Mortgage lenders have been increasingly reporting tighter margins as costs rise for each actual loan transaction. In the last few years the principal reason behind this as revealed in Fannie Mae's quarterly Mortgage Lender Sentiment Survey has been increased competition for customers. As the demand for refinancing has fallen, purchase originations have not yet been able to pick up the slack, exacerbating the situation. The survey has found lenders are working to improve efficiency to cut the cost part of the profit equation.

Outside of the mortgage industry, businesses are increasingly turning to digital technologies to reduce errors, cut costs, improve customer service, and speed up transactions. Among those businesses that deal with large amount of data, Artificial Intelligence, including Machine Learning (ML) are gaining traction. With AL, computer systems can perform almost as well as humans in some areas such as visual perception, speech recognition, language translation, even decision making. ML capabilities allow computers to process large amounts of data from varied sources and identify patterns within the data which can enable them to identify opportunities or risks.

Fannie Mae's August Survey sought to determine the role AI and ML might currently be playing in the mortgage industry's efforts to gain greater efficiency and what lenders are planning in the medium term. The survey included special questions to determine:

1. How familiar lenders are with AI/ML technology? How do they currently use it? If they are currently using some AI/ML applications, what are their objectives and use cases?

2. What barriers do they see in adopting AI/ML technology? What would be their adoption status in two years?

3. What AI/ML application ideas are most appealing to them to improve or expand their mortgage business? Ideas tested included chatbots, property valuation, borrower default assessment, and fraud/defect detection.

Tracy Stephan. Fannie Mae's Director of Innovation writing in the company's Executive Perspectives blog says that two-thirds of respondents reported they are familiar to varying degrees with AI/ML technology. Executives of larger and mid-sized institutions are more likely to be aware than smaller institutions and those at mortgage banks are significantly more aware (75 percent) than their peers at depositories (53 percent) and credit unions (39 percent.)

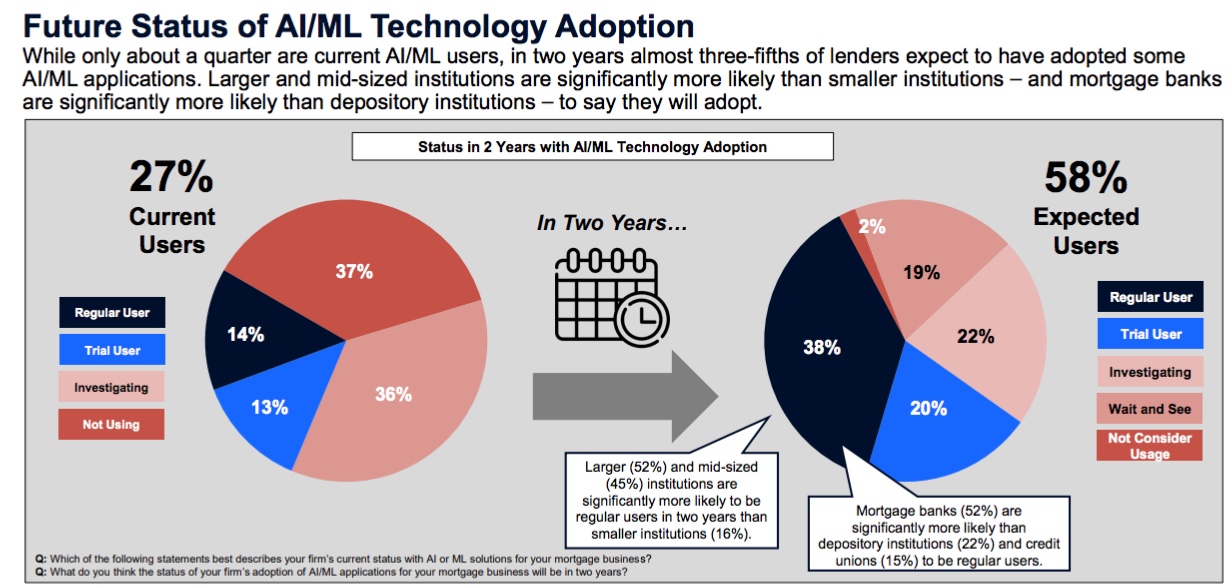

Only about a quarter (27 percent) of respondents report they are actually using the technology in their mortgage business, and only 14 percent are using it regularly, another 13 percent are "trying it out." An additional 36 percent say they are investigating use of the technology. Fifty-eight percent of lenders say they do expect to adopt some AI solutions within the next two years.

