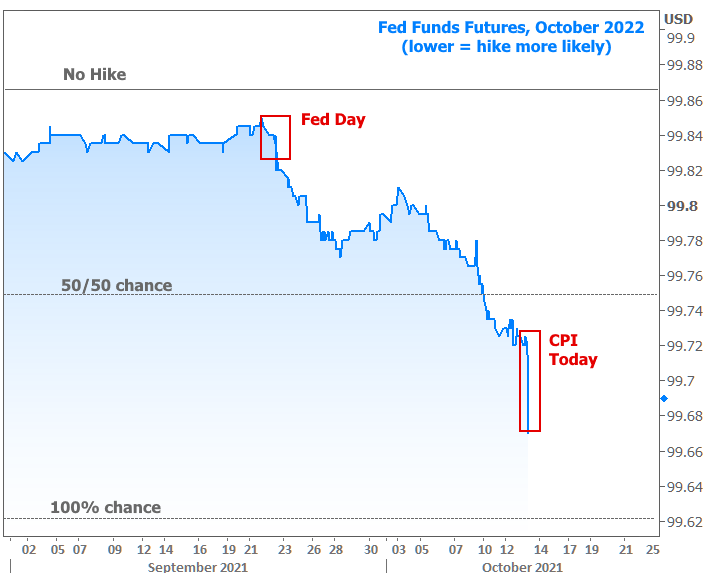

There has been more than a little bit of willingness on the part of the bond market to react to Fed's rate hike outlook. This began in earnest after the last Fed announcement, but we're seeing it again this morning after the Consumer Price Index data. Fed Funds Futures for October 2022 (that's where the volume is) were showing less than a 30% chance of a hike about a month ago. Today, the probability is over 65%, and it's increased 15% in the past week alone. The reaction plays out in the form of weaker bonds and stocks with the telltale mirror image pattern between stock prices and bond yields.

The chart above shows 'mirror image' trading earlier in the overnight session as well. What's up with that? Simply put, global economic data and foreign central bank info also has an effect on the rate hike outlook. Bottom line: when the market is actively engaged in trading future odds of Fed accommodation, we see these patterns constantly. CPI data is just an opportunity to see a bigger, clearer version.

How do we know markets have been trading the Fed outlook? Trading in Fed Funds Futures shows a fairly clear departure from "flat" at the end of September, and a steady slide since then.

Fortunately, if we continue to zoom in on the chart above, we see that some of the drama has already abated (more than half of it, actually).