Good Morning. Stock futures are higher and benchmark interest rates are losing a portion of their flight to safety bid.

After closing at a 7-month low yesterday (worst close since Nov.11,2009), S&Ps rebounded off a key level of technical support in the overseas electronic session. S&Ps are currently +5.00 at 1053.25. While off the overnight high of 1061, S&Ps are holding above 1050 support.

Trading volume in equities was low vs. recent averages yesterday, but busier than the amount of activity seen during last week's profit taking/position squaring parade. Trading volume this morning is once again nothing to blog home about, but open interest is slightly higher indicating there a modest amount of "new" money entering the market. Don't read too much into this though, low volume implies the uptrade is driven by speculative positioning for short term profit opportunity...aka day trading. I can't stress this enough...the market is noncommittal but it's a good sign that S&Ps are holding 1050 support. SEE LONG TERM S&P CHART FROM LAST NIGHT'S CLOSE

An appreciation of the EU member currency led the S&P off of 1050 support last night. In overseas trading the Euro saw a high of 1.1982 and a low of 1.1901, currently the Euro is bid +0.2% at 1.1936. The Euro experienced a bearish breakdown following the release of NFP data on Friday, since then forex flows have led the Euro sideways in a tight range below the 1.20US$ pivot. Continued weakness would drag stock indexes down which would likely lead to lower benchmark Tsy yields (and wider MBS yield spreads). READ MORE

The benchmark 10yr TSY note closed at it's lowest yield since May 15, 2009 yesterday. However yields rose overnight as stock futures ticked higher. The 3.50% coupon bearing 10 year TSY note is currently -0-10 at 102-22 yielding 3.182%. The 2s/10s curve is 1bp STEEPER. Tomorrow the TSY will reopen (auction) $21 billion 3.50% coupon 10yr notes. Look for debt traders to seek out price concessions to accommodate new inventory supply (lower prices = higher yields)...the STEEPER shape of the 2s/10s curve is one example of a pre-auction concession, of course the continued success of supply cheapening strategies is highly dependent on the sentiment of stocks and the value of the Euro. READ MORE

Last but not least, rate sheet influential MBS prices are lower and yield spreads are tighter. The FN 4.0 is currently -0-02 at 100-02. The FN 4.5 is -0-01 at 102-28. The secondary market current coupon is .08bps higher at 4.005% (1 CPR on 4.0s for anyone else keeping score). MBS yields have risen less than benchmark yields so far today, yield spreads are tighter. Here's how I have 'em: +83.2bps/10yr TSY yields. +72.5/10yr IRS rate. HERE is a long term MBS price chart

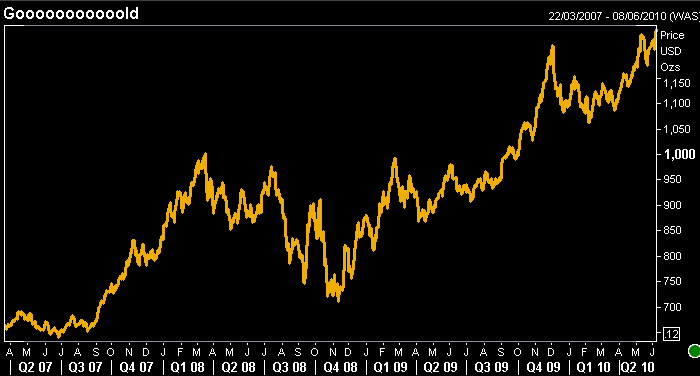

Yesterday I discussed the increasing opportunity cost of investing in risk averse US Treasuries. This observation implied market pariticipants would soon begin looking for greater relative returns in another risk averse asset. Well Gold rallied to an all-time high yesterday and XAU is holding those gains today...regardless of a modest stock market rebound. This reflects a broad based risk averse attitude and a desire to protect principal investment from deflation.

Markets are range bound at the moment but teetering on a broader technical breakdown. It's still all about the stock lever and the Euro. If the Euro fails to find stable footing vs. global currencies and U.S. equities break 1050 support...interest rates will fall further.

Regardless of the modest uptick in benchmark yields, MBS prices are mostly flat. I spy with my little eye rate sheet rebate paying at 4.375!!!

I will add some comments below on the headlines that "motivated" the markets last night....