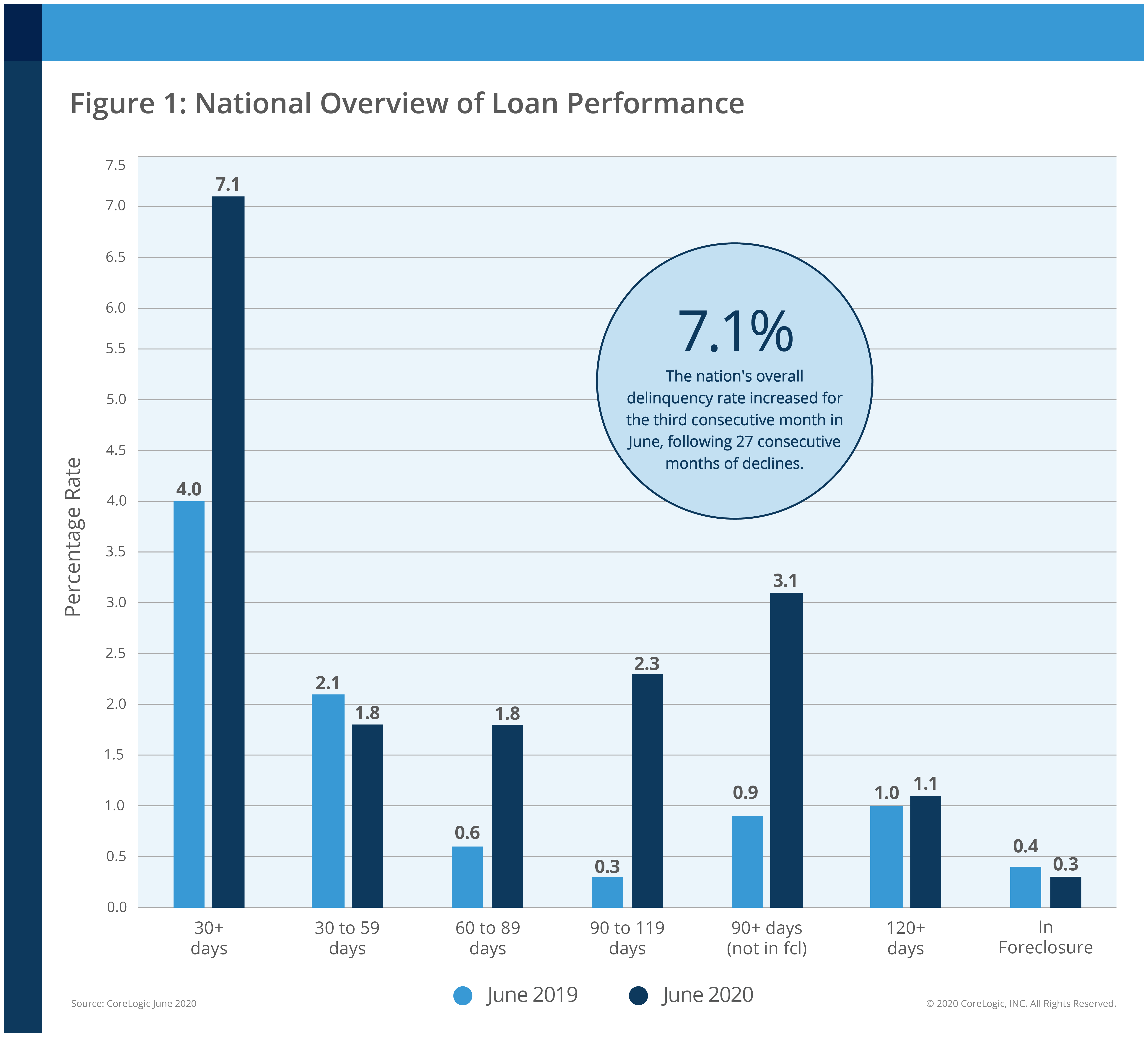

Mortgage delinquencies spiked in June and the serious delinquency rate, loans 90 or more days past due but not in foreclosure, reached its highest level in more than five years. CoreLogic in its monthly loan performance report, said 7.1 percent of all mortgages nationwide were at least 30 days past due, including those in foreclosure. This is 3.1 percentage points higher than the delinquency rate in June 2019.

Further, the company predicts that, barring additional government programs and support, serious delinquency rates could nearly double from the June 2020 level by early 2022. Not only could millions of families potentially lose their home, through a short sale or foreclosure, but this also could create downward pressure on home prices - and consequently home equity - as distressed sales are pushed back into the for-sale market.

Early-stage delinquencies, those 30 to 59 days past due, improved a bit from a year earlier. The rate was 1.8 percent, down 0.3 on an annual basis. The rate at which loans transitioned from current to 30 days past due also slowed in June, down from 1.1 percent in June 2019 to 1.0 percent. CoreLogic notes that the transition rate peaked in April at 3.4 percent but has improved, along with the labor market, since the early days of the pandemic.

The percentage of loans that were 60 to 89 days non-current, which CoreLogic refers to as "adverse delinquency" tripled, from 0.6 percent to 1.8 percent year-over-year, while those in the serious category rose to the highest rate since February 2015, 3.4 percent, compared to 1.3 percent the previous June. The foreclosure inventory rate, percentage of loans in the process of foreclosure, was 0.3 percent, a 0.1-point decline, probably reflecting the COVID-19 related foreclosure moratorium.

