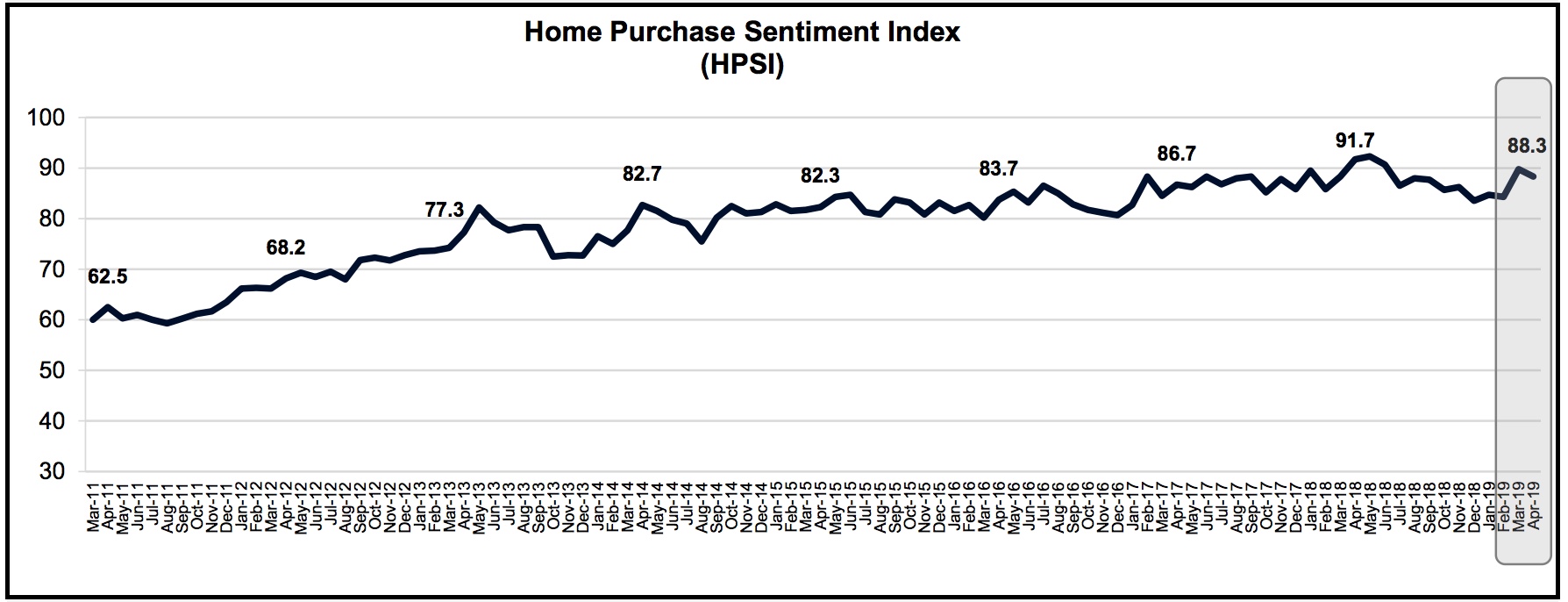

Even though mortgages rates have declined over the last several months, consumers remain bearish about buying a home. Fannie Mae said net positive responses to the question about whether it is a good time to buy more than reversed a 7-point increase in March, falling 8 points to 14 percent in April. That is 15 percentage points lower than the April 2018 level. That reversal was, in part, responsible for a 1.5-point decline in the Home Purchase Sentiment Index (HPSI) to a reading of 88.3. The HPSI is down 3.4 points compared with the same time last year.

The "good time to buy" question is among those asked of consumers in Fannie Mae's monthly National Housing Survey (NHS) and is one of six questions that are used to calculate the HPSI.

Consumers are very much aware of the recent good news about interest rates. Fannie Mae says the net positive share of survey respondents who expect rates to decline over the following 12 months has risen a total of 12 points over March and April. Five points of that gain came last month. The net share is now -40 percent, 8 points higher than in April 2018.

The net share of those who say it is a good time to sell a home was unchanged at 43 percent in April. This component is down 2 percentage points from the same time last year.

Survey respondents are acknowledging the recent slowing of home price gains. The net share of those who say home prices will go up over the next 12 months decreased 2 percentage points to 36 percent and is down 13 percentage points from the same time last year.

"Households remain upbeat about economic activity but have more mixed attitudes toward the housing market," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "While home selling confidence remains strong and more consumers on net expect mortgage rates to decline over the next year, respondents walked back some of their buying optimism from March. Improving perceptions of income gains and a softening home price growth outlook should help support housing demand. However, increasing expectations among consumers that mortgage rates will continue to be favorable for some time will likely gain additional support following last week's Fed meeting - and may also be reducing their urgency to buy."

Respondents were more bullish about personal finances. Those who say their income is significantly higher than it was 12 months ago increased 2 percentage points on net to 22 percent, 4 points higher than a year earlier. The net share of Americans who say they are not concerned about losing their job dropped by 6 percentage points to 74 percent. This component is down 2 percentage points from the same time last year.

The NHS, from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. In addition to the six questions that form the framework of the index, respondents are asked questions about the economy, personal finances, attitudes about getting a mortgage, and questions to track attitudinal shifts. The April 2019 National Housing Survey was conducted between April 1 and April 23, 2019.