahead. If the 10 year note breaks 3.31% support and the S&P cross through 1120..I would be locking. This guidance is for the gamblers out there...personally I don't see much reason to roll the dice. Don't be the hog that gets slaughtered.

On a side note, one of my college roommates is getting married tomorrow so I will be traveling to Pittsburgh today. Wedding + Hockey Players + Loud Music + Tasty Refreshments = GOOD TIME. In the event we lose cabin pressure and the market makes a directional move, please use the comments section of this post to alert fellow rate watchers. I will be watching from the road...