Good Morning All. We were dominant in Vancouver yesterday....at least based on what NBC aired last night.

Shaun White was a man among boys on the halfpipe...I had to take Dramamine after his second run to slow the spins. Lindsey Vonn, of SI swimsuit edition fame, took gold in downhill skiing...and was hysterical afterwords. Shani Davis is now the back-to-back 1,000m mens speed skating champion, first time thats ever been done. And we are first in the medal count...5 Gold, 3 Silver, 6 Bronze. US 1 World 0. To be honest , all I care about is Canada not winning hockey Gold. I need the US or Russia to win that....actually no, I am good with any country besides Sidney Crosby's at this point. If he wins the Gold, Mike Milbury might just <insert sexual favor> Sid on national TV. I loathe Mike Milbury

Anyway, yesterday was a busy day.

- Single Family Building Permits and Housing Starts improved in January, Multifamily Permits were a drag. READ MORE

- Loan apps fell despite rates holding below 5.00%. READ MORE

- HAMP permanent loan mods doubled. 57.4% of permanent mods have been made to unemployed or underemployed Americans. Chance of re-default is high, job creation is a must. READ MORE

- FOMC Minutes revealed the Fed is torn between the selling assets and letting them run off on their own. We dont think the Fed sells MBS anytime soon...it would push rates up too much. READ MORE

- The FHFA released updated GSE initiatives. READ MORE

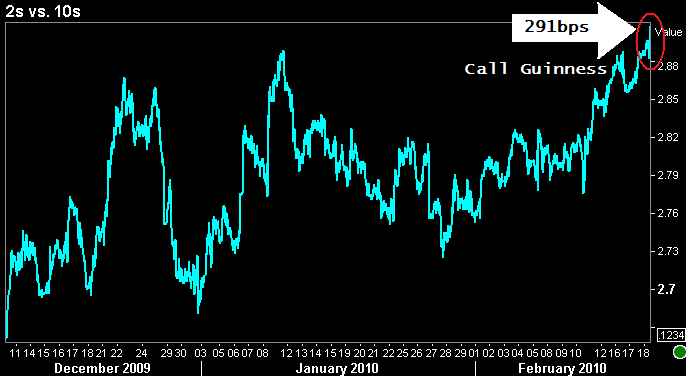

The yield curve bear steepened...again. The 2s/10s spread moved up to 289bps after the release of FOMC minutes. The 3.625% coupon bearing 10 year note went out -0-20 at 99-02 yielding 4.738%. The FN 4.0 was -0-17 at 97-26 yielding 4.227% and the FN 4.5 was -0-13 at 100-21 yielding 4.43%. The secondary market current coupon ended the session at 4.41%. +67.2/10yr TSY yields and +57.5/10yr swap rate. SUPER RICH STILL. Mortgages traded in average volume, which is good this week. Originators sold around $2bn 4.5s, which the Fed gobbled up faster than Mike Milbury at a drive in movie with Sidney Crosby. (ha!)

The dollar recovered short term losses against the Euro, Stocks stayed in the green, and Oil prices inched higher, holding above $77/barrel.

Treasuries traded sideways in LOW VOLUME last night, again. Dont forget that China is out all week for Lunar New Year, so to whatever extent you are looking to tie rational fundamentals to trader tactical biases...you could be spinning your wheels because thin flows have likely distorted directionality to some extent in the past two sessions, especially when you consider that China is one of those "real money" bargain buyers.

Jobless Claims and the Producer Price Index were released at 830 am.

JOBLESS CLAIMS: The market was expecting 430,000 new claims, it got 473,000. Much worse than anticipated. Mark one in the BOND BULLISH column.

PPI: The market was expecting core at +0.1%, it got +0.3%. Overall PPI was +1.4%, this was warmer than anticipated ( +0.80%). Mark one in the BOND BEARISH column.

In regards to initial claims, one has to wonder how much two consecutive blizzards in the DC/Philly area affected these numbers. Then again...anyone who had two hands, snow boots, and a shovel could have gotten work last week. I suppose that is "under the table". Anyway this was the NFP survey week...put that in the back of your head as a possible reason to believe that NFP might show RED again this month. Here is a recap of the rest of claims data:

re: PPI. Gasoline and Heating Oil pushed producer prices higher. The Fed is not worried about demand pull inflation...they are concern about COST PUSH INFLATION. Rising commodities prices and wages are two of the main sources of cost push inflation...wage inflation is not on the Fed's radar. Here is a recap of the data:

In the MBS CLOSE, MG reminded of the technical nature which the market continues to trade in, describing bias and strategy as "organic directionality confined to technical ranges"...and then "It's all about that past performance and it's suggestion for future behavior". This explains why bond bearish data has often times met with counterintuitive market responses over the past year.

The 3.625% coupon bearing 10 year Treasury note is unchanged at 99-02 yielding 3.738%. Yields are outside the 3.57 to 3.71 range...the confines of these pivot points have held true for most of 2010. With more TSY supply on the horizon (11AM today), one has to assume the market is willing to let benchmark yields continue to rise ahead of next weeks auctions.

When we zoom in on the past two days, there is a significant amount of chopatility, but that bearish bias is still evident. If the bearish bias continues to manifest itself through flows, 3.75% is our next level of support, after that 3.78% is a pivot. If the range holds, 10s could make a move all the way back to 3.68% then 3.66%. We think you know what we are expecting at this point....higher rates.

After opening to the upside, mortgages are now trading flat thanks to inflationary concerns in PPI data (if you need an explanation). The FN 4.0 is +0-01 at 97-21 yielding 4.224% and the FN 4.5 is +0-00 at 100-21 yielding 4.43%. The secondary market current coupon is 4.41%.

REPRICES FOR THE WORSE would occur around 100-16.

REPRICES FOR THE BETTER would occur around 100-30.

The dollar is +0.11%, stocks are up 0.23% (testing 1100 resistance), and oil is more expensive after a pretty big price dip at 830AM. The 2s/10s curve is now at 291bps. That's a new record...CALL GUINNESS!

NEXT EVENT: Philly Fed and LEI at 10am. Treasury auction terms at 11am. AQ doctors appointment at 11:15