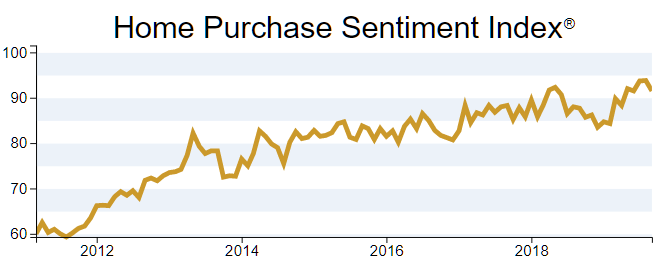

Fannie Mae's Home Purchase Sentiment Index (HPSI) has been relatively volatile in recent months, and September was no exception. The Index set back to back record highs in July and August, reaching 93.8 in the latter month which put it 5.8 points higher than in August 2018. September saw a 2.3-point drop in the index to 91.5 with three of the six components declining on a month-over-month basis. The index remains 3.8 points higher than a year earlier.

The index, based on selected responses from Fannie Mae's National Housing Survey (NHS) saw a nearly unprecedented 8-point drop in its net "Confidence About Not Losing Job" component, adding to a 4-point drop the previous month. The net of those who are not concerned about losing their job was 69 percent, the lowest since an 11-point dive in July 2018 took the net down to 65.

There was also a 7-percentage point drop in the component measuring sentiment about home prices increasing. This continued a decline that started in June. Only a net of 29 percent of respondents expect higher home prices over the next year, down 10 points from the previous September. Even among those who still expect prices to go up expectations have moderated. The average appreciation predicted has drifted down from 2.7 percent in early summer to 1.7 percent in September.

The declines were partially offset by increases in the "Good Time to Buy" and "Good Time to Sell" components, which rose 3 and 4 percentage points on net, respectively. A net of 28 percent now say it is a good time to buy while the good time to sell sentiment sits at a net of 44 percent.

The two-week uptick in mortgage rates may have convinced some respondents that rates were as low as they were going to go. The net of those who expect lower rates declined by 6 basis points to -23 percent. Still, this is up 33 points from a year earlier.

The final of the six components, the net of respondents who said their income had gone up over the previous 12 months remained at 21 percent for the third straight month.

"Consumer sentiment remains relatively strong overall, though uncertainty about the economy and individual financial circumstances appear to be weighing on housing market attitudes a bit more than a month ago," said Doug Duncan, Senior Vice President and Chief Economist. "Views about the direction of the economy held relatively steady, and the share of respondents who say it's a good time to buy or sell a home rose slightly. However, consumers who are pessimistic about current housing market conditions are more likely to cite unfavorable economic conditions than the prior month. Job confidence remains high but still well shy of its July reading. Despite some added uncertainty, the September HPSI indicates continued strength in housing market attitudes and is consistent with recent data on housing activity."

The NHS, from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. In addition to the six questions that form the framework of the index, respondents are asked questions about the economy, personal finances, attitudes about getting a mortgage, and questions to track attitudinal shifts. The September 2019 National Housing Survey was conducted between September 1, 2019 and September 24, 2019. Most of the data collection occurred during the first two weeks of this period. Interviews were conducted by PSB, in coordination with Fannie Mae.