CoreLogic says the current housing situation is a paradox. The company's Home Price Index (HPI) has shown home purchase demand fueled by record-low mortgage rates driving prices higher over the summer while loan performance has progressively weakened. "Sustained unemployment has pushed many homeowners further down the delinquency funnel, culminating in the five-year high in the U.S. serious delinquency rate this June," the report says, "With unemployment projected to remain elevated through the remainder of 2020, we may see further impact on late-stage delinquencies and, eventually, foreclosure."

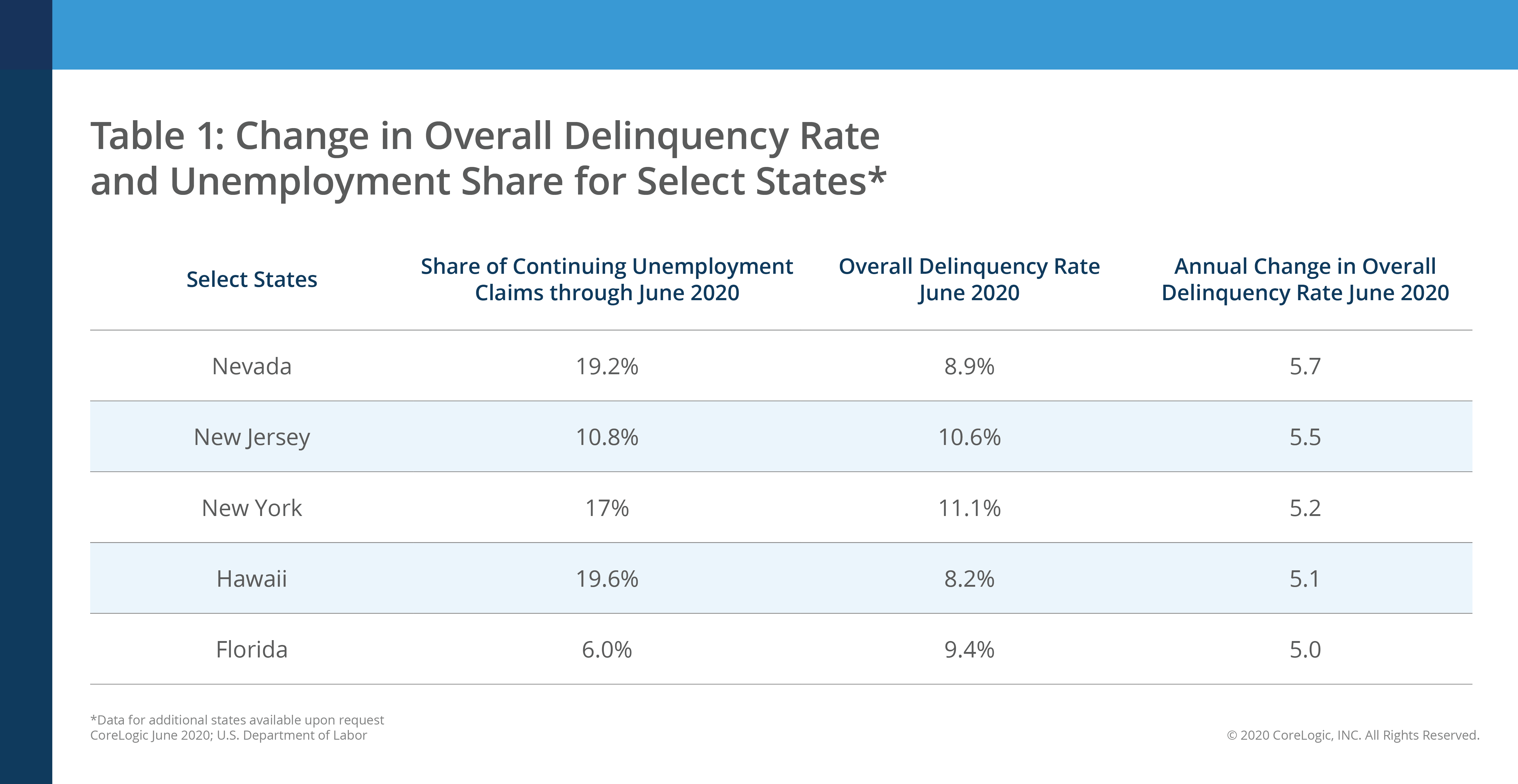

All states logged annual increases in both overall and serious delinquency rates in June with those hit hardest by the pandemic showing the most damage. In New Jersey and New York serious delinquent rates were up 3.7 and 3.6 percentage points, respectively. Nevada's rate rose 3.4 points and Florida's by 3 points.

Similarly, all U.S. metro areas logged at least a small increase in serious delinquency rate in June. Miami and Atlantic City, both hard hit by the collapse of the tourism market saw increases of 5.1 and 4.3 points while energy dependent markets such as Odessa, Midland, and Laredo Texas had similar increases.

"Forbearance has been an important tool to help many homeowners through financial stress due to the pandemic," said Frank Martell, president, and CEO of CoreLogic. "While federal and state governments work toward additional economic support, we expect serious delinquencies will continue to rise - particularly among lower-income households, small business owners and employees within sectors like tourism that have been hard hit by the pandemic."