The next 24 hours are all about JOBS JOBS JOBS

Tomorrow morning the Bureau of Labor Statistics will release the EMPLOYMENT SITUATION REPORT. Because the Employment Situation Report is such an influential economic metric, it has become a source of great speculation. One dataset that foreshadows the government's official read on the labor market is the ADP Employment Report.

From ADP's Methodology Overview: Automatic Data Processing, Inc. (ADP) is the nation's premier provider of payroll-related services. Currently, ADP processes over 500,000 payrolls, for approximately 430,000 separate business entities, covering over 23 million employees, in all major industries and states. While doing so, every month ADP collects a wealth of information related to payroll employment well before publication of the Employment Situation.

The biggest difference between the two reports: ADP does not cover government jobs...ONLY PRIVATE PAYROLLS.

The Reuters consensus estimate for May 2010 payroll growth: +60,000

From the Release: Nonfarm private employment increased 55,000 from April to May 2010 on a seasonally adjusted basis, according to the ADP National Employment Report. The estimated change in employment from March to April 2010 was revised, from an increase of 32,000 to an increase of 65,000.

Plain and Simple: While this print was slightly worse than expected, revisions of the April report added 33,000 jobs to the overall private payrolls total. This more than makes up for the marginally worse than anticipated May number.

More excerpts from the release...

May’s rise in private employment was the fourth consecutive monthly gain. However, over these four months the increases have averaged a modest 39,000. The slow pace of improvement from February through May is consistent with the pause in the decline of initial unemployment claims that occurred during the winter months.

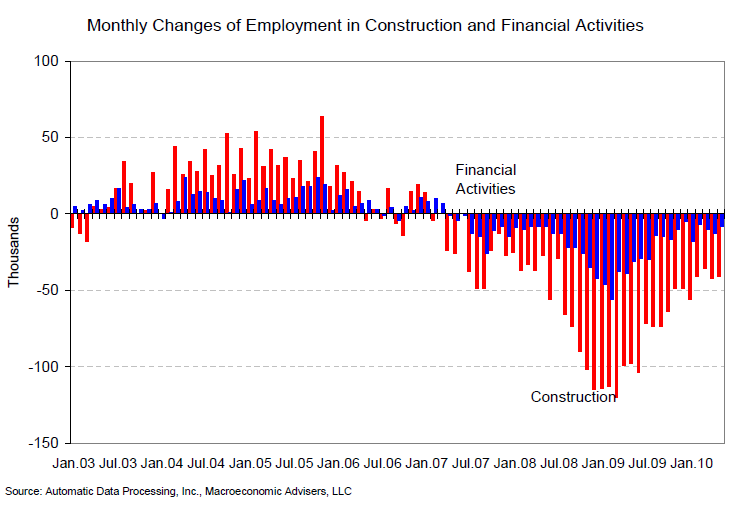

CONSTRUCTION AND FINANCIAL SERVICES ARE BIGGEST LOSERS: In May, construction employment dropped 41,000. This was slightly less than last month’s decline of 42,000. This was its thirty-fifth consecutive monthly decline, and brings the total decline in construction jobs since the peak in January 2007 to 2,191,000. Employment in the financial services sector dropped 8,000, resulting in over three years of consecutive monthly decline.

Ew construction...ew.

HERE IS AN IMPORTANT PART: Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s ADP Report does not include any federal hiring in May for the 2010 Census. For this reason it is reasonable to expect that Friday’s figure for nonfarm total employment reported by the BLS will be considerably stronger than today’s estimate for nonfarm private employment in the ADP Report.

The most relevant BIG PICTURE observation I take away is: THE PRIVATE INDUSTRY IS PRODUCING JOBS. Not just the U.S. government.

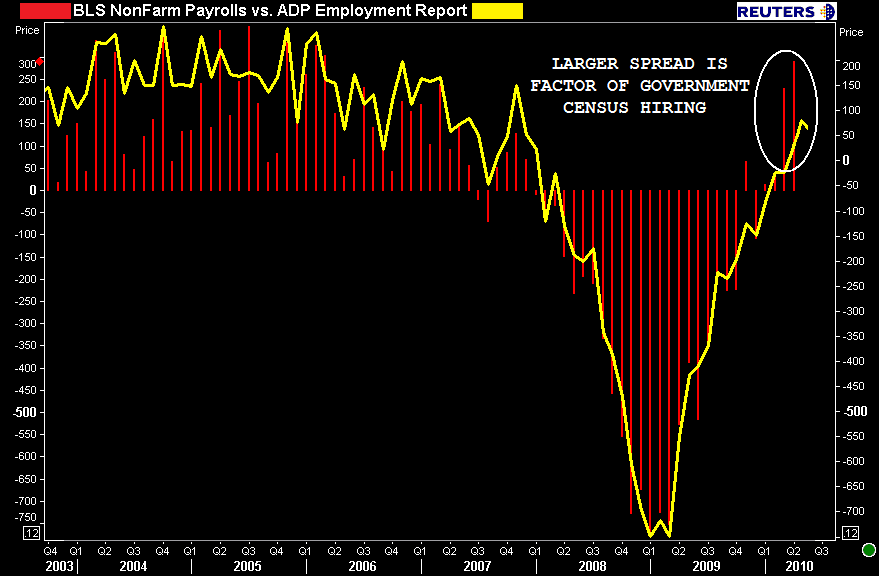

Below is a chart comparing ADP data to the official BLS NFP release that illustrates the widening spread between the two reports. The reason for the divergence is the government is on a hiring spree (census jobs plus less reliance on contractors) and the ADP does not count government payrolls while the BLS report does.

