The Commerce Department released December New Residential Construction: Building Permits, Housing Starts, and Housing Completions data this morning.

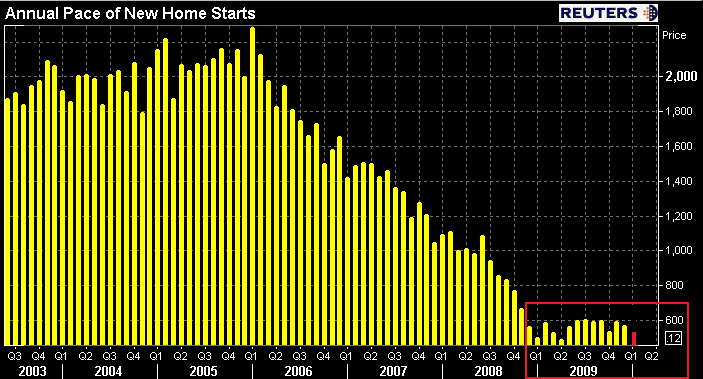

Housing Starts data estimates how much new residential real estate construction occurred in the previous month. New construction means digging has begun. Adding rooms or renovating old ones does not count, the builder must be constructing a new home (can be on old foundation if re-building). Although the report offers up single family housing, 2-4 unit housing, and 5 unit and above housing data...single family housing is by far the most important as it accounts for the majority of total home building.

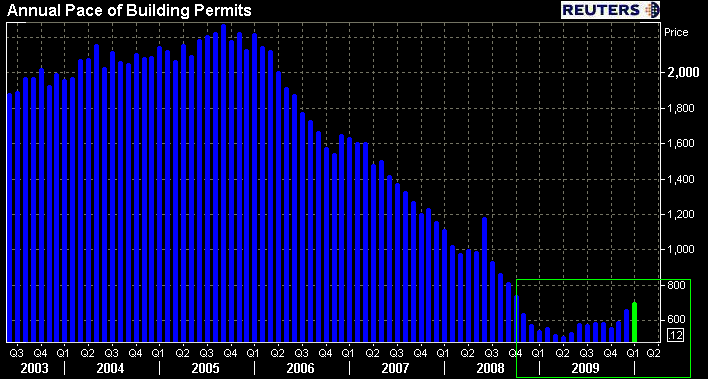

Building Permits data provides an estimate on the number of homes planning on being built. The number of permits issued gauges how much construction activity we can expect to take place in the future. This data is a part of Conference Board's Index of Leading Economic Indicators.

In the previous release, which reported on November New Construction data, Housing Starts rose 8.9% to an annual pace of 574,000. This was worse than expected as economist had forecast an annual pace of 580,000 new starts. Building Permits improved 6.0% to an annual rate of 584,000 permits. This was better than expected as economists had forecast an annual rate of 570,000 permits. Building Permits hit their highest annual rate since November 2008 when 630,000 printed.

BUILDING PERMITS

CONSENSUS ESTIMATE: 590,000

RESULT: Better than expected. +10.9% at 653,000 annual permits

From the Commerce Department...

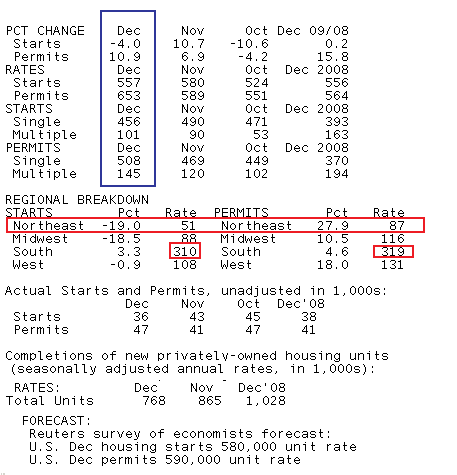

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 653,000. This is 10.9 percent (±2.4%) above the revised November rate of 589,000 and is 15.8 percent (±2.9%) above the December 2008 estimate of 564,000.

Single-family authorizations in December were at a rate of 508,000; this is 8.3 percent (±1.2%) above the revised November figure of 469,000. Authorizations of units in building with five units or more were at a rate of 127,000 in December. An estimated 571,600 housing units were authorized by building permits in 2009. This is 36.9 percent (±1.0%) below the 2008 figure of 905,400.

