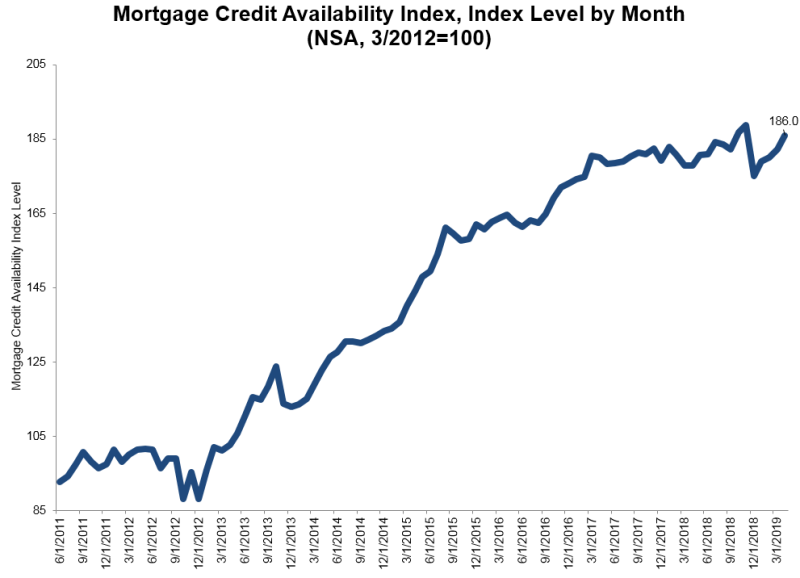

A big jump in jumbo loan lending drove an increase in mortgage credit availability in April. The Mortgage Bankers Association's Mortgage Credit Availability Index (MCAI) rose 2.1 percent in April to 186.1. An increase in the index indicates that lending standards are loosening.

The Conventional MCAI increased 4.3 percent largely because of a 6.8 percent surge in its Jumbo Index component. The second Conventional component, the Conforming MCAI, was up a more modest 1.2 percent. The Government MCAI was unchanged.

Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting said, "Credit supply increased 2 percent in April and was driven by a 7 percent gain in the jumbo index, which reached its highest level since the beginning of the MCAI in 2011. Additionally, investors continued a trend from March of further increasing their willingness to purchase more non-QM and non-agency jumbo loans. The high-end of the purchase market had shown weakness earlier this year, before the recent decline in mortgage rates, and it appears investors are trying to remain competitive in that segment of the market."

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) gathered from over 95 lenders and investors. They are combined with data from an AllRegs proprietary product to calculate a summary measure indicating the availability of mortgage credit at a point in time

The MCAI and its components are designed to show relative credit risk/availability for their respective indices and were benchmarked in March 2012. The total MCAI, Conforming, and Jumbo indices were indexed at 100 while the Conventional and Government indices were indexed at 73.5 and 183.5 respectively to better represent where each index might have been relative to 100.