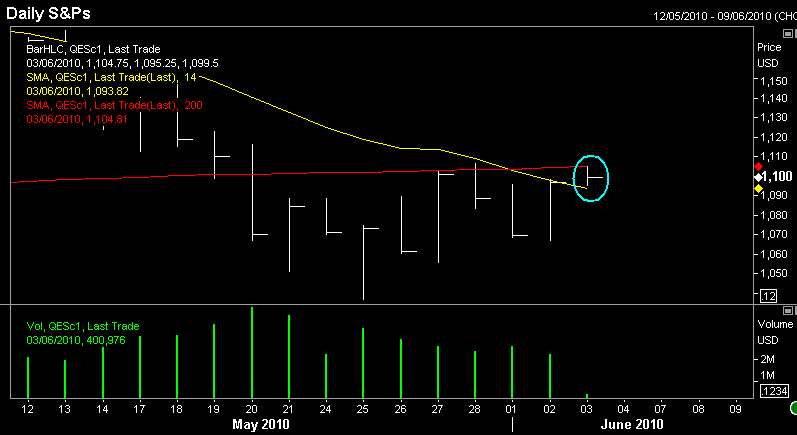

S&Ps moved higher overnight but failed to breach 200 day moving average resistance. Since then the S&P futures contract has bounced back and forth in a tight range between 1100 and 1104.75 (200 dma). Open interest is lower and prices are rising in below average volume...this price action implies more market participants are covering their short positions (forced buying and position squaring)

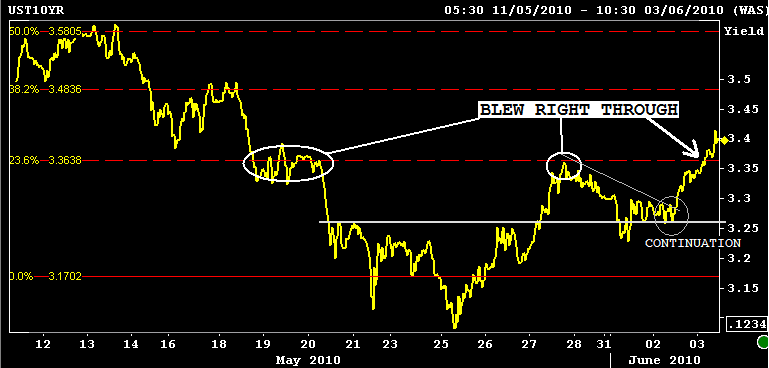

The opposite is occuring in the rates market, but for the same reasons: Traders are getting flat ahead of what is expected to be a strong NFP read tomorrow morning. The benchmark 10 yr TSY note yield is up another 5.2bps at 3.399%. The "energy storage" discussed yesterday morning has been released...and the move higher was violent (blew right through key retracement level which implies sellers are being washed out)

Falling interest rates prices plus declining open interest in a low volume environment implies investors are liquidating longs...this could the market telling us a short term trend reversal is coming as sellers are washed out of the market. However, this assumption would need to be followed by heavy buying and a strong rally in the next few days. Either way, if you are in the float boat you should be feeling very defensive! MORE ON PROFIT TAKING AND POSITION SQUARING

Once all the sellers are washed out I would expect 10s to retest the 23.6% retrace at 3.36/37...

All things considered, mortgages are doing great thanks to continually favorable supply and demand conditions. The FN 4.5 is -0-03 at 101-31. The secondary market current coupon is only 3.1 basis points higher at 4.191% and yield spreads are once again tighter (but off their tights of the day). The relative stability of rate sheet influential MBS over the last three days has generally allowed lenders to keep mortgage rates from rising as violently as their benchmark guidance givers.

Prices below 102-00 have drawn out demand from real money accounts....this is a strong level of support.

Plain and Simple: Traders have closed longs and covered shorts and are now ready to react to whatever news and information is offered in the next 24 hours. The big question is whether or not the recent stock market rally/bond market sell off is purely a factor of short term positioning ahead of NonFarm Payrolls or a broader shift in BIG PICTURE sentiment that favors risk/stocks.

It's really all about stocks still!

This is a tough spot to be in if you're floating. We are at a crossroads. Given the global environment I am more apt to believe the recent turnaround in rates is only short term, but that isn't supported by any conclusive evidence. Waiting for guidance with everyone else....

At least you didn't have your perfect game ruined by a blown call. READ MORE