HOUSING STARTS

CONSENSUS ESTIMATE: 580,000

RESULT: Worse than expected. -4.0% at 557,00 annual housing starts

From the Commerce Department...

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 557,000. This is 4.0 percent (±9.3%)* below the revised November estimate of 580,000, but is 0.2 percent (±11.5%)* above the December 2008 rate of 556,000.

Single-family housing starts in December were at a rate of 456,000; this is 6.9 percent (±8.5%)* below the revised November figure of 490,000. The December rate for units in buildings with five units or more was 92,000. An estimated 553,800 housing units were started in 2009. This is 38.8 percent (±1.4%) below the 2008 figure of 905,500.

Looking deeper into housing starts data, ground breaking on single-family homes, the largest component of New Construction data, fell 6.9 percent in December. This is clearly the culprit in new construction weakness. However it should be noted that multifamily starts actually rose 12% in December. Is demand is on the rise for affordable housing options? Eh...am I missing something here? Last I checked it was a buyers market for renters, not buying in the sense of buying a new home, buying in the sense that renters had room to negotiate because so many were looking to rent out their home or condo. Why build more multifamily units now? This may explain: READ MORE ON AFFORDABLE HOUSING

HOUSING COMPLETIONS

From the Commerce Department...

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 768,000. This is 11.2 percent (±13.6%)* below the revised November estimate of 865,000 and is 25.3 percent (±8.6%) below the December 2008 rate of 1,028,000.

Single-family housing completions in December were at a rate of 503,000; this is 11.1 percent (±10.2%) below the revised November rate of 566,000. The December rate for units in buildings with five units or more was 245,000. An estimated 796,000 housing units were completed in 2009. This is 28.9 percent (±3.0%) below the 2008 figure of 1,119,700.

Below is a table summarizing the data....

GOOD NEWS FIRST...

Thanks to a 8.3% gain in single family homes in December, Building Permits rose 10.9% to their highest level in over two years. Home Builders are ready and willing to start building...they've even got the permits to do it!

From NAHB Chairman Joe Robson, a home builder from Tulsa, Oklahoma:

"At this point, home builders have done everything we possibly can to set the stage for a housing recovery – we’ve thinned our inventories, we’ve kept new construction to a minimum, and we’ve fought for and achieved a great new buying incentive with the extension and expansion of the home buyer tax credit,"

NOW FOR THE BAD NEWS...

Based on the above comments and the increase in building permits, we know builders are ready and willing to start building...the problem is they aren't building yet. Housing Starts continue to lose momentum as the off-season winter months pass. Whether or not they are able to start breaking ground on new homes is largely a function of the macroeconomic outlook.

From NAHB Chairman Joe Robson, a home builder from Tulsa, Oklahoma:

"We stand poised and ready to deliver new homes as soon as our customers are ready to take advantage of the tax credit and other historically good buying conditions in terms of interest rates, selection, and prices. Yet builders also realize that factors beyond our control – including consumer concerns about job security and competition from foreclosed homes on the market – are still impeding demand for new homes at this time."

Plain and Simple: builders are ready to start working on new inventory, but are not likely to do so until the labor market improves. The NAHB is hopeful this will occur sometime this spring. MND is less optimistic but still waving our pom-poms. READ MORE on MNDs "chicken or the egg" outlook

The market is coming off of record low levels of activity, with that in mind home builders will be looking to get out in front of future housing demand. In the months to come, if forward looking builder sentiment improves and losses in the labor market continue to moderate , we will likely see gains in housing starts and building permits. Don't let month over month and year over year statistical improvements fool you. We still have a major demand side issue to deal with here...

Will consumers be able to add debt to their balance sheet or will they be forced to focus on rebuilding wealth and credit?

If builders are too optimistic, it concerns me they may end up adding unwanted supply of new homes to the still overcrowded marketplace. This would put downward pressure on home prices and hurt the overall economic outlook.

This is a tight rope walk....I hope builders are cautious in their housing demand forecasts. If not...it could have adverse effects on home prices.