May mortgage performance data indicates that the mortgage finance industry might consider shifting priorities for a while. Black Knight, in the current edition of its Mortgage Monitor, points to the heavy prepayment risk for especially for adjustable rate mortgage (ARM) borrowers shown in the report and the growing pool of financeable mortgages. It is time, Black Knight says, for lenders and servicers to focus attention on retention so their existing customers don't refinance elsewhere.

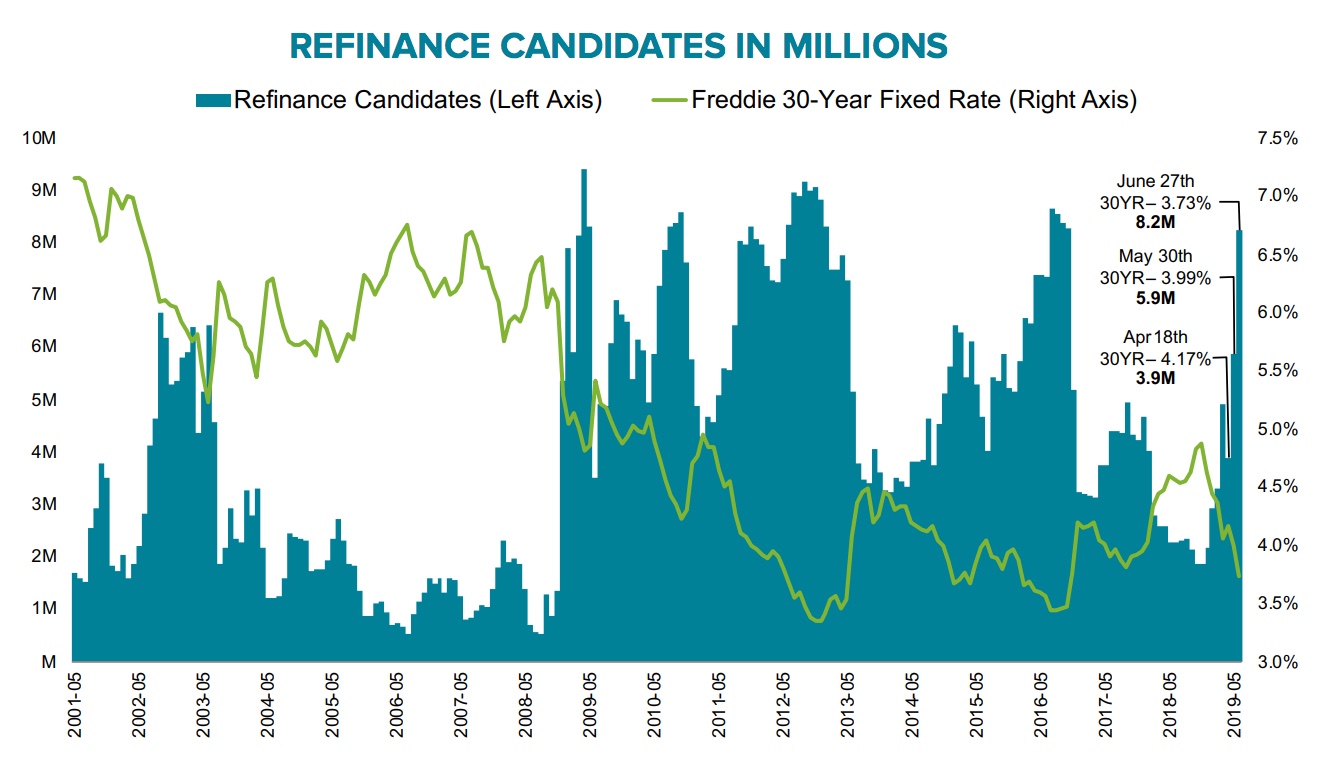

Behind both of the activities cited, of course, is the continuing retreat of interest rates. On Thursday Freddie Mac announced another 11-basis point (bp) slide in its mortgage rate, bringing it to 3.73 percent, a three-year low.

The Monitor has reported in several of its recent editions about the growing pool of borrowers who could benefit from refinancing but given the run-up in rates during 2018 and the subsequent ratcheting down, has been hard-pressed to keep up with the changing numbers. Black Knight defines a financeable loan as one where the homeowner can both qualify to refinance and save 0.75 bps or more by doing so.

