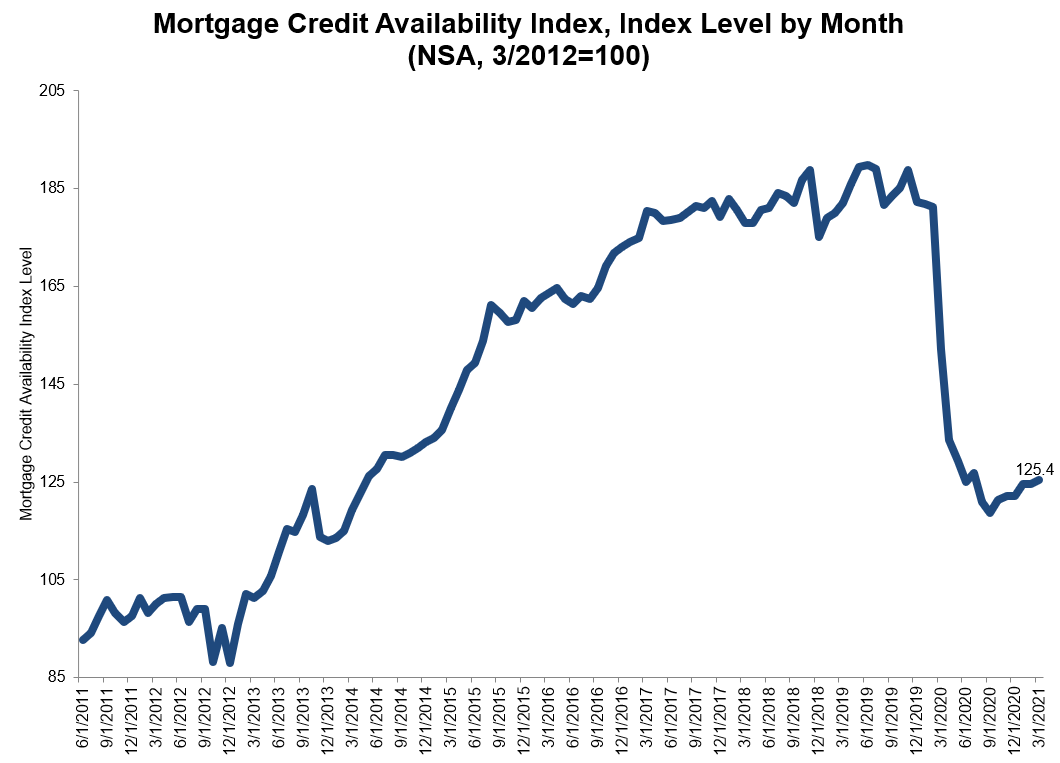

Non-government lenders continue to return to mortgage lending after fleeing at the start of the pandemic. The Mortgage Bankers Association (MBA) says this has helped increase the supply of jumbo mortgages for six straight months and helped drive MBA's Mortgage Credit Availability Index (MCAI) up slightly in March.

The Index rose 0.6 percent to 125.4 last month. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The Conventional MCAI increased 0.8 percent, while the Government MCAI increased by 0.4 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.5 percent, and the Conforming MCAI rose by 0.2 percent.

"Credit availability inched higher in March, driven by the ongoing economic and job market recovery. This has increased the amount of low credit score and high LTV products," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "All the market segments covered by our sub-indexes increased over the month, notably government and jumbo indexes. The government index, which includes FHA, VA, and RHS mortgages, increased for the sixth time in seven months to its highest level in a year. As we look ahead to the expected growth in the purchase market, which will be driven by millennials and first-time home buyers, credit availability to qualified borrowers will play an important role in supporting this demand."

Added Kan, "Jumbo availability is increasing again as the economy regains its footing and coincides with the strong demand for homebuying and accelerated home price growth in many markets."

The MCAI and each of its components are calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via a proprietary product from Ellie Mae. The resulting calculations are summary measures which indicate the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.