- FN4.5: +0-20 at 102-22! GN4.5: +0-20 at 103-09!

- Secondary Market Current Coupon: 4.029%

- CC Yield Spreads:+82.1/10yTSY. +70.9/10yIRS. 3m10y Vols Higher

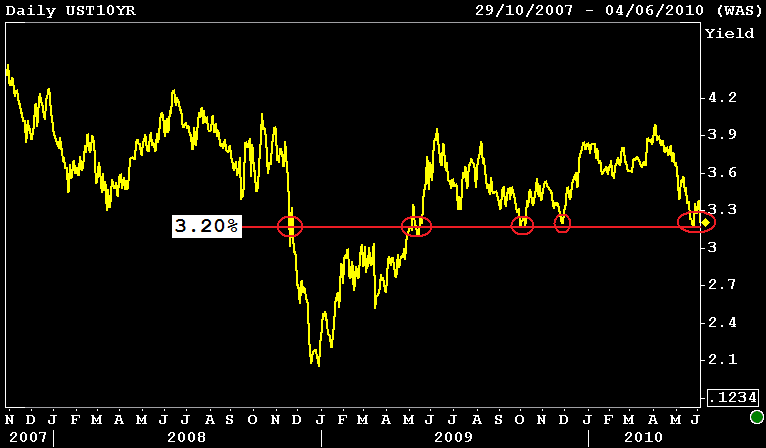

- UST10YR: -16.2bps at 3.208%.+1-12 at 102-15. 2s are least best performer. -9.1bps at 0.73%

- S&P CLOSE: -3.44% at 1064.88. HIGH: 1102.79 LOW: 1061.46

The Employment Situation report disappointed risk markets. Stocks sold off. Bonds rallied and lenders repriced for the better. Aggressively! Mortgage rates are back to their best levels of the year.

The FN 4.5 went out at a record high closing price...only 7 ticks below the all-time intraday high price print.

The 10 year TSY note's violent bounce at 3.40% support almost totally washed out short-term bearish technicals, but yields failed to break long standing 3.20% resistance.

We've been here before....

While this week was all about profit taking and position squaring ahead of the release of NonFarm Payrolls, the stock lever is still the directional guidance giver of interest rates. When stocks sell, bonds rally. When stocks rally, bonds sell.

The devaluation of the Euro currency is the driving factor behind the market's tolerance for risk (stocks) though. U.S. Stocks and the Euro have been playing grab ass since early April when Greek "contagion" spread overseas into our markets.

If the stock lever is the primary influence over interest rates and a weaker Euro is leading stocks lower....then the bearish breakdown illustrated in the Euro chart below is a sign that interest rates are due to trade lower.

If this bearish breakout is a sign that the Euro is doomed to tick toward parity with the dollar...does that mean the U.S. is destined for a double dip? With housing teetering on a ledge and 6.7 million Americans out of a job for longer than 27 weeks...another decline in stocks will surely trigger more discussion about the potential for a "double dip".

Although the Euro broke a key technical support level, the S&P is still trading above 1050 and 10s haven't torn through 3.20% resistance. That means the range is still intact and pre--NFP "status quo" has been restored. With that in mind I think we should let the dust settle on this week end sell off before we seriously consider whether a double dip is really a 50/50 possbility.

PS. Can we even call it a "double-dip" if the economic recovery hasn't really gotten off the ground yet?

READ VIC's MORTGAGE RATE RECAP. IT'S GOOD STUFF