Top line, bottom line: Brexit is a big deal. Without the Brexit referendum in mid-2016, US bond yields never would have revisited all-time lows. It's important to remember that London is big player in financial market history. The London Stock Exchange was founded in 1571 or 1698, depending on how you look at it, and it became the first regulated exchange in history in 1801. With that date roughly coinciding with the proliferation of the telegraph, this was arguably the birthplace of modern financial markets.

To this day, London is ranked as the 2nd biggest financial center behind New York. It's importance is only amplified due to the closer relationships between the two cities. The UK has long been the English-speaking base camp for US-based traders who participate in European markets. For all these reasons and more, what happens in London doesn't stay in London when it comes to the market.

But Brexit waxed and waned in 2016, right? And now they're just sort of sorting it out, aren't they?

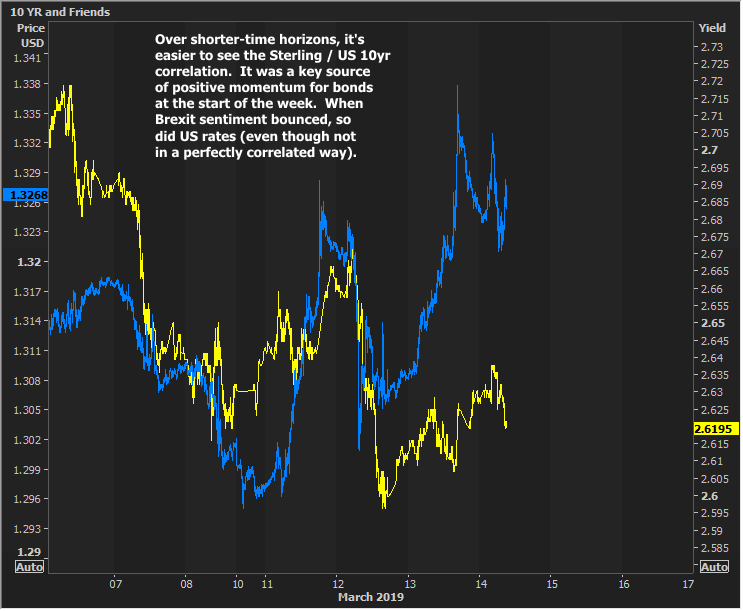

Yes and no... It's true that 2016 was the biggest deal, but we're still seeing episodes of correlation when we look at British pounds sterling vs US rates. In the medium term, this correlation is fleeting at best. Each market has plenty of other things to consider.

Correlation is easier to spot in the short term. For instance, Brexit news was a key source of strength on Tuesday, and very likely behind the bounce that followed.

When we look at British BONDS (as opposed to currency), it's much easier to see correlation. But we have to be careful because there will always be a good amount of correlation between sovereign debt of the biggest players. The trick is to look for big spikes in one market that are definitely informed by Brexit news and then to see how the other market reacts. When we do this, we see that the mysterious sell-off in US bonds on Feb 27th was very likely a factor of Brexit news (Sterling was spiking around the same time, but the correlation was harder to see on a chart).

The past few days are informative as they logically show more volatility in British bonds while not abandoning the correlation we'd expect to see in the US. From here, the risk is that Theresa May wins over enough support to get MV3 through parliament (the 3rd compromise deal, designed to avoid the "no-deal" brexit that lawmakers voted down last night). If that happens, it will be "risk-on" for markets (i.e. bond yields will move higher). This will be a bigger deal for British financial markets, but US markets will definitely get some spillover.