Good Morning.

News from across the pond was not what I would consider "investor friendly" last night....

FROM REUTERS: German ZEW index posts first fall in 9 months, tempering recovery hopes. German analyst and investor sentiment fell in June by the most since the height of the financial crisis in 2008, hit by concerns over the euro zone's debt troubles and sending the euro lower against the dollar. The closely watched survey by the Mannheim-based ZEW think tank dropped much more than expected to 28.7 from 45.8 in May, its sharpest fall since October 2008. The consensus forecast in a Reuters poll of analysts was for a slide to 42.0. Current conditions indicator rises to -7.9 from -21.6.

FROM REUTERS: A day after admitting that some Spanish banks were being frozen out of international credit markets, Madrid raised 5.2 billion euros in 12- and 18-month T-bills at an auction, but paid a significantly higher average yield than last month. Spain paid an increased risk premium at a debt auction on Tuesday, after having had to deny German media reports that it may soon be the next euro zone state to need a Greek-style bailout. A German government official this morning said he did not think that Spain, the latest focus of concern about euro zone sovereign debt, would be on the agenda of a European Union summit about stricter fiscal rules and economic reform on Thursday.

FROM REUTERS: The Bank of Japan chief said on Tuesday financial markets have yet to be convinced by Europe's efforts to tackle its debt crisis, underlining the need for Tokyo's new government to win investor confidence that it can rein in the country's huge public debt. The central bank also detailed its new loan scheme aimed at beating deflation over the longer term, saying it would provide up to 3 trillion yen ($32.75 billion) to industries with growth potential, although analysts say it will do little to boost the fragile economy.

FROM REUTERS: French President Nicolas Sarkozy bowed to German demands for tougher European budget rules as a steep downgrade of Greece's credit rating and distress signals from some Spanish banks put new pressure on the euro zone. After talks in Berlin late on Monday, Sarkozy accepted a German proposal that euro zone states which persistently breach budget deficit limits should have their voting rights in the bloc suspended, even if that requires changing the EU treaty. He also yielded to Chancellor Angela Merkel's insistence that closer "economic government" should involve all 27 European Union members and not just the 16 that share the common currency, as France had sought, and he dropped demands for a dedicated euro zone secretariat.

FROM REUTERS: The global economic recovery is likely to be "slow and tortuous" and China faces risks from a multitude of factors including trade protectionism and bad real estate loans, China's Banking Regulatory Commission (CBRC) said on Tuesday. "The chances in 2010 of some credit assets forming into substantive risks and losses has increased," the CBRC said in its annual report. Among the risks faced by Chinese banks, it identified quite large risks from "unwise lending" to local government investment units, as well as the sovereign debt crisis and U.S. dollar exchange rates.

Not to mention Moody's downgraded Greece's credit rating yesterday: READ MORE

Yet the Euro shrugged off the news and continues to rally....

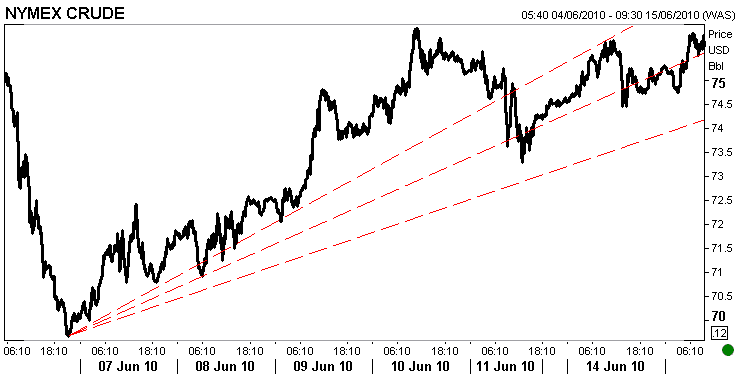

As does oil....

And U.S. stocks..

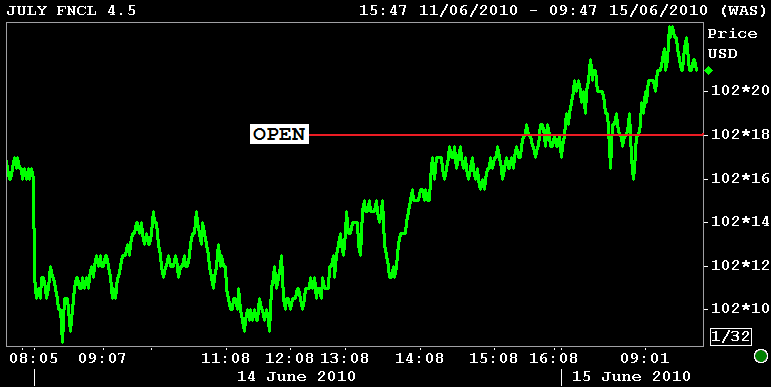

And the FN 4.5...

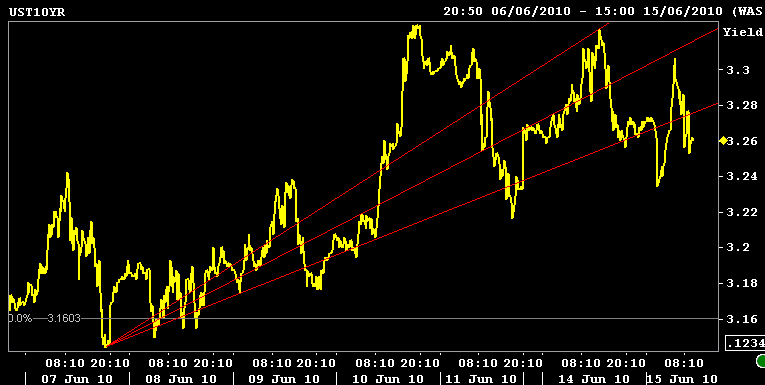

The 10yr note isn't "rallying" but it ain't doing so bad all things considered....currently +0-00 at 101-31 at 3.264%.

Negative news out of the EU isn't much of a surprise anymore and investors seem to be comfortable with the EU crisis discount they have priced into asset valuations...either that or options expiration week is driving activity and sending all sorts of mixed messages to a market clamoring for more information. Look for stock traders to attempt another test of 1108. Meanwhile, mortgages are performing quite well vs. their benchmarks this morning...rate sheets s/be unchanged or slightly better.