Major areas of AI/ML application that may be available to the mortgage industry include identifying anomalies, assessing risk, exploring non-credit bureau data to enhance prediction of loan performance, and answering customer questions (e.g., search tools, improved guides, and chatbots).

Among those currently using some types of AI/ML applications the reason most frequently given (42 percent) was as to increase efficiency but improving the customer experience was close behind at 41 percent. Other reasons given were controlling human errors and reducing risks, but each had only single digit shares.

Lenders who currently use AI/ML technology report using it primarily to improve operational efficiency or enhance the consumer/borrower experience. Use cases center around loan application, origination, and underwriting. Some specific applications mentioned by current users were to provide customer assistance in the application process through "...a 'smart' application portal, where the interview questions being asked of a consumer are responsive and intelligent to the previous responses given." In underwriting some respondents mentioned optical character recognition (OCR) tools for invoice recognition, automatic income analysis, and auto indexing borrower documents. Another respondent said, "We have...incorporated machine learning in our front-end origination where the system asks for clarification based on submitted data." And another said it was used in document recognition, data scraping, and task routing.

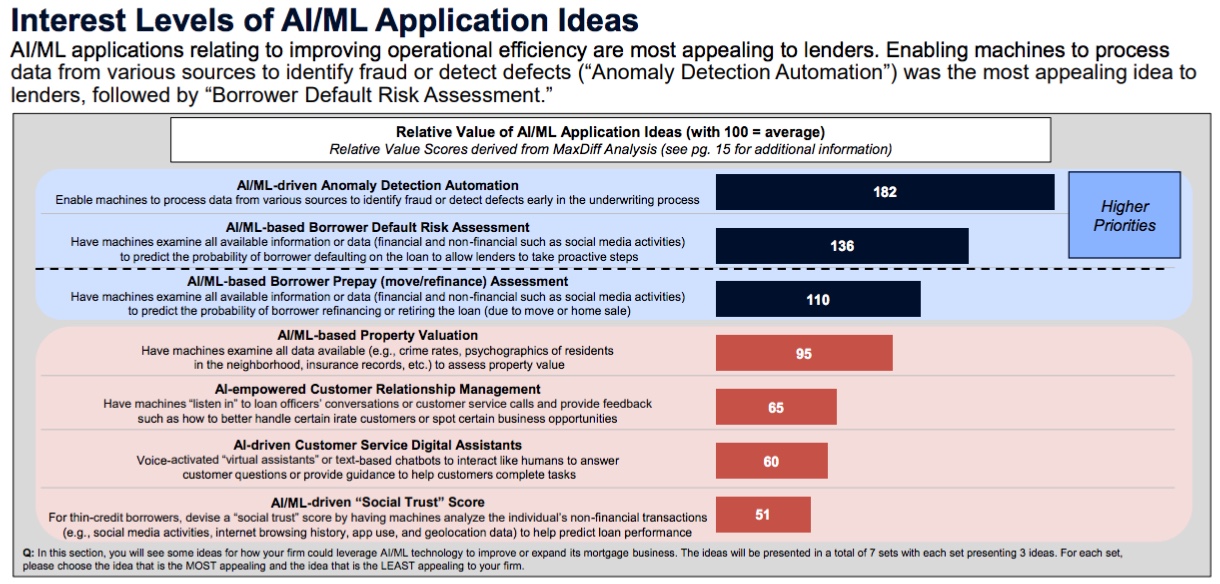

As lenders consider moving toward using AI/ML they are most interested in applications relating to improved operational efficiency. Enabling machines to process data from various sources to identify fraud or detect defects ("Anomaly Detection Automation") was the most appealing idea to lenders, followed by "Borrower Default Risk Assessment."

