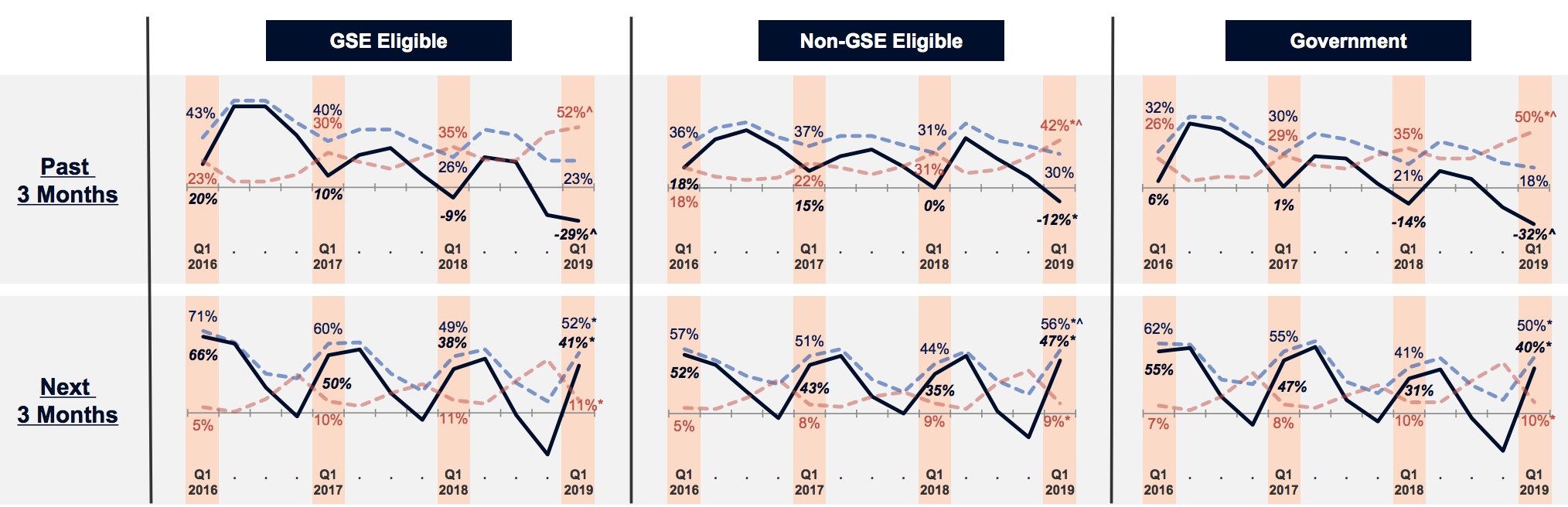

While still far from buoyant, mortgage lenders were a little more upbeat about their expected profit margins and the demand outlook for both purchase and refinance mortgages when responding to Fannie Mae's first quarter Mortgage Lender Sentiment Survey. The net share of lenders reporting that demand had increased for purchase mortgages over the prior three months fell to a new survey low, however the net responses reflecting more positive expectations for the upcoming three months rose compared to one year ago. The responses were consistent across all loan types.

