The National Association of Realtors released December Existing Home Sales data this morning.

When

new homes are being built AND selling, money moves around the economy

more efficiently. The size of the housing market combined with the

broad influences it has over the economy make the real estate sector a

reliable leading indicator of economic activity. Real estate is one of

the first sectors to contract when a recession is looming and one of

the first to show signs of recovery when economic activity begins to

improve.

BUT...

When

viewing housing data and its influence over the broader economy,

Existing Home Sales are not as forward looking as other housing

indicators such as housing starts and building permits. This is for a

few reasons...

Think about the materials that go into BUILDING a

home....WOOD, STEEL, PLASTICS, WIRING, PIPING, CONCRETE, GLASS,

ELECTRICITY, FURNITURE, CARPETING, ELECTRONICS, APPLIANCES....LABOR.

These

goods and services are not a part of the money transfer process of an

Existing Home Sale. Existing Homes are already built, and while there

are more and more " foreclosure fixer uppers" on the market, the

overall economic activity boost seen from a spike in new construction

is absent when discussing the Existing Home Sales supply chain.

Also,

existing home sales data is only reported at the time of closing, when

the deed is actually transferred to the new owner. It can take up to

three months for a purchase transaction to close, if it closes at all

as the origination process remains cluttered with roadblocks and

delays. On top of this, the additional tightening of credit guidelines

is expected to continue to reduce the number of qualified borrowers who

are looking to buy. With that in mind, while the exhaustion of existing

home supply is a key part toward growth in new residential

construction, Existing Home Sales data is considered less forward

looking than other indicators like building permits and housing starts.

NOVEMBER EXISTING HOME SALES

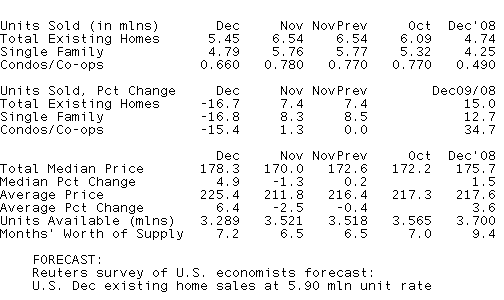

In November, the NAR reported that sales of previously owned homes rose 7.4% to an annual rate of 6.54 million sales.

Single family homes led the overall index higher, recording an uptick

from 5.32 million sales to 5.77 million annual sales. Supply of

previously owned homes fell from 3.565 million to 3.518 million, at the

current annual pace of existing home sales, this was 6.5 months of

supply. Raw unsold inventory figures are 15.5 percent below levels one

year.

DECEMBER EXISTING HOME SALES

Consensus Estimate: 5.90 million annual pace of existing home sales

Result: Worse than Expected. -16.7 percent at 5.45 million annual sales

From the NAR...

After a rising surge from September through November, existing-home

sales fell as expected in December after first-time buyers rushed to

complete sales before the original November deadline for the tax

credit.

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 16.7 percent to a seasonally adjusted annual rate of 5.45 million units in December from 6.54 million in November, but remain 15.0 percent above the 4.74 million-unit level in December 2008.

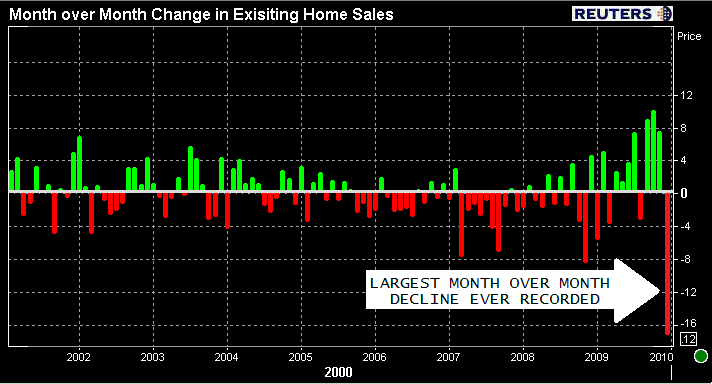

Here is the month over month change, this was the worst monthly decline since the NAR began reporting on Existing Home Sales in 1968.

Single-family home sales fell 16.8 percent to a seasonally adjusted annual rate of 4.79 million in December from a pace of 5.76 million in November, but are 12.7 percent above the 4.25 million level in December 2008. For all of 2009, single-family sales rose 5.0 percent to 4,566,000.

Existing condominium and co-op sales fell 15.4 percent to a seasonally adjusted annual rate of 660,000 in December from 780,000 in November, but are 34.7 percent higher than the 490,000-unit pace a year ago. For all of 2009, condo sales rose 4.8 percent to 590,000 units.

Raw unsold inventory is 11.1 percent below a year ago, is at the lowest level since March 2006, and is 28.2 percent below the record of 4.58 million in July 2008.

For all of 2009 there were 5,156,000 existing-home sales, which was 4.9 percent higher than the 4,913,000 transactions recorded in 2008; it was the first annual sales gain since 2005.

Total housing inventory at the end of December fell 6.6 percent to 3.29 million existing homes available for sale, which represents a 7.2-month supply at the current sales pace, up from a 6.5-month supply in November. Here is the number of existing home sales expected to take place annually at the current pace of demand.

