Fannie Mae asked lenders, as part of its third quarter Mortgage Lender Sentiment Survey about their digital transformation efforts. The company says that, in previous surveys, lenders have consistently shown a strong interest in leveraging technology to improve both the front-end consumer experience and back-end operational efficiency.

Lenders were asked four questions:

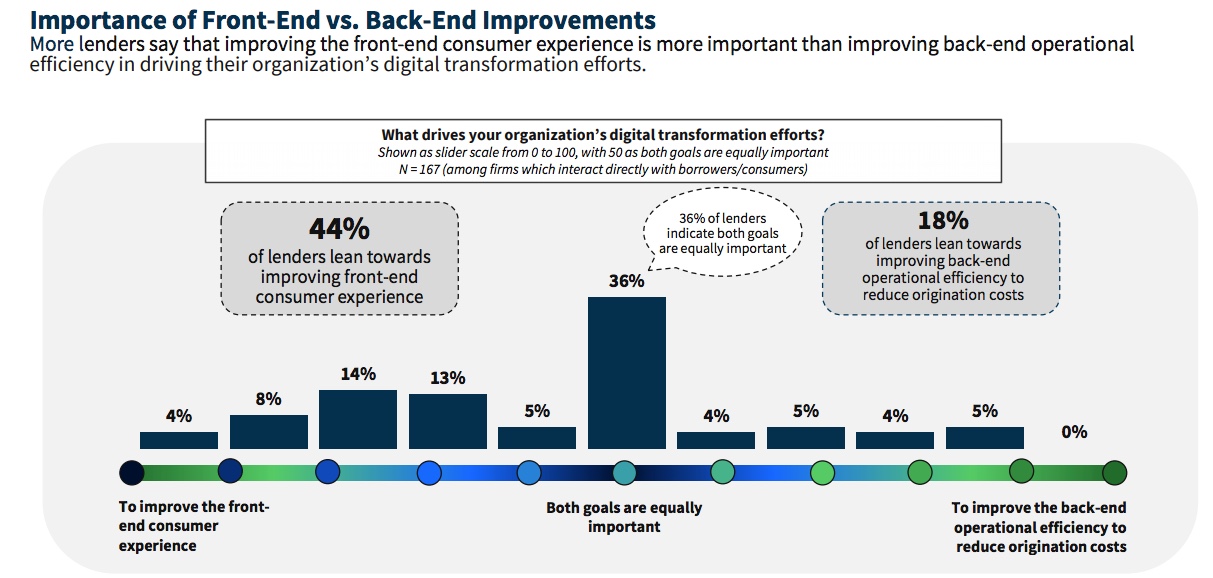

1. Between improving the front-end consumer borrower experience and the back-end operational efficiency to reduce origination costs, which area drives more lenders' digital transformation efforts?

2. How successful do lenders view their front-end digital transformation efforts versus their back-end efforts? Which area has a higher success rate? How successful do lenders view the scope and the impact of their digital transformation initiatives?

