The so-called GSE Patch for the Consumer Financial Protection Bureau's (CFPB) 2013 Ability-to-Repay (ATR) and Qualified Mortgage (QM) rule (Rule) is scheduled to expire in January 2021 (earlier if the government sponsored enterprises (GSEs) are released from conservatorship.) The Patch created a temporary category under the ATR and QM rule under which loans eligible for purchase or guarantee by the GSEs can qualify as QM loans.

The ATR and QM rules require lenders to make a reasonable, good-faith determination of a consumer's ability to repay a mortgage loan based on verified borrower financial information. These include consumer protection features generally associated with responsible mortgage lending practices. In most cases, meeting QM requirements provides lenders with a safe harbor from the Rule's legal liabilities. Lenders who fail to comply can be held liable for damages by both the CFPB and the homeowner.

However, for what is called higher-priced mortgage loans (HPMLs), loans that were previously called nonprime or subprime mortgages, the ability to repay presumption can be rebutted by the homeowner on the basis that the lender did not leave them with enough "residual income" to cover basic needs after making their mortgage payment. (HPMLs have an Annual Percentage Rate (APR) greater than or equal to the Average Prime Offer Rate (APOR), the daily market index of the lowest APRs offered by a selection of lenders, plus 150 basis points.) The GSE Patch is intended to provide lenders with legal protection in such circumstances.

CoreLogic's Pete Carroll says mortgage industry stakeholders are "buzzing" over how the CFPB views the pending expiration of the GSE Patch and, in a two-part blog article, attempts to offer some objective, third-party data, and insights to inform these discussions.

CFPB's primary reason for the Patch was to preserve access to mortgage credit during a period after the housing crisis when mortgage markets were still in transition. The fear was that certain features of the QM mortgage would lock out some consumers with high DTIs or financial characteristics such as borrowers with inconsistent income streams or non-W-2 wage earners.

For the first installment of Carroll's analysis, he looked at the mortgage market share last year in terms of where they fell within QM.

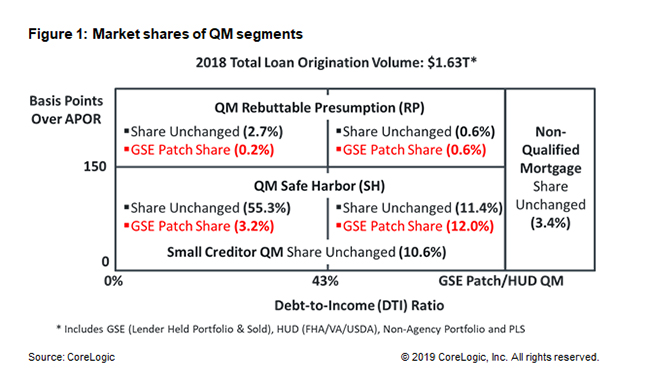

The total volume of mortgage loan originations in 2018 is estimated at $1.63 trillion. Figure 1 charts the market shares of all QM and Non-QM segments based on the APOR threshold and the 43 percent general QM threshold. Non-W-2 wage earners (which include self-employed, part-time or "gig-economy" workers, seasonal workers, or retirees) are factored into each of the QM quadrants in Figure 1. Carroll says he is unaware of any study showing the extent to which lenders feel confident in underwriting those borrowers under Appendix Q. The appendix defines rules for DTI for QM eligibility purposes. Carroll assumes that all non-W-2 wage earners who were eligible for QM in 2018 would not otherwise have qualified if not for the GSE Patch.

The shares of Non-QM and Small Creditor QM loans are included in Figure 1 to complete the sizing of the entire 2018 mortgage market. The 2018 market share not impacted by the GSE Patch is displayed in black while the share CoreLogic estimates were only eligible due to the presence of the patch is in red. The company estimates that roughly 16 percent, the sum of all segments highlighted in red, or $260 billion in loan origination volume was in the patch category. In other words, absent the patch, that volume would have had to be originated as non-QM loans.

Carroll cautions that the $260 billion figure is a rough order of magnitude with an upper and lower range of $200 billion to $320 billion. "While that is indeed a large swing," he says, "the ultimate point remains the same, a significant share of 2018 mortgage loan origination volume would have been impacted by the GSE Patch's expiration, all things equal." (Emphasis is the author's)

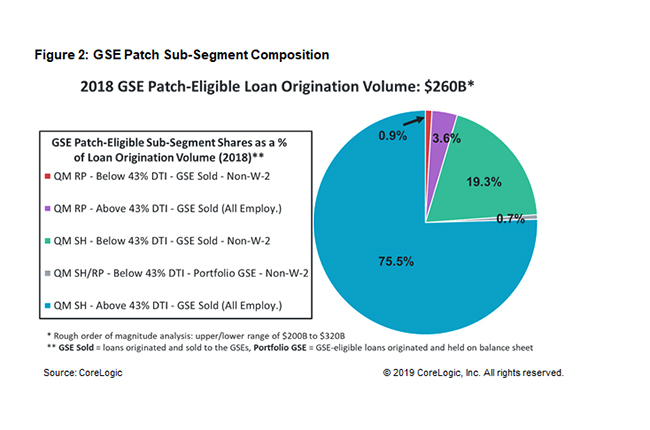

With a range of GSE market share and loan volume estimated, Carroll examined additional characteristics (sub-segments) that account for loans being QM eligible solely because of the patch. Figure 2 provides a further breakdown of GSE Patch loan sub-segments.

The sub-segment with the greatest percentage share (75.5 percent) was QM Safe Harbor loans with DTI ratios above 43 percent, originated and sold to the GSEs, and covering borrowers of all employment types (both W-2 and Non-W-2 wage earners). The second largest (19.3 percent) was QM Safe Harbor loans with DTI ratios below 43 percent, originated and sold to the GSEs, covering Non-W-2 wage earner borrowers. Carroll says, "To the extent CFPB's original concern regarding lender discomfort underwriting Non-W-2 wage earner borrowers to QM using Appendix Q was accurate, GSE Patch-equivalent volume at stake is significant."

Carroll says the next installment of his research "will empirically demonstrate the various profiles of borrowers that compose the largest GSE Patch sub-segment in recent vintage years, who will likely switch to the Non-QM segment following the GSE Patch expiration, all things [being] equal."