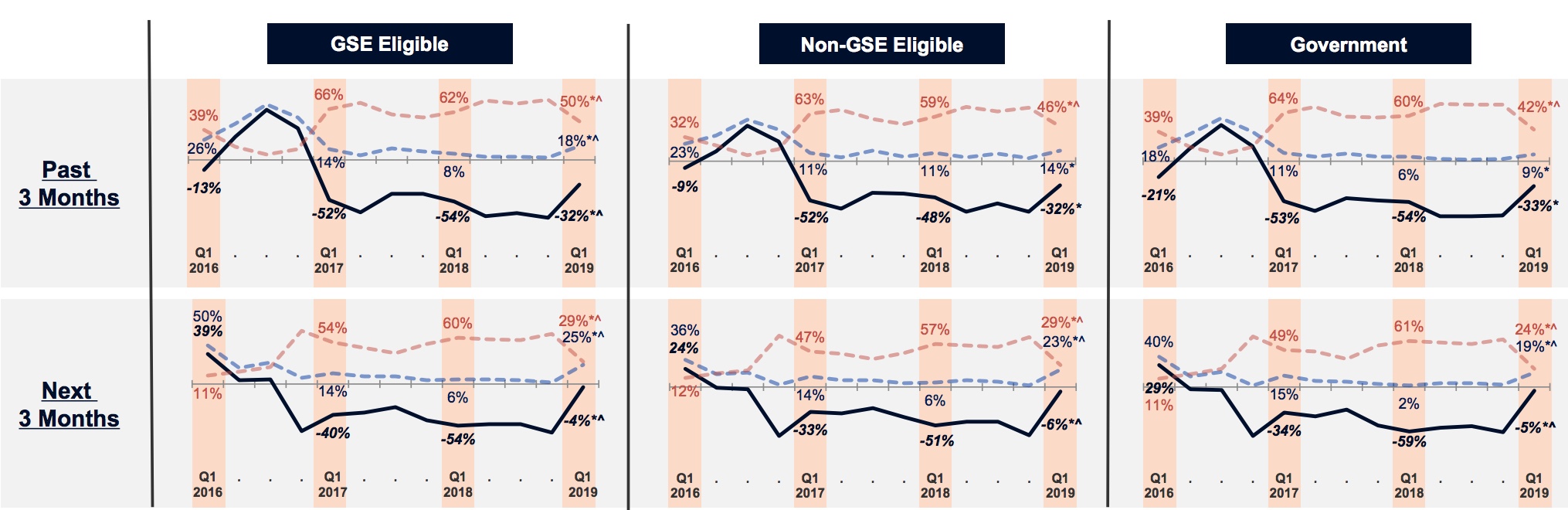

While more lenders continued to report weaker demand for refinancing over the previous three months than reported rising demand, the net share of positive responses increased significantly; rising to the highest level in two years across all loan types. The same pattern held for upcoming refinance expectations; the net share expecting growth in the next quarter remained negative but was also at a two-year high.

Doug Duncan, Fannie Mae's senior vice president and chief economist said, "Lenders appear less pessimistic regarding mortgage demand expectations; thus their profit margin outlook over the next three months is also slightly improved. While the results seem to portray the gloomiest picture of purchase mortgage demand during the prior three months in the survey's five-year history, the net share of lenders expecting rising demand over the next three months exceeded the level recorded in the same quarter last year. Lenders' view of the refinance market was somewhat rosier, as both recent and expected demand improved to the best showing in two years, helping to support lenders' improved profit margin outlook."

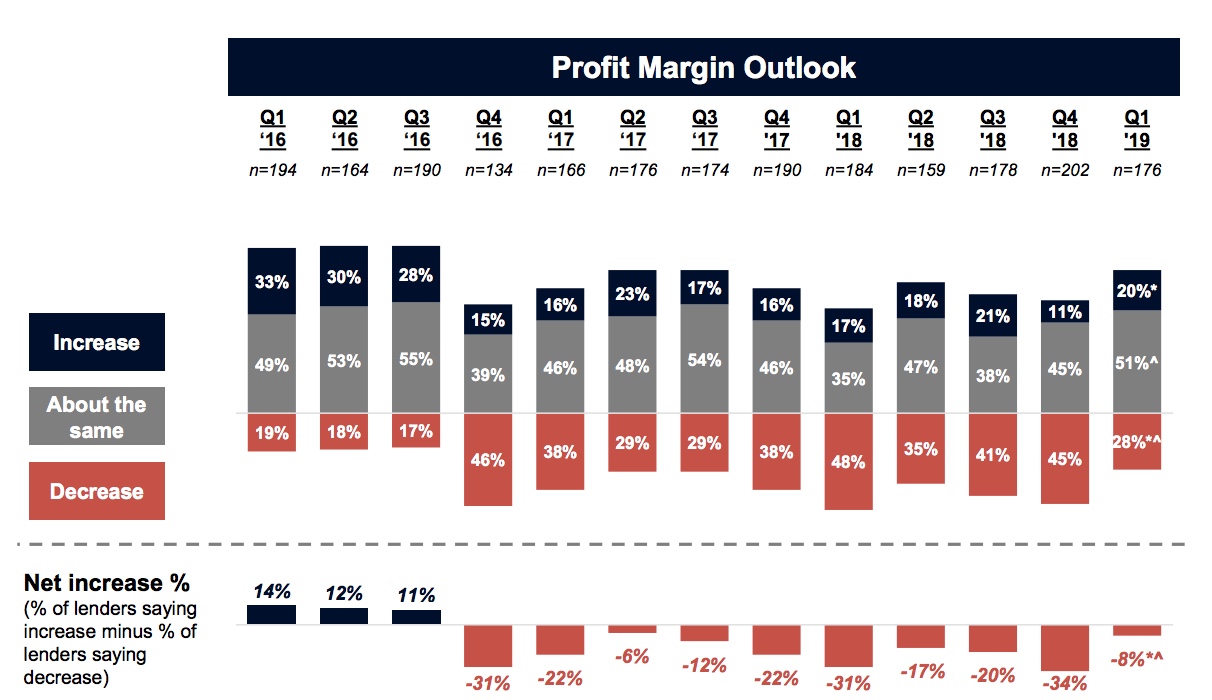

That profit outlook, while remaining negative on net for the tenth consecutive quarter, has improved significantly from the survey low it reached in both the first and fourth quarter 2018 surveys.

Competition from other lenders continues to be the chief reason cited for the decreased profit margin outlook. It was the ninth consecutive quarter that this explanation topped the list. Consumer demand continues to be the second most important reason.

"While more lenders anticipate declining rather than rising profit margins, continuing the trend that started in the fourth quarter of 2016, the net share expecting falling profit margins decreased from a survey high in the prior quarter to the lowest share in nearly two years," continued Duncan. "Lenders' improved demand outlook going into the spring selling season bodes well for our forecast of relatively flat mortgage volume this year following the double-digit drop in 2018."

Overall, lenders on net continued to report easing lending standards at a modest pace across all loan types. For GSE eligible loans, the share reporting that credit standards eased during the prior three months was only slightly above the share reporting tightening, with the net share reporting easing at the lowest level in four years.

Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The first quarter survey was conducted between February 6, 2019 and February 17, 2019. The survey received responses from 184 lending institutions; 53 were mortgage banks, 79 depository institutions, and 33 credit unions.