Freddie Mac is forecasting that there will be GDP growth of 3.0 percent in the second quarter of this year, moderating from the strong 4.2 percent growth in the first quarter. The company's October Forecast, prepared by its Economic and Housing Research Group, now extends its predictions into 2020 and they are looking at substantial economic slowing by then. The forecast for all of 2018 is growth of 3.0 percent, slowing to 2.4 percent next year and to only 1.8 percent in 2020 "as the effects of expansionary fiscal policy fade." Last year's hurricanes damaged both the economy and the housing sector, but at this point Hurricane Florence is expected to create only a small dip in economic growth and cause no appreciable increase in foreclosures.

The labor market picture continues to be strong with 134,000 new jobs added in September and a 0.2 percent decline in the unemployment rate to a 49 year low of 3.7 percent. There was an uptick in the record low level of unemployment claims following Hurricane Florence, but it disappeared after a week and the four-week moving average of continuing claims fell to a 45-year low. Still, wage growth increased only 0.3 percent during the month and Freddie Mac calls that "inconsistent with the current strong labor conditions." The forecast is for unemployment to average 3.9 percent this year, 3.8 percent next year and then rise to 4.0 percent in 2020.

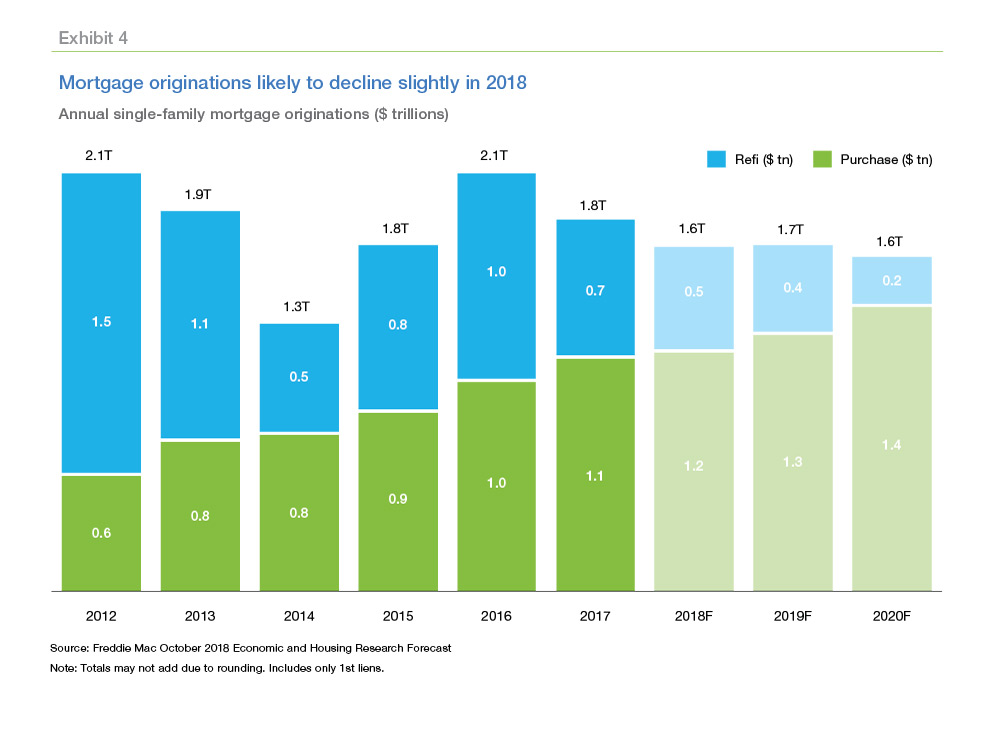

Mortgage rates remained steady at 4.6 percent early in the third quarter, but then the weekly average rate increased to 4.9 percent in the beginning of October, a level that we have not seen since mid-2011. Freddie Mac expects mortgage rates to continue to gradually inch higher, anticipating a 30-year fixed-rate mortgage averaging 4.5 percent in 2018. It expects the rate to rise to 5.1 percent in 2019 and 5.6 percent in 2020.

