Roughly 60 percent of U.S. households are effectively priced out of the new home market according to 2021 estimates from the National Association of Home Builders (NAHB). Na Zhao, writing in a pair of posts in NAHB's Eye on Housing blog says 75.1 million households are unable to qualify for a mortgage to purchase a median priced new home under standard underwriting criteria and, if the median price of a home increases by $1,000, another 154,000 households would join the priced-out list. Further, Na Zhao used a 2.8 percent interest rate in the calculations, and the 30-year fixed rate is now over 3.0 percent.

Other underwriting criterion used to determine affordability assumes a 10 percent down payment on a $336,757 home and that the sum of mortgage payments, property taxes, homeowners, and private mortgage insurance premiums (PITI) during the first year is no more than 28 percent of the household's income. At that purchase price, the PITI would be $1,821 and require an annual income of $78,036. Add another $1,000 to the price and the PITI rises to $1,826 and the required income to $78,264, not a lot, buy enough to knock over 150,000 households out of the new home market.

Texas registered the largest number of households priced out of the market by a $1,000 increase in the median-priced home in the state (14,309), followed by California (12,361), and Florida (10,215), largely because these are the country's three most populous states.

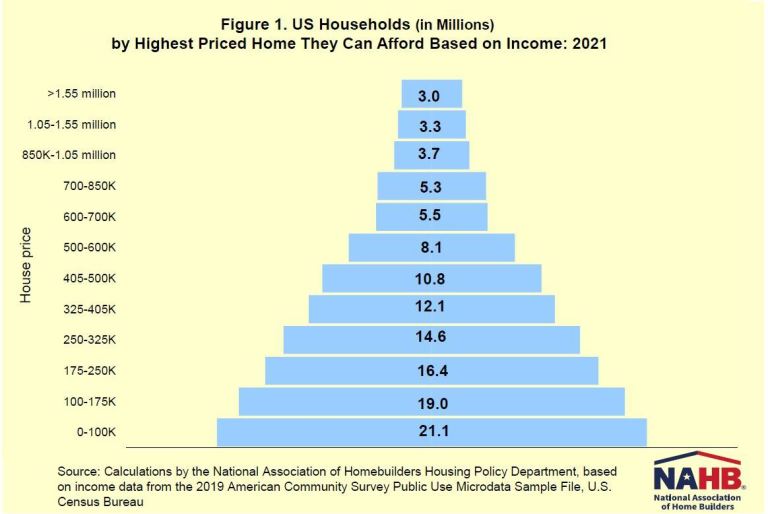

In a second post, Na Zhao presents an affordability pyramid, showing how many U.S. households are assumed to be financially qualified to afford homes at various price thresholds.

The pyramid uses the same standard underwriting criterion as above and concludes that the minimum income required to purchase a $100,000 home is $22,505. In 2021, about 21.1 million households in the U.S. are estimated to have incomes at or below that threshold and, therefore, the maximum priced home they can afford is between $0 and $100,000. These 21.1 million households form the bottom step or base of the pyramid. Another 19.0 million can only afford to pay a top price of somewhere between $100,000 and $175,000 (the second step on the pyramid), and so on, with fewer and fewer household on each higher step.

At the top of the pyramid around 3 million households could qualify to buy a home priced over $1.55 million. Na Zhao says these comparatively wealthy Americans and the type of homes they can buy are interesting, but market analysts should focus more on the larger number of potential homeowners at the pyramid's base.