Fannie Mae says consumer spending will continue to support the economy. The company's Economic Summary for September cites increases in auto and retail sales, real disposable personal income, and real personal consumption expenditures (PCE) as evidence of that strength. In the monthly report, written before release of the very strong census data on August's residential construction, they also say that the recovery in new single-family construction spending suggests that residential fixed investment may be slightly stronger this quarter than they previously expected.

As a result of these two factors, the economists upped their forecast for growth in real gross domestic product (GDP) by one-tenth of a percent in the third quarter but revised their view of nonresidential fixed investment to a negative number. They now project top-line GDP growth in 2019 at 2.2 percent and have downgraded the full year estimate for next by one-tenth to 1.6 percent.

The risks to the forecast include confusion in the U.K. over the never-ending Brexit issue and renewed evidence that the U.S. manufacturing sector may be dragged into the global slowdown. There are also indications that the resilience of consumer spending may be starting to wear thin, with weak growth in employment and a sharp turn downward in consumer sentiment.

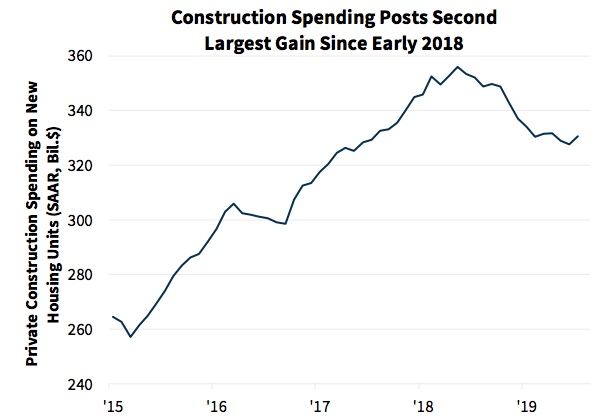

Fannie Mae is growing bullish on housing and says the third quarter started off in line with their earlier expectations. Existing home sales rose to 5.42 million annualized units in July, a 2.5 percent increase and the second highest rate of sales since April 2018. New single-family and multifamily residential construction spending had the best month since May with a 0.9 percent uptick and retail sales at home improvement stores, a proxy for home remodeling spending, moved higher. These positive developments suggest a modest rebound in residential fixed investment in the third quarter, which would end six consecutive quarters of declines.

Uncertainty over U.S.-China trade tensions and financial market volatility are problems for homebuying sentiment, but Fannie's economists see the continued growth in employment, solid wage gains, and the low mortgage rates as supporting housing demand. The Fannie Mae Home Purchase Sentiment Index (HPSI) inched up in August to 93.8, a new survey high, suggesting continued buying interest on the part of consumers.

As the report was written, the 30-year fixed mortgage rate was 3.49 percent, the lowest weekly level since October 2016 and only 18 basis points above the rate trough of the expansion in 2012. The decline in rates means fewer homeowners have mortgages with rates lower than those prevailing and could be freeing more to both list their existing homes and buy another.

The authors add that their survey data does not suggest enough of a shift in the existing home supply to alleviate overall supply constraints. Inventories of existing homes, which had increased on an annual basis for ten months, fell in July for the second time in as many months. The 1.6 percent decline brought the inventory down to its lowest point since Fannie Mae first tracked it.

July's pending sales almost completely erased the June gain so a pullback in existing home sales in probable in both August and September. Further, the average number of purchase mortgage applications posted the largest decline in August since February, suggesting a weakening sales pace in September and early October. The lack of listings has prevented home sales from responding to lower interest rates as strongly as they have in the past and given the weak response, Fannie has revised its existing sales forecast down slightly; 2019 sales will be 0.3 percent lower than last year's levels.

The lack of inventory should, however, support new construction. The economists expect single-family housing starts to move modestly upward through the remainder of the year, even as builders continue to face labor and land constraints. New home sales will also rise, but not as fast as starts. The year-to-date sales have allowed home builders to draw down the excess inventory that had built up at the end of last year. In coming months homebuilders will have to rely more heavily on starts to fulfill sales demand, and sales will be increasingly limited by the pace of construction.

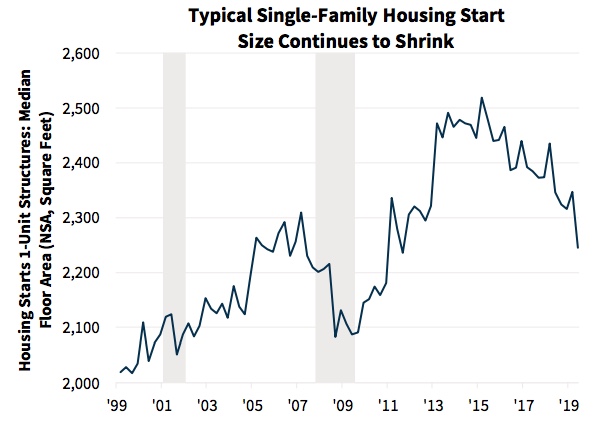

The authors appear pleased that builders seem increasingly focused on entry-level products. The median square footage of new single-family construction fell 4.3 percent in the second quarter to the lowest level since 2011. This should aid affordability, especially for first-time homebuyers. But building smaller homes has a downside; it is more labor intensive per dollar of construction. Combined with the shortage of construction labor, residential fixed investment has not boosted the overall economy in recent quarters. "Given the supply and demand fundamentals, the decline in mortgage rates has been a price accelerator exacerbating the affordability challenge for entry-level buyers," the report says.

Fannie Mae has updated its estimate of for single-family (1- to 4-unit properties) mortgage originations for 2017 and 2018 in its regular benchmarking to the Home Mortgage Disclosure Act (HMDA) data. Their higher estimated purchase originations for the two years resulted in an upwardly revised path for purchase originations in 2019 and 2020 as well. The benchmarking also resulted in higher refinance originations in 2017 and 2018, with the refinance share of total originations unchanged at 36 percent in 2017 and revised upward by 1 percentage point in 2018 to 30 percent.

The decline in the mortgage rate forecast since last month led to an upward revision in the refinance origination forecasts for both 2019 and 2020. The new projection is for total originations to rise by 11.6 percent from 2018 to $1.97 trillion in 2019, with a refinance share of 35 percent. The following year total originations are expected to decline by 6.8 percent from this year to $1.84 trillion as projected declines in refinance activity outpace essentially flat purchase activity, with the refinance share dropping to 31 percent.