Robert Dietz, chief economist for the National Association of Home Builders (NAHB) has provided a couple of updates on housing construction trends taken from the Census Bureau's Quarterly Starts and Completions by Purpose and Design in the association's Eye on Housing blog. Dietz takes a granular look at the trend toward larger homes and custom home building.

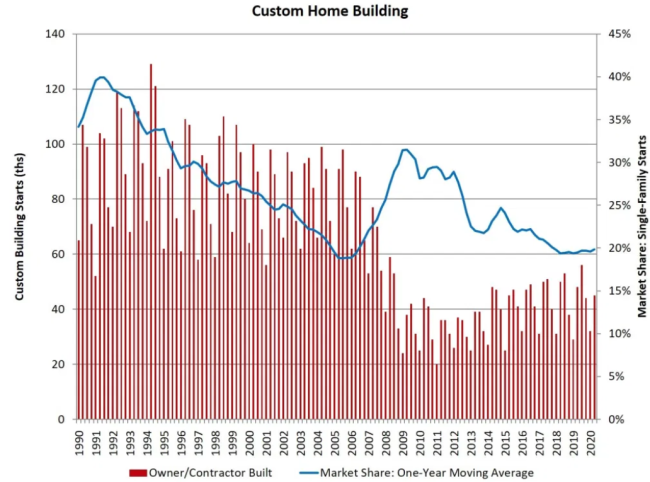

Dietz says the data shows that custom home building outperformed, in relative terms, spec building in the second quarter, contrary to the "conventional narrative that spec home building saw outsized gains during the April to June time period." Custom home building (defined as built for a specific owner) did decline during the quarter, impacted by the temporary shutdown of work sites in many locations and shaken confidence in the entire economy as the coronavirus hit. However, it was down by 6 percent from a year earlier to 48,000 units while the overall decline in housing starts was 11 percent. Over the last four quarters, custom housing starts totaled 177,000, a 5 percent increase over the four quarters ending in Q2 2019 of 168,000 starts.

As a one-year moving average, the market share of custom single-family home starts is 20 percent. The cycle high was 31.5 percent in the second quarter of 2009. Dietz says custom building is likely to increase during "low density markets

Builders continued the trend of producing smaller homes in the second quarter, although the downturn has begun to level out and is not expected to continue. Dietz says the median single-family square floor area ticked down to 2,264 square feet and the average (mean) square footage declined to 2,458 square feet.

Moving averages tend to smooth out data, and a one-year average in the figure below shows the beginning of the leveling of home size. Compared to the lows of the Great Recession, the moving average of new single-family homes has grown only 5 percent and the median by less than 8 percent to 2,482 square feet and 2,265 square feet, respectively.

The home size increases after the Great Recession are typical of patterns following downturns. Home sizes usually fall prior to and during a recession to match tightened household budgets. They then rise as high-end buyers, with fewer credit restraints, return to the market. This pattern was exacerbated during recent years due to market weakness among first-time homebuyers and supply-side constraints in the building market. Declines in size over recent years reflected builders' attempts to bring more entry-level buyers into the market.

Dietz says this time the post-downturn patterns will probably be different. Home size is expected to level off and then increase because of consumer preference for increased space to accommodate at working and studying from home in the post-Covid-19 environment.