The company estimates there are now 8.2 million homeowners who could benefit from refinancing. This is 6.4 million more potential refinancers than in November of last year, just before rates began to slide and the largest the pool has been since late 2016 (8.3 million.) In fact, the pool has swollen by 1.5 million between the May peak and June 27th. These borrowers could save an average of $266 per month on their mortgage payment and, if all were to refinance, it would put aggregate savings of $2.2 billion a month back into the economy.

Among that 8.2 million, are 1.5 million homeowners who took out their loans only last year. More than 35 percent of all mortgages originated in 2018 are currently considered financeable by Black Knight. accounting for one of every six such candidates in the market and matching the total from the 2013-2017 vintages combined.

The prepayment rate shows clearly that homeowners are paying attention to rates. While some of the prepayments are the result of the spring homebuying season (which probably is enjoying a rate boost as well), homeowners are also refinancing. The prepayment rate in May surged 24 percent and has more than doubled over the last four months. to the highest level since late 2016.

As Black Knight Data & Analytics President Ben Graboske explained, prepayments are up across the board, but some cohorts are seeing greater levels of activity than others. "Overall, prepayment activity - largely driven by home sales and mortgage refinances - has more than doubled over the past four months," he said. "While we've observed increases across nearly every investor type, product type, credit score bucket, and vintage, some changes stand out. For instance, prepayments among fixed-rate loans have hewed close to the overall market average, rising by more than two times over the past four months. However, ARM prepayment rates have now jumped to their highest level since 2007 as borrowers have sought to shed the uncertainty of their adjustable-rate products for the security of a low, fixed interest rate over the long haul."

"Likewise, while all loan vintages have seen prepayment activity increase, they are all dwarfed by 2018. Prepays among the 2018 vintages have jumped by more than 300% over the past four months and are now nearly 50% higher than 2014, the next highest vintage.

"Early estimates suggest closed refinances rose by more than 30% from April 2019, with May's volumes estimated to be three times higher than the 10-year low seen in November 2018. Given that interest rates have fallen further from May to June - and that we've yet to see the calendar year peak in terms of housing turnover related-prepayments - we may very well continue to see rising prepayment activity again in June's mortgage data." Graboske said.

Higher credit score borrowers are, as is usually the case, more reactive to downward trending rates. Prepayments among this with 720 or higher scores are up 121 percent over the past four months.

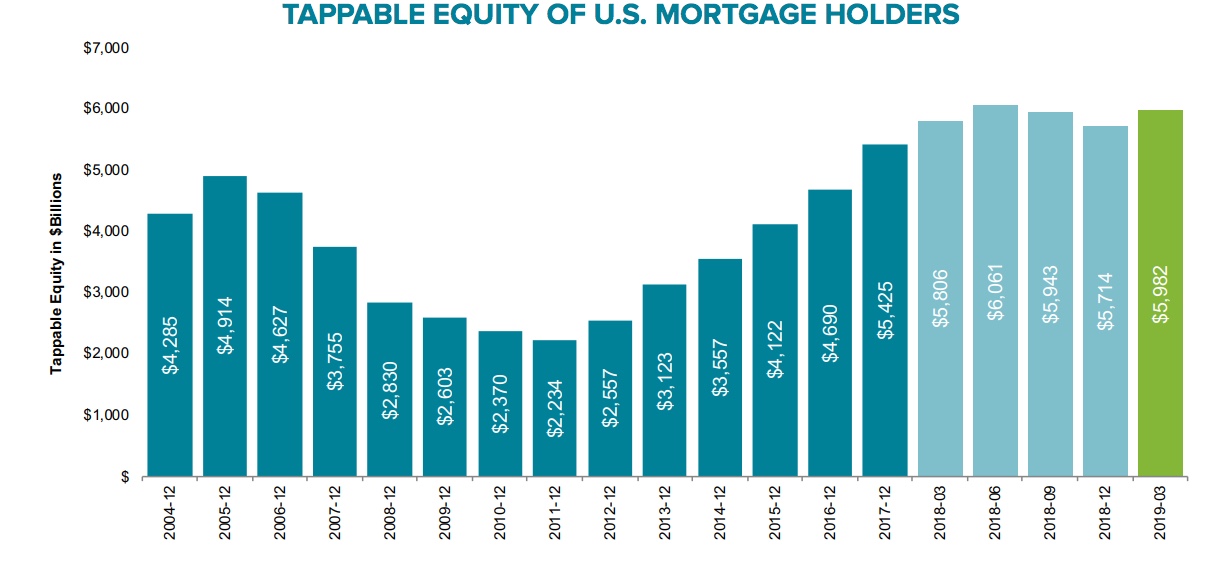

Refinancing could get an additional boost from cash-out transactions. Black Knight found that after two-quarters of declines, tappable equity is rising again. The company estimates that there are 44 million homeowners with more than 20 percent of the equity in their homes, able to draw out on average $136,000 per household before hitting a combined 80 percent cap. The tappable equity aggregates to $5.98 trillion.

