The Treasury Department announced the terms of next week's debt auctions. Treasury will offer $70 billion 3s, 10s, and 30s. Here is a breakdown of the auction dates and amounts...

3-Year Notes: $36,000,000,000 will be offered on Tuesday June 13. This is $4 billion less than the April 6th auction. This will be a new issue maturing in June 2013.

10-Year Notes: $21,000,000,000 will be offered on Wednesday June 14. This amount is unchanged from the April 7th auction. This is a reopening of the May 2020 maturity 3.50% coupon.

30-Year Bonds:$13,000,000 billion will be offered on Thursday June 15. This amount is unchanged from the April 8th auction. This is a reopening of the May 2040 maturity 4.375% coupon.

Auction sizes continue to trend lower. Less debt supply is always a great thing for the bond market's state of mind. However we may be battling greater forces next week, specifically the general sentiment of the marketplace. If stocks extend their rally and the bond investors lose their appetite for longer duration debt, less supply won't be much of a concession to potential bidders. In that event, market participants would gladly let these issues cheapen in price and rise in yield. Bad news for anyone floating their loans. Then again bad news comes in a more simpler form: a stock market rally. Debt auction supply in a risk tolerant environment just compounds the pain. On the other hand, if stocks are unable to maintain momentum and a "flight to safety" goes back in style, recently higher yields might look attractive to bidders and the snowballing could work in favor of mortgage rates. It's funny...everything seems to be resting on the fate of the stock lever.

Quick check on the markets....

S&P futures are currently +1.50 at 1098. Prices are back and forth between the 200 day moving average at 1104.80 and the 14 day moving average at 1093.

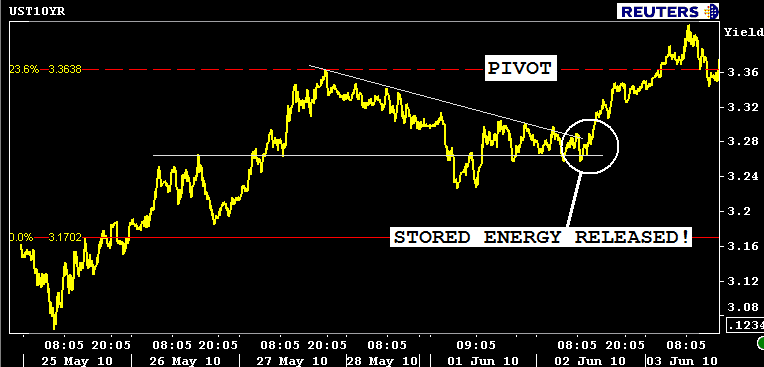

10s are meandering around the mid-3.30s. The 3.50% coupon bearing 10 year TSY note is -0-06 at 101-02, up 2.6bps in yield at 3.373%.

Mortgages continue to...TREND SIDEWAYS IN A TIGHT RANGE!!! Nothing new to discuss in this market. Rate sheet influential MBS coupons continue to perform well even though their directional leaders have chopped around a wide yield range. The FN 4.0 is -0-03 at 99 even while the FN 4.5 is -0-03 at 102 the figure. The secondary market current coupon is +1.8bps at 4.178%. Yield spreads moved tighter on the open and have basically held at the tights or just off the tights for the entire session.

I really don't want to over analyze price action today. Over the past two sessions we've witnessed the market price in a strong NFP print/take profits on stock shorts and TSY longs (get flat). Now that positions are square the market looks to be quietly re-evaluating what it deems to be "fair asset prices" based on seller supply and buyer demand (flows), which are modest at best today. Volume in stocks continues to decline on a day over day basis and volume bonds isn't terrible but remains consistently below average. (10yr futures contract open interest is lower. The same thing goes for S&P futures = POSITION SQUARING!).

READ THE OPEN FOR MORE PERSPECTIVE

Reprice risk grows as we get closer to the equity close at 4pm...but they're unlikely.