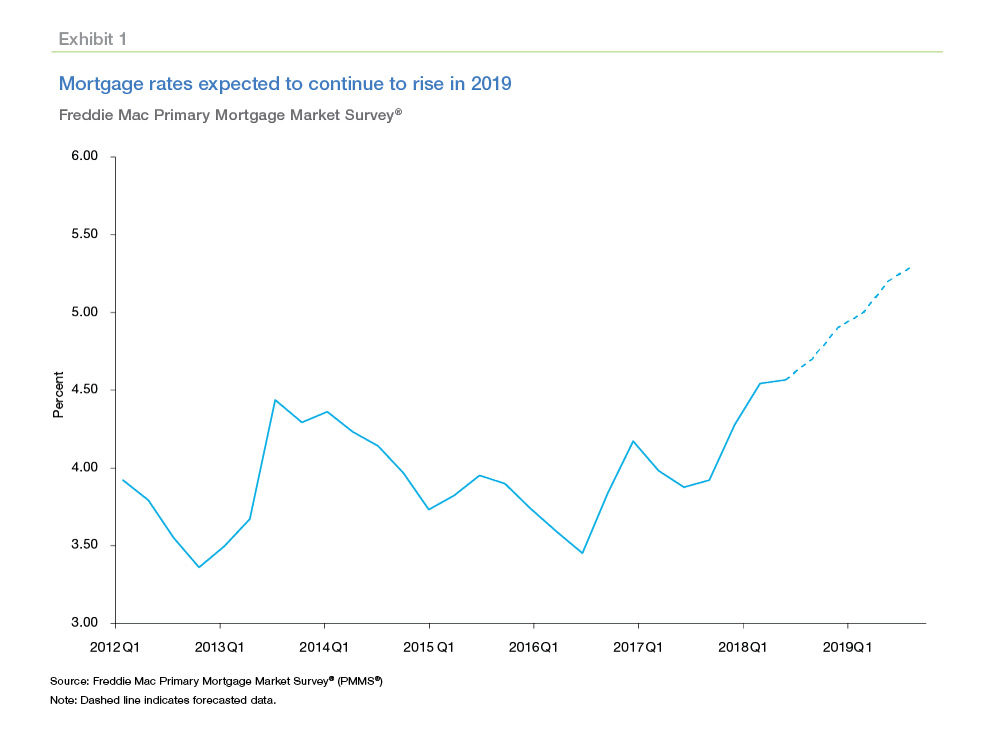

The forecast points to slowing home sales. Sales of existing homes had fallen for four straight months leading into August when they stalled at an annual rate of 5.34 million units. New home sales jumped by 3.5 percent to 629,000 but are still trending down thanks to a negative revision of the July numbers. Residential construction seems unable to break out - housing starts jumped 9.2 percent to 1.28 million in August, but largely due to an increase in multifamily construction activity. Permits fell 5.7 percent to more than a one-year low of 123 million.

With headwinds from rising rates and home prices Freddie Mac forecasts that total home sales will fall by 0.9 percent from 2017 to 6.07 million this year. They will then regain momentum, rising to 6.18 million next year and up another 1.1 percent to 6.25 million units in 2020.

Home price growth is also seen as slowing. It remained steady during the third quarter, up only 1.0 percent over the three months and Freddie Mac predicts an average growth rate of 5.4 percent this year. That will slow to 4.6 percent in 2019 and to a moderate 2.9 percent in 2020.

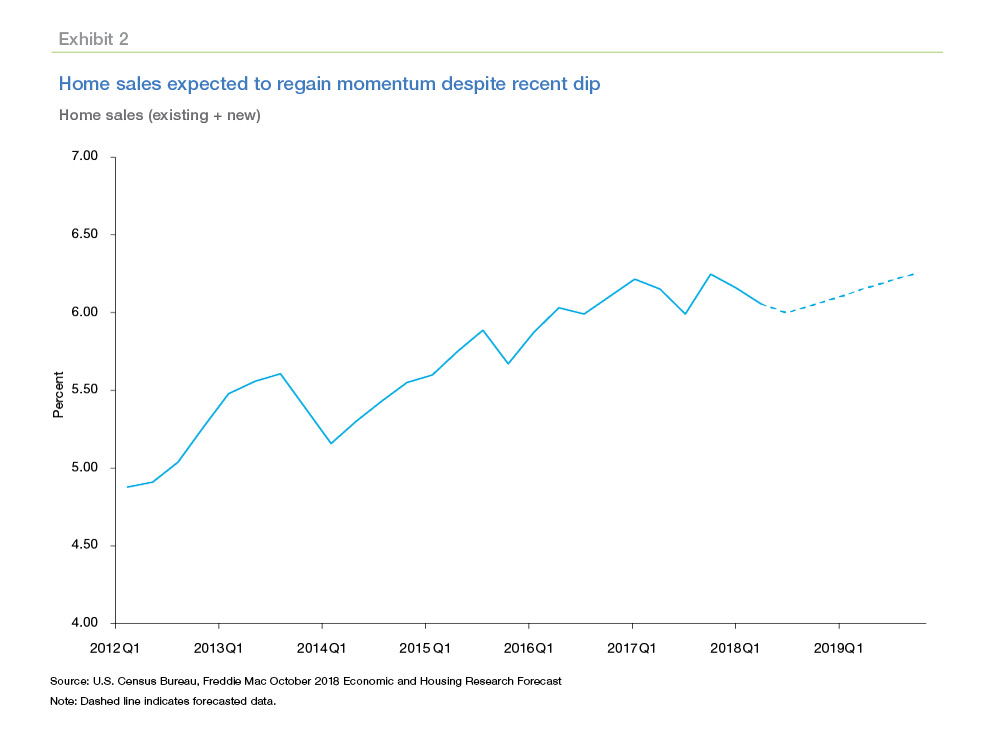

With home sales down and incentives for rate/term refinancing drying up, it is a given that mortgage originations will be hurt. The company sees those for single family homes declining 8.9 percent to $1.65 trillion this year, holding fairly steady in 2019, then falling again to $1.60 trillion in the final year of the forecast horizon.