While this equity is growing again, it is growing more slowly. While tappable equity peaked at 6.06 trillion last summer and is likely to surpass that number, the annual growth rate slowed to 3 percent in the first quarter compared to 5 percent a year earlier. There have also been some notable local declines in a lot of West Coast cities, Houston, and Baton Rouge, although it continues to grow in 47 states and 94 of the largest markets.

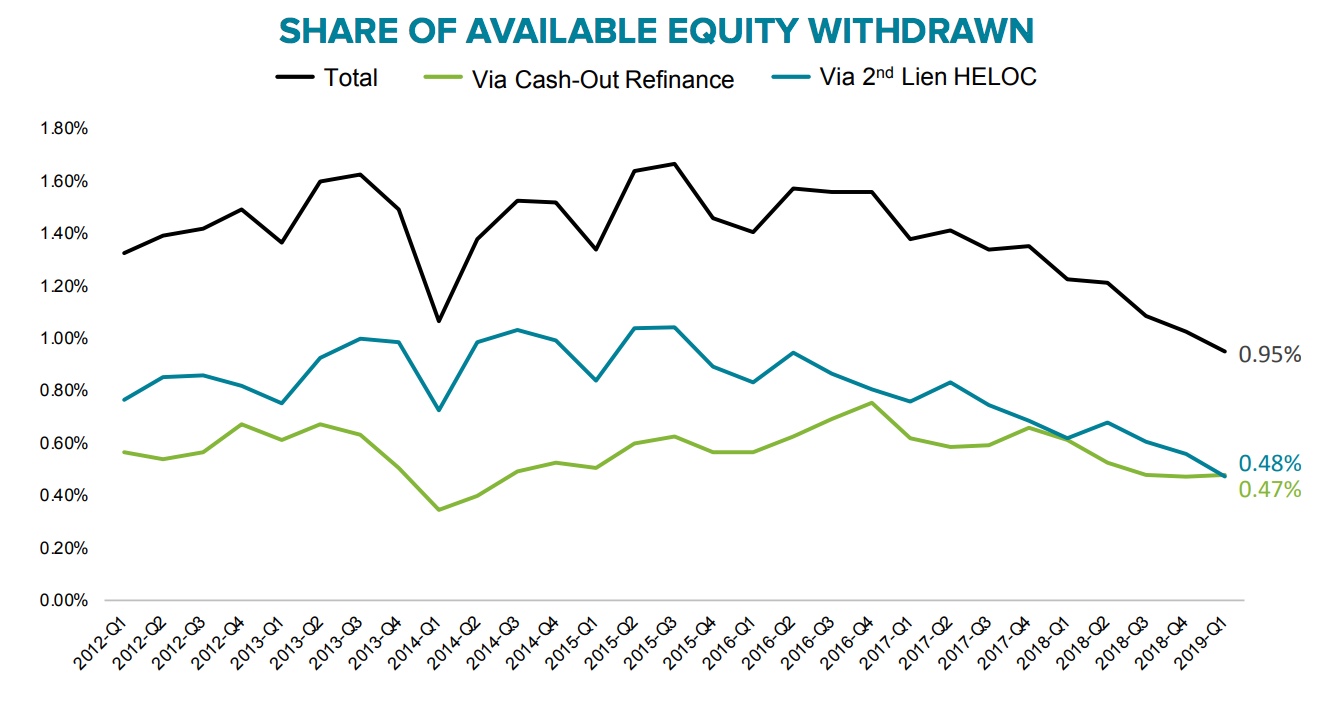

Homeowners continue to be cautious about tapping equity, only $54 billion was cashed-out in the first quarter, the lowest volume in four years. Withdrawals as a share of available equity are down 16 percent over that same span.

Homeowners have increasingly steered away from HELOCs as a vehicle for cash out. Those withdrawals were down by 18 percent compared to both the previous quarter and on an annual basis, hitting a 5-year low and falling below withdrawals through cash-out refis for the first time in more than eight years. Those withdrawals as a share of available equity have also fallen, reduced by half over the past three years

Early indications suggest cash-out withdrawals are up in Q2 2019 as lower rates provide refinance incentive and reduce the long-term expense of tapping equity