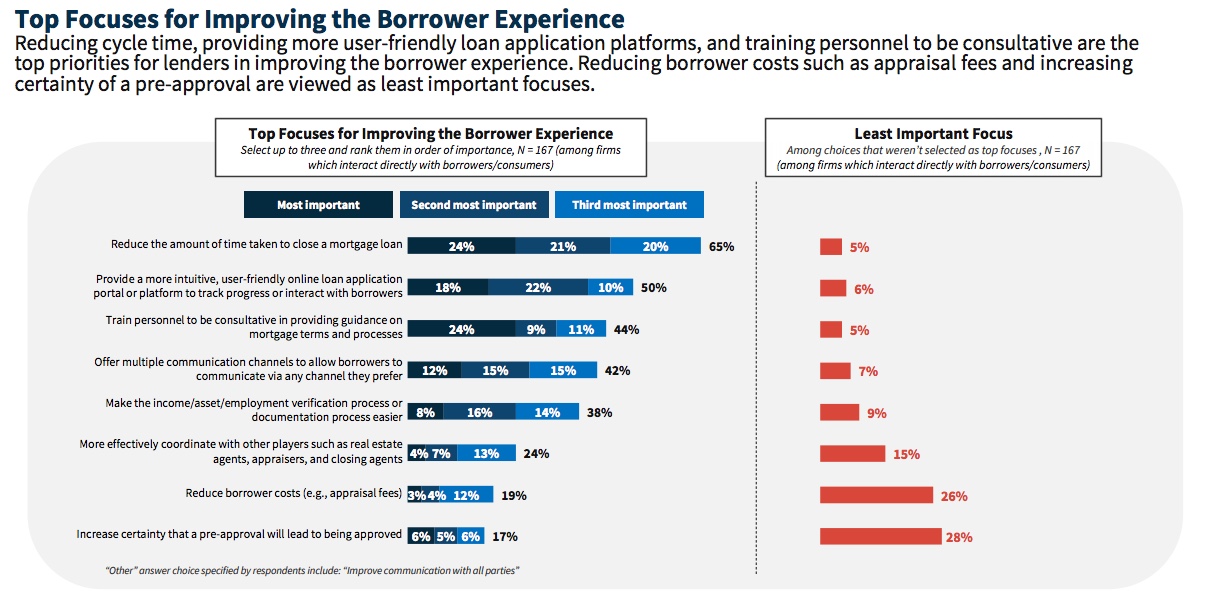

3. What specific areas do lenders focus on when they say they want to improve the consumer borrower experience?

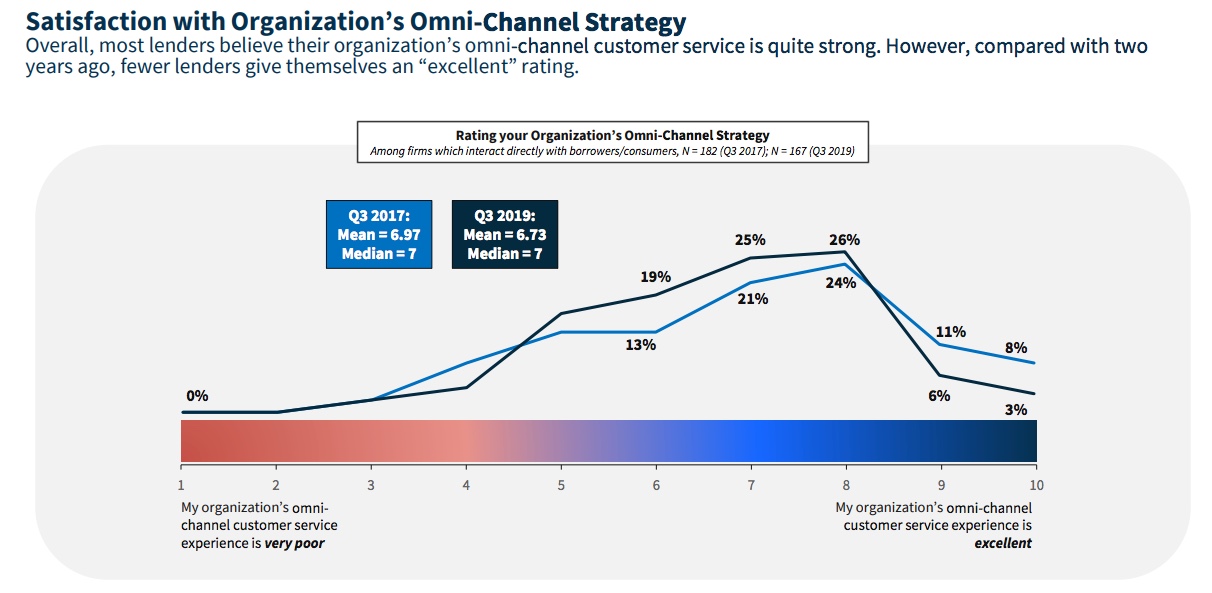

4.How do lenders assess their own omni-channel customer service practice, in comparison to the results from two years ago (Q3 2017)?

Forty-four percent of lenders indicated they tend to prioritize improving the front-end consumer experience, while 18 percent of lenders reported leaning toward improving back-end operational efficiency. Thirty-six percent of lenders gave approximately equal weight to each.

Lenders considered the most important parts of the borrower experience to be reducing the cycle time, providing more user-friendly loan application platforms and training their staff to be "consultative." Reducing borrower costs was generally considered less important.

Lender responses indicated that they prefer to invest in front in solutions and perceive them as more successful than their back-end efforts.

Fannie Mae notes that mortgage origination is complex. It involves many players and many processes to transmit large volumes of data among a series of interconnected parties, including consumers, investors, and an array of service providers and stakeholders. Back-end operations are inherently more complicated than the front-end borrower experience. While most lenders cited the implementation of a Point-of-Sale (POS) system as a success example on the front-end, it is more difficult to implement a single solution to transform back-end operations.

There are other roadblocks to transforming back-end operations including a talent shortage for digitizing legacy systems and less ability to justify the effort. It is more difficult to calculate returns on those changes than transformation on the front end and returns may take a while to manifest themselves. But eventually the investments help to reduce human errors and do-overs and also translate fixed labor costs into variable costs, allowing a business to scale capacity up or down as the market expands or contracts.

When evaluating their transformation efforts, 21 percent of respondents considered their front-end efforts to be very successful versus 11 percent who viewed their back-end efforts that way. Sixty-six percent saw the front-end efforts as somewhat successful while 58 percent said that about back-end changes. A total of 13 percent said front-end efforts were not very or not at all successful while those responses on the back end totaled 31 percent.

When asked about transformation efforts overall, two-thirds were "somewhat satisfied" with both the impact and the scope. Dissatisfaction with either registered in the high teens.

Most lenders believe their organization's omni-channel customer service is quite strong. However, fewer gave themselves an excellent rating than when asked the question two years earlier.