With mortgage delinquencies continuing to be at historic lows, CoreLogic points to natural disasters as a significant cause of the slight deterioration of loan performance in a few local markets. The company's Loan Performance Insights report for February notes that the nation's overall delinquency rate has fallen on a year-over-year basis for the past 14 consecutive months, a result of the strength of loan vintages since the housing crisis.

Ralph McLaughlin, CoreLogic's deputy chief economist says, "The persistently impressive economic expansion continues to drive down housing market distress, with delinquencies and foreclosures hitting near two-decade lows. Furthermore, with unemployment at a 50-year low, wage growth nearing double inflation and a positive demographic structure that will drive housing demand upwards, the future of U.S. housing and mortgage markets look bright even if short term indicators suggest cooling."

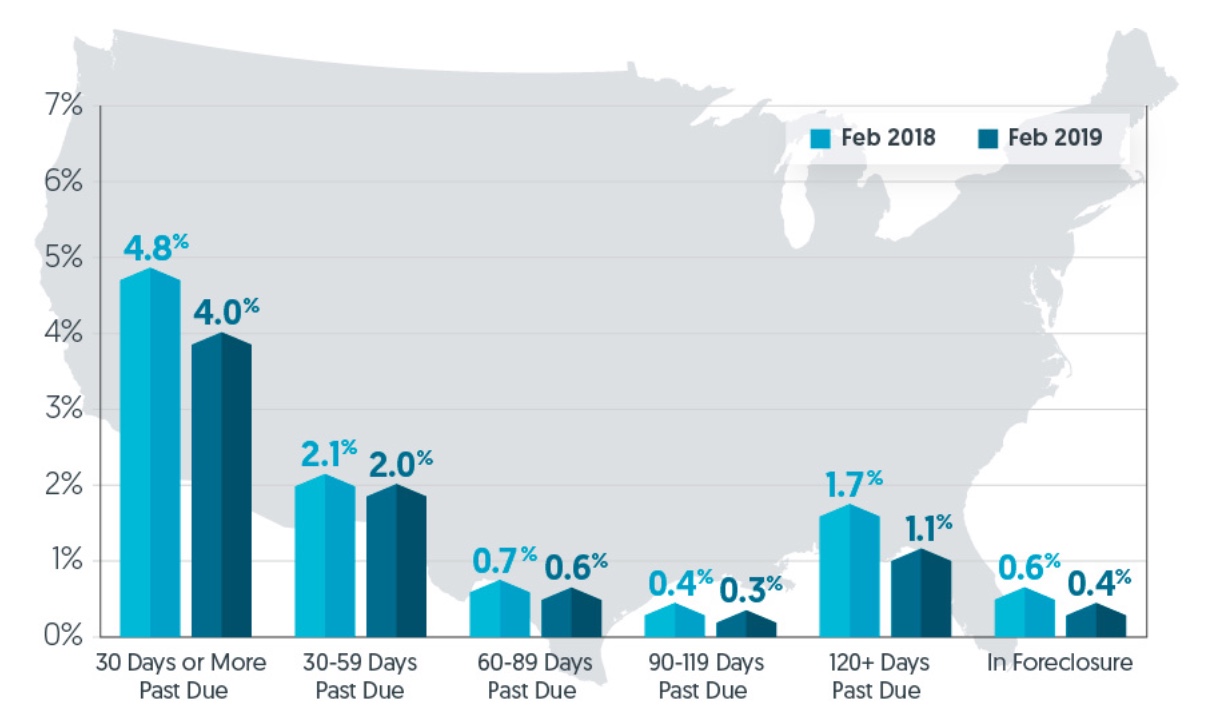

The national rate of loans that were 30 days or more past due, including those in foreclosure, was 4.0 percent in February, down from 4.8 percent at the same point in 2018. The year-over-year improvement was reflected in all delinquency buckets including the foreclosure inventory rate, loans in the process of foreclosure, at 0.4%, down 0.2% from February 2018.

In February, 11 metropolitan areas experienced annual gains - mostly very small - in their serious delinquency rates. The largest gains were in four Southeast metros affected by natural disasters in 2018. The largest year-over-year increases were in Panama City, Florida and Albany, Georgia at 2.0 percent and 0.9 percent respectively. Both received significant damage from Hurricane Michael. Two North Carolina cities, Jackson and Wilmington, hit by Hurricane Florence, saw their rates increase by 0.7 and 0.6 percent.

Frank Martell, CoreLogic's president and CEO said, "We are on track to test generational lows as delinquency rates hit their lowest point in almost two decades. Given the economic outlook, we are likely to see more declines over the balance of this year. Reflective of the drop in delinquency rates, no state experienced a year-over-year increase in its foreclosure inventory rate so far in 2019."

CoreLogic also looks at transition rates each month, that is the percentage of mortgages that move from one stage of delinquency to the next. One percent of all mortgages that were current in January had missed one payment by February, the same transition rate as in February 2018. By comparison, in January 2007, just before the start of the housing crisis, the current-to-30-day transition rate was 1.2 percent. It peaked in November 2008 at 2.0 percent.

The share of mortgages moving from the 30-day bucket to 60 days past due was 15.2 percent compared to 15.9 percent the previous February and 24.8 percent of 60-day delinquencies moved to 90 days, a 0.3 percent annual increase.

Serious delinquencies declined in every state but Minnesota where the rate was unchanged. In addition to the 11 core-based metro areas where serious delinquencies increased, there were 17 where the rate was unchanged. All of the remaining areas saw serious delinquencies decline.