Black Knight concurs with an earlier forecast from the Mortgage Bankers Association, that 2020 will have a higher level of mortgage originations in 2020 than was registered in 2019. Black Knight, in its new Mortgage Monitor covering September loan performance data, said its interpretation of recent rate lock information suggests that, for the first time ever, the market is on track to top $4 trillion in originations.

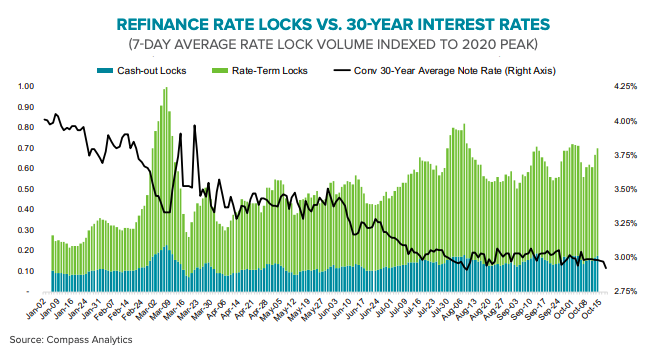

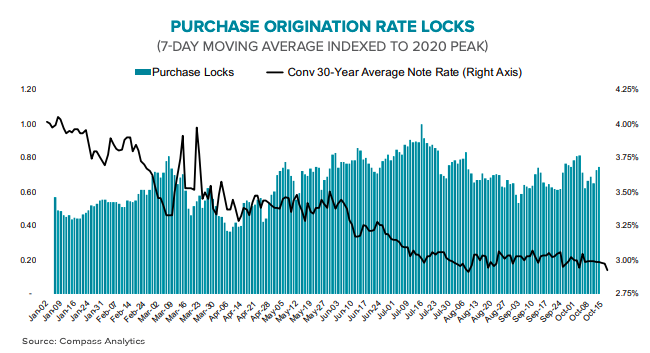

Rate lock activity in September was relatively even with that in August increasing a nominal 1 percent. Purchase locks were down 2 percent, typical for the season, while refinance locks were essentially unchanged. However, lock activity picked up in October, rising 4 percent through the first half of the month. Purchase locks were up 6 percent and refinancing locks rose 3 percent month-over-month.

The company's Data & Analytics President Ben Graboske said, "Assuming a 45-day lock-to-close period, not only could Q3 2020 set quarterly records for refinance, purchase and total origination volumes alike, but that volume could remain at or near peak levels through November 2020 - if not longer. Estimated origination volumes based on underlying locks suggest both Q3 refinance and total originations could be up 25 percent or more from Q2 while purchase lending could be up by 35 percent or more. This would push 2020 purchase lending to the highest level since 2005 and both refinance lending and total origination volumes to their highest levels ever. Indeed, total lending in 2020 is well on its way to easily eclipse the $4 trillion mark for the first time in history."

Even with the impacts from the pandemic early in this year, this also suggests that by the end of November, purchase lending in 2020 could be up 11 percent from the same period in 2019 and poised to expand on those gains in December. Quarter 3 along appears to have recording purchase originations that were up 23 percent compared to the previous year.

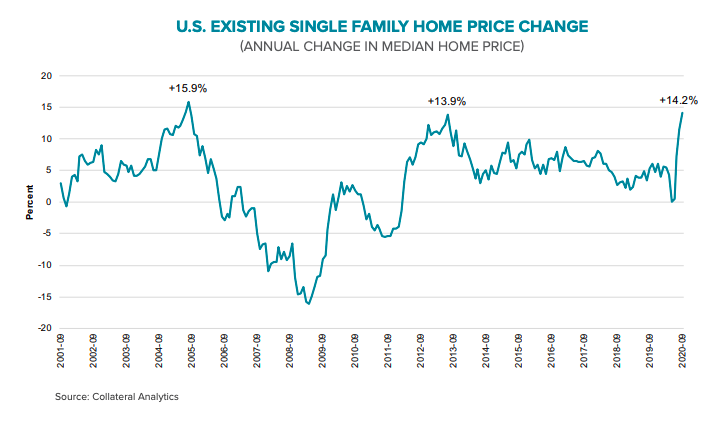

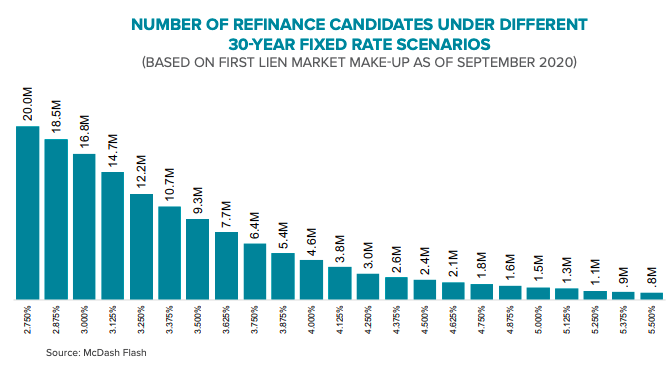

Home price growth slowed to a standstill in May, the first time there was no annual increase since early 2012. But by August, annual price growth was up to 11.5 percent and in September it grew to 14.2 percent, the highest rate in more than 15 years. This, along with record low interest rates, (Freddie Mac says new record lows have been set 11 times this year, the latest on October 22) means there is still significant refinance incentive. While millions of homeowners have already refinanced this year, Black Knight estimates that, with rates at 2.8 percent, 18.5 million homeowners still qualify for and could benefit from refinancing, cutting at least 75 basis points from their current interest rate. This is 10.4 million more potential refinancers than at the same time last year.

More than 7M homeowners could save more than $300/month, while 2.5M could save $500 a month or more. The average refi candidate could save $304 each month through refinancing, for an aggregate monthly savings of $5.6B if all eligible candidates were to take advantage of today's record-low rates.

The company estimates that a further drop in rates to 2.75 percent would bring another 1.5 million homeowners into the refinance pool. If rates edged up to 3.0 percent, the pool would drop to 16.8 million.

Black Knight tracks the status of COVID-19 forbearance plans and reports that data out weekly. However, they added some additional details about the 3 million remaining plans in the Mortgage Monitor.

There had been a sharp decline (-18 percent) in plans in the first week of October. The first wave of plans reached the end of their initial six-month terms in September and Black Knight speculated that servicers had been unable to reach some borrowers to confirm an extension request. Then plan starts spiked by 20 percent in early October and, among those, the percentage of repeat starts was up 80 percent. This would indicate that some borrowers who had not been in contact with their servicers before their September 30 expiration date may have reached out in October to continue their plans.

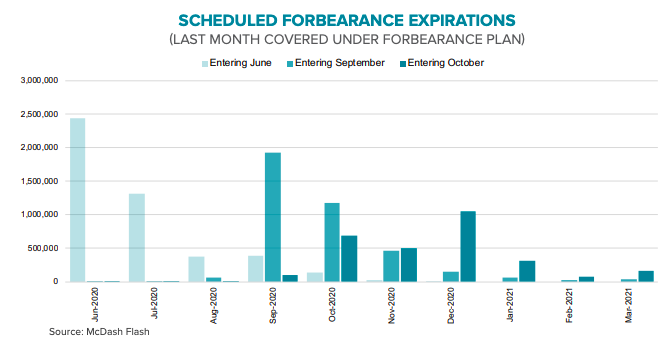

Another 700,000 plans were set to expire in October which probably means less overall extension/removal activity in October and early November. The next, more moderate wave of expirations will hit in December when the initial wave of forbearances reach their nine-month mark. More than 1 million of the remaining 3 million plans are scheduled to expire then.

The majority of borrowers in forbearance are now four or more payments past due. Nearly a quarter (809,000) of those in forbearance continue to remain current on their mortgage payments as of the end of September.

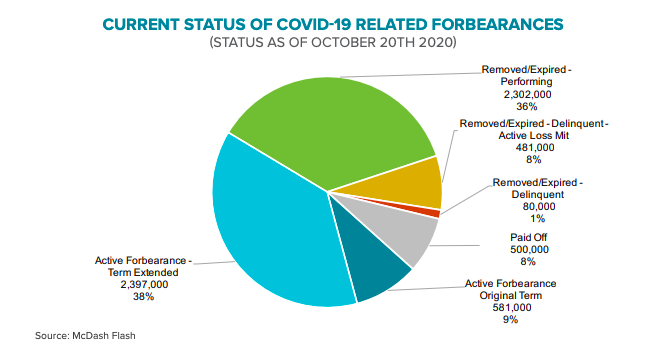

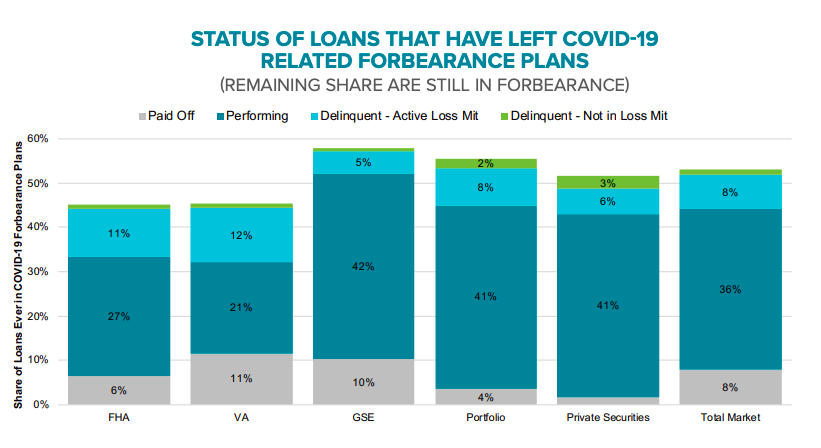

More than 6.3 million borrowers have participated in forbearance plans over the past seven months. Fifty-three percent of them have exited their plans and of those, 36 percent are now performing on their mortgages. Eight percent have paid off their loans and another 8 percent have exited plans but are working on loan mitigation options with their servicers and 1 percent are past due, not in forbearance nor pursuing a loan workout.

The percentage of removals is highest among GSE loans at 57 percent, followed by VA borrowers at 46 percent and FHA at 45 percent. The current disposition of plans and users is shown in the chart below

Black Knight says that, while post forbearance performance has been strong so far, those borrowers who have left their plans may represent "low hanging fruit", those more seriously impacted by the pandemic are likely to remain in forbearance.