Regionally:

- The Northeast dropped 19.5 percent to an annual level of 910,000 in December, 21.3 percent above a year ago. The median price in the Northeast was $241,700, up 3.2 percent from December 2008.

- The Midwest fell 25.8 percent in December to a level of 1.15 million, 8.5 percent higher than December 2008. The median price in the Midwest was $143,200, which is 1.8 percent above a year ago.

- The South dropped 16.3 percent to an annual pace of 2.01 million in December, 15.5 percent above December 2008. The median price in the South was $152,000, down 1.0 percent from a year ago.

- The West declined 4.8 percent to an annual rate of 1.38 million in December but are 15.0 percent higher than a year ago. The median price in the West was $236,000, up 2.7 percent from December 2008.

The national median existing-home price for all housing types was $178,300 in December, which is 1.5 percent higher than December 2008.

The median existing single-family home price was $177,500 in December, which is 1.4 percent above a year ago. For all last year, the single-family median was $173,200, down 11.9 percent from 2008. The median existing condo price was $183,700 in December, up 1.0 percent from December 2008. For all of last year, the median condo price was $176,100, which is 16.1 percent below 2008.

Distressed homes, which accounted for 32 percent of sales last month, continue to downwardly distort the median price because they generally sell at a discount relative to traditional homes in the same area. For all of 2009, the median price was $173,500, down 12.4 percent from $198,100 in 2008; distressed homes accounted for 36 percent of total sales last year.

An NAR practitioner survey shows first-time buyers purchased 43 percent of homes in December, down from 51 percent in November. Repeat buyers rose to 42 percent of transactions in December from 37 percent in November; the remaining sales were to investors.

Here is a recap of the data:

Here are some quotes of interest from the release...

Lawrence Yun, NAR chief economist:

“It’s significant that home sales remain above year-ago levels, but the market is going through a period of swings driven by the tax credit,”

“We’ll likely have another surge in the spring as home buyers take advantage of the extended and expanded tax credit. By early summer the overall market should benefit from more balanced inventory, and sales are on track to rise again in 2010. However, the job market remains a concern and could dampen the housing recovery – job creation is key to a continued recovery in the second half of the year.”

“The median price rose because of an increased number of mid- to upper-priced homes in the sales mix,”

------------------------------------------------------------

Going into this report we knew the recent spike in Existing Home Sales was a function of an anticipated expiration of the FTHB tax credit. That said, although the drop was more than anticipated, it was not unexpected that Existing Home Sales would decline in December. They did...no big deal.

Looking ahead, nothing has changed, the same old issues are seen as being roadblocks to expansion in the housing market and macro-economy.

We need to work off current supply of all homes available on the market. In order for that to happen we need qualified buyers and borrowers. Those buyers and borrowers need stable jobs.

The first time home buyer tax credit has been a huge help in this effort, so too has the Fed's MBS Purchase Program. While the extension and expansion of the home buyer tax credit is progressive, from a buyer's perspective I still see several issues that will deter demand.

Failed loan modifications, an uptick in foreclosures, and continually high delinquency rates are the main argument against an evolving positive forward looking outlook. Some like to throw in the notion that shadow inventory will be counterproductive once demand is more stable and home prices find level ground. While there really isn't much we can do about added supply due to foreclosures (loan mod programs really not doing great), there is a degree of "self policing" the market has over a voluntary increase in home supply (new construction and shadow inventory). It's all about perceptions of economic reality.

Last week, builders informed us they are READY AND WILLING to start construction but do not plan to break ground until the labor market is creating jobs. Once home builders see it fit to begin pouring new foundations, the overall economy should be showing significant signs of improvement. If both home builders and prospective home sellers are feeling confident enough to begin building or put their house on the market, it would imply there was enough improvement in the demand side of the equation to justify the move. We have to hope home builders and looming home sellers time their strategies accurately. If builders are too optimistic, they may end up adding unwanted supply of new homes to the still overcrowded marketplace. If there really is an overhang of shadow inventory and it comes to market, a huge spike in supply would add downward pressure to home prices and hurt the overall economic outlook. READ MORE ON THE HOME BUILDING OUTLOOK.

Both events assume the macro-economy is prepared to handle increased supply. This puts us back to the same spot we've been stuck in for months: ALL IS DEPENDENT UPON JOBS

This is where I copy and paste a very familiar message...

Until jobs are being created for the herd of citizens on unemployment benefits, the housing market will likely undergo a slow, frustrating recovery process.

If you dont have a job, find a way to make yourself a more attractive labor source. Technology is replacing human brawn. More and more computers are performing production responsibilities humans once held. Costs are still being cut and operations are being more productive with their resources. While this will eventually lead to more hiring in the future, job creation will be focused on specific intellectual capabilities. Some jobs will be lost forever, human labor must be able to manage new technology.

The point: If you are without a job, dont waste this "time off". Go back to school. Re-educate and re-tool. Get new certifications and licenses. Find a way to evolve your intellectual capabilities. The labor market will be very competitive for years to come.

Its that "chicken or the egg" dilemma again!