Homeowners' housing wealth grew by record numbers in the fourth quarter of last year. CoreLogic, in its Home Equity Report for the period, says the average equity in a U.S. home increased 16.2 percent since the fourth quarter of 2019, the greatest increase in seven years. Homeowners gained an average of $26,300 in equity and the aggregate increase across the 62 percent of U.S. homes with mortgages was $1.5 trillion.

CoreLogic's chief economist Frank Nothaft said, "Compared with a year earlier, home prices in December 2020 were up sharply - 9.2%, according to the CoreLogic Home Price Index - boosting the amount of home equity for the average homeowner with a mortgage to more than $200,000. This equity growth has enabled many families to finance home remodeling, such as adding an office or study, further contributing to last year's record level in home improvement spending."

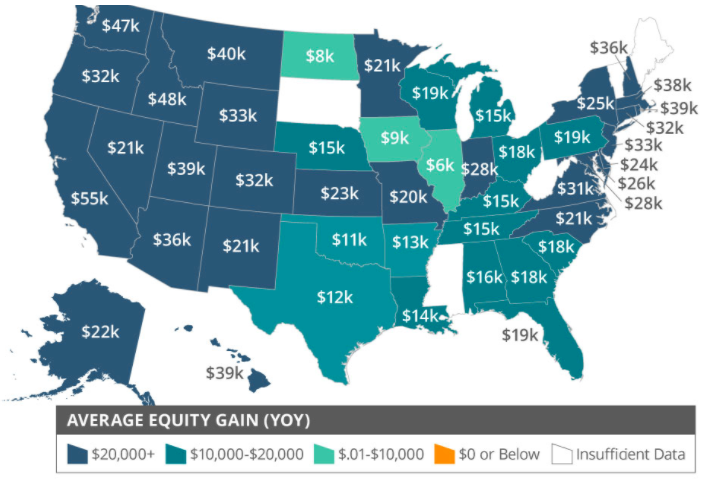

Of course, it was those states with strong home price growth and high home prices which experienced the largest gains in equity. Leading the list were California, where gains averaged $54,400, Idaho, up $48,500, and Washington with a $47,000 average increase. States that were hard hit by the pandemic experienced smaller gains, the least being in North Dakota with an average annual increase of $7,900.

"Positive factors like record-low interest rates and a booming housing market encouraged many families to enter homeownership," said Frank Martell, president and CEO of CoreLogic. "This growing bank of personal wealth that homeownership affords was noticed by many but in particular for first-time buyers who want a piece of the cake. As a result, we may see more of those currently renting start to enter the market in the near future."

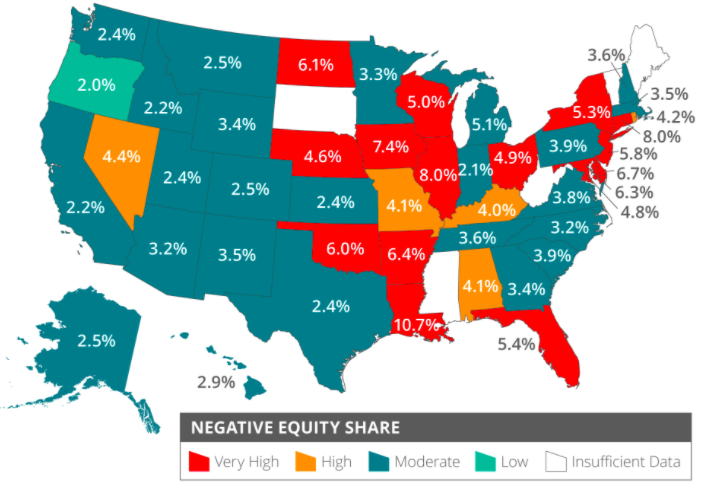

As equity increased, the number of mortgages that were underwater or in negative equity, with more owned on the loan than the value of the house, fell by 21 percent compared to the fourth quarter of 2019, from 1.9 million homes (3.6 percent of all mortgaged properties) to 1.5 million or 2.8 percent. Eight percent of that decline happened between the third quarter and the fourth quarters.

The national aggregate value of negative equity was approximately $280.2 billion at the end of the fourth quarter of 2020, a quarter-over-quarter decline of approximately $3.4 billion, or 1.2 percent, from $283.6 billion in the third quarter of 2020. On an annual basis it fell by approximately $7.5 billion, or 2.6 percent, from $287.7 billion in the fourth quarter of 2019.

The company says that, for current owners, these gains have created a buffer against the pandemic's financial difficulties and enabled means for pursuing renovations as people are spending more time at home. For the broader market, home equity gains have also reduced the risk of homes falling underwater and pushing distressed sales into the market.

Borrowers with equity positions near (+/-5 percent) the negative equity cutoff are most likely to move out of or into negative equity as prices rise or fall. Looking at the fourth quarter of 2020 book of mortgages, with a 5 percent increase in prices, 216,000 homes would gain equity. The same level of decline would drag 292,000 homes underwater.