Admittedly, this is less of a "day ahead" at this point and more of a "day in progress." Nonetheless, we can discuss the lay of the land as we gear up for more volatility in financial markets.

Why would we expect volatility? The reasons are many.

Election. The US presidential election is weeks away. This always has potential to cause volatility, and the run up to the election is currently keeping financial markets relatively more subdued.

Covid at home. Covid-related news is ongoing, of course. Markets continue to show a willingness to react to significant changes in case counts, vaccine trials, new treatments, mortality, and the anticipated economic effects of all of the above. Winter is coming, and we're about to learn 'something' either way. If the fight against the pandemic goes better than expected in the coming months it implies significant upward pressure on rates.

Covid abroad. Europe is arguably entering a new covid crisis. This has been helping the US bond market rethink its recent efforts to push toward higher rates.

If the situation continues to spiral, it should continue to help bonds, but only as a supporting actor. US bonds have already proven more than capable of marching to their own beat, post-covid.

Stocks, Bonds, Technicals! Bonds have been in such a narrow range and have recently broken out. Moreover, they failed to re-enter that range despite several attempts this week.

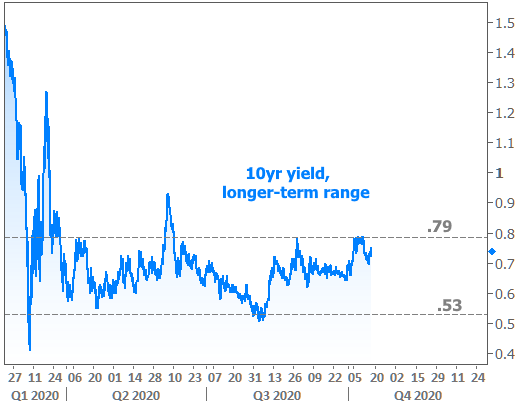

Such behavior often implies additional momentum toward higher rates, but importantly, there is a longer-term range that remains unbroken.

Stocks were on a tear before the big sell-off in early September (the one that seemed to help bonds calm down and enter the aforementioned range in bonds). Stocks haven't made it back to recent highs. Now, both sides of the market seem to be consolidating--circling the wagons, if you will--in preparation for their next move. Neither have broken above their recent highs. The timing of the presidential election and the anticipation for an impending stimulus deal are no coincidence, but markets may not be able to wait that long to make a move.

In the chart below:

1) the big stock sell-off that helped bonds calm down

2) stocks and bond yields moving higher together, but staying inside recent ranges

Any Caveats?

Yes! Let's talk about one! With all of the above out of the way, there's at least one great reason to expect slightly less volatility in mortgage rates relative to the broader financial market. The reason is also very simple. Mortgage rates may be very low, but they haven't fallen remotely as quickly as their long-time companion and guidance giver: US 10yr Treasury yields. Most of the time, 10yr yields and mortgage rates look like the left side of the following chart. Things obviously changed post-covid.

What this means is that the mortgage market has some room to "soak up" a certain amount of weakness in the broader bond market. The more gradual the weakness is, the easier that would be. If 10yr yields are spiking significantly, don't expect mortgage rates to just take it in stride. But if yields are slowly working their way up from .75% to 1.0% in the coming months, it wouldn't be a huge surprise to see mortgage rates hold relatively sideways.