Risk markets are feeling the flow and doing the bull dance this morning...much to the chagrin of interest rates.

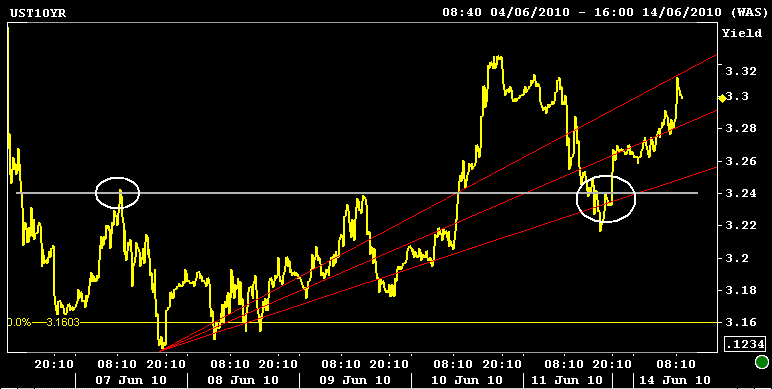

The 10-year TSY note yield is currently -0-18 at 101-22 in price and +6.6bps in yield at 3.299%. The Fibonacci fans I used to demonstrate weakness on Friday have proven a reliable forward indicator as 10 yr yields continue to trend upward. If 10s blow through 3.31% support and break the 3.33% pivot, the next technically significant test would occur at 3.36%, then 3.40%.

This is the beginnings of a bearish breakdown for the benchmark 10yr note...confirmation of this breakdown is in process at the moment.

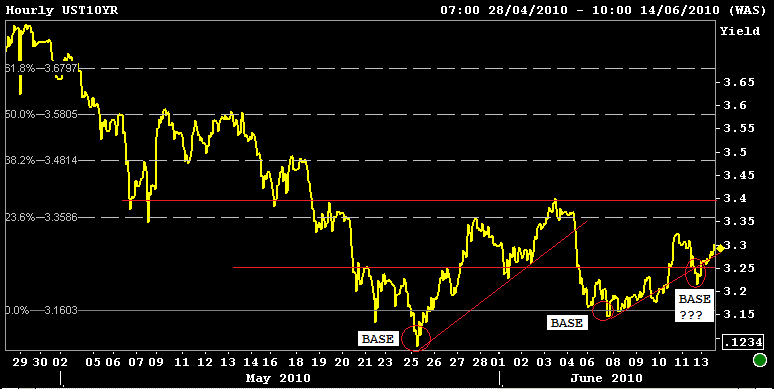

Looking at recent progress from a wider perspective, the intermediate interest rate trend is indicative of higher yields in the week ahead. Notice how corrective rallies have failed to reach previous lows and new bases have been formed at higher yields. A close at or above 3.31 would serve as a sign that the market is willing to let yields wander into the 3.40 to 3.50% range.

The stock lever is still the primary guidance giver of "rate sheet influential" benchmarks though. Rallying stocks = selling interest rates. Unfortunately the S&P appears destined to retest the 200 day moving average at 1108....currently +0.51% at 1097.19. While I wouldn't expect a rush of new cash to pour into equity markets if 1108 is broken (from the short end of the yield curve), an attempt to pass S&P 200dma resistance would likely lead the 10 year note toward the above discussed bearish yield targets. Not good for rate sheet rebate!

Mortgages are following the directional guidance of their duration adjusted benchmarks. The FN 4.0 is -0-05 at 99-18 (99.563) and the FN 4.5 is -0-04 at 102-12 (102.375). The secondary market current coupon is 3.2 basis points higher at 4.085%. Yield spreads are modestly tighter as TSY yields backup. Here is my scorecard: +78.1bps/10yTSY and +69.2bps/10yIRS.

We didn't learn anything last week that we didn't know already know about the health of the global banking system, the crisis in Europe, or a potential solution to the oil spill. Yet the Euro, Stocks, and Oil are all testing the will of "doom and gloomers" to start the week.

With trader sentiments still reflective of a non-committal bias, headline news remains a primary motivational factor of tactical stances (short term strategy). But what headlines will the market focus its flows on? More recently the EU crisis has started to show signs that its strength as a tapebomber is fading. If that's the case...what is the next bubble trade? OIL??? This seems appropriate given the nine month low crude oil prices hit in May, especially as we move deeper into the summer driving season and oil continues to pour into the Gulf. When does supply and demand start to "matter" again?

NYMEX Crude prices are recovering and looking to get more expensive....

If oil rallies, stocks will follow, and mortgage borrowing costs will rise. What do you think will move money in the week ahead? More range trade or an extension of intermediate trends?

May housing data and an update on inflation are on the econ calendar. READ MORE