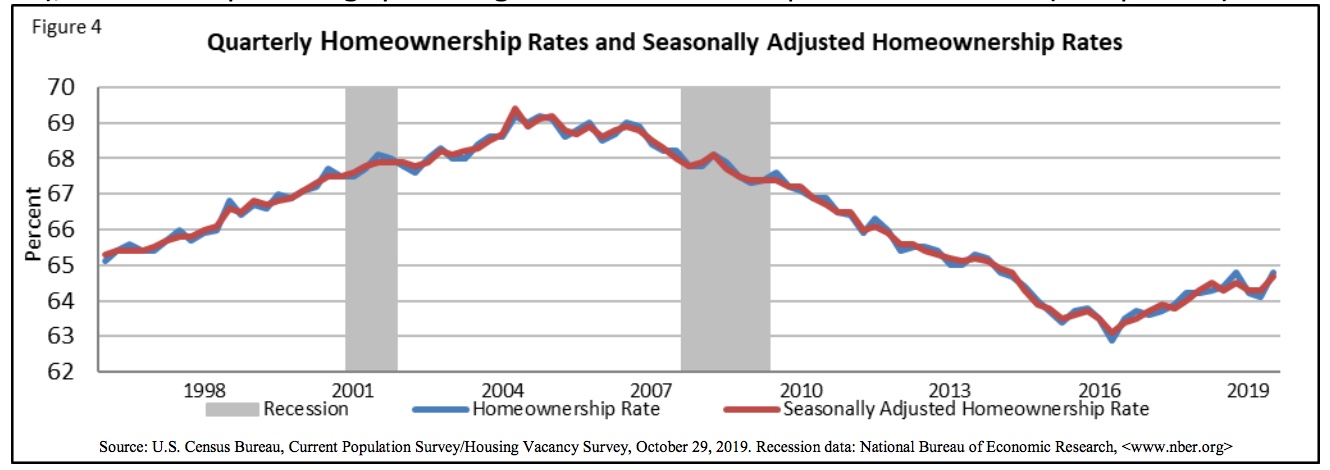

The Census Bureau reports that the homeownership rate, while up fractionally in the third quarter of this year compared to Quarter 2, was essentially unchanged from one year earlier. The Bureau's Vacancies and Homeownership Report put the national rate at 64.8 percent. That rate peaked at more than 69 percent on several occasions during the 2004-2006 housing boom before beginning a decline that lasted more than a decade. The rate bottomed out at 62.9 percent in the second quarter of 2016 and has risen only slightly since then.

The good news is that the greatest annual increase in homeownership over the previous 12 months was among the youngest age cohort, those under 35 years of age, a group fell far behind earlier generations of the same age during the Great Recession. Their rate, 37.5 percent, rose 0.9 point over the previous 12 months and has recovered by more than 3 points since the second quarter of 2016. The next older group, which now includes the oldest of the Millennial generation has a rate of 60.3 percent.

Homeownership is, as usual, highest among the oldest age groups, 75.1 percent for those 55 to 64 and 78.9 percent for those over age 65. The Midwest tops the other four regions with a homeownership rate of 69.0 percent. The West is lowest at 60.6 percent.

The gap between white and black homeownership rates, while still huge, has narrowed slightly over the last year. The white rate gained 0.3 point to 73.4 percent while the black rate increased a full point to 42.7 percent. Hispanic homeownership grew by 0.9 point to 47.8 percent while Asian homeownership slipped slightly to 58.5 percent.

The rental housing vacancy rate, at 6.8 percent was essentially unchanged from both the second quarter of this year and the third quarter of 2018. Homeowner vacancies fell 0.1 point from the previous quarter and 0.2-point year-over-year to 1.4 percent. The median monthly asking rent for a vacant unit was $1,002 and the median asking price for a for-sale unit was $220,700.

The Census Bureau estimates 1,152,000 units were added to the housing stock over the last year to a total of 139.785 million units. There were 122.735 million units occupied, 79.492 million owner units and 43.243 million rental units.