Condominium loans represent only about 8 percent of total mortgages, a share that has remain fairly stable for several years. However, CoreLogic says they are poised to play a much larger role. Jacqueline Doty, writing in the company's Insights blog, says the loans, which are overwhelmingly (80 percent) conventional, have enjoyed recent gains.

The changes have been especially notable in the jumbo sector where there has been a steady increase of condo sales in the over $1 million price range since 2009. Sales of condos are especially hot in Washington D.C. where they represent 37 percent of the market and Hawaii at 42 percent and both are high-priced markets.

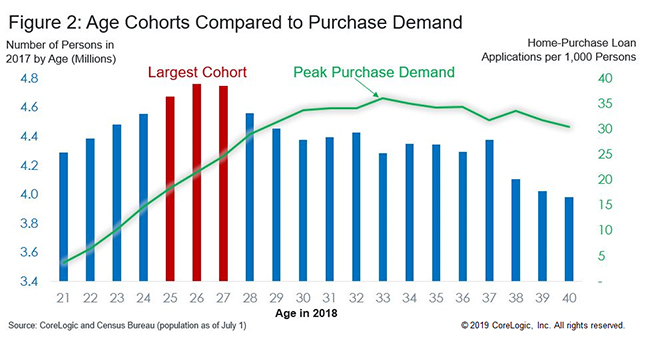

Doty says the condo market has become tighter than ever with an average marketing time of 60 days, the shortest since CoreLogic started tracking it in 2000. Add to this the looming entry into the housing market of young Americans, those aged 25 to 27 and it appears that the demand for condos will only increase.

She says that lenders who hope to take advantage of a potential surge in condo loan originations need to avoid unnecessarily strict underwriting. The current delinquency rate for those properties is about 2 percent lower than that of single-family housing, so there might be room to loosen some guidelines.

The GSEs Freddie Mac and Fannie Mae have already done so, making several changes in their condo policies last year to allow lenders more flexibility. Among the changes was to allow the commercial space of up to 35 percent in condo developments rather than the 25 percent that existed previously. They relaxed requirements for small two-to-four-unit projects and streamlined underwriting for some low loan-to-value and investor loans. They also removed the ban on projects with pending litigation as long as it did not pose a threat of significant impact to the project's financial stability. Such flexibility, Doty says, will allow for more condo loans to be originated and sold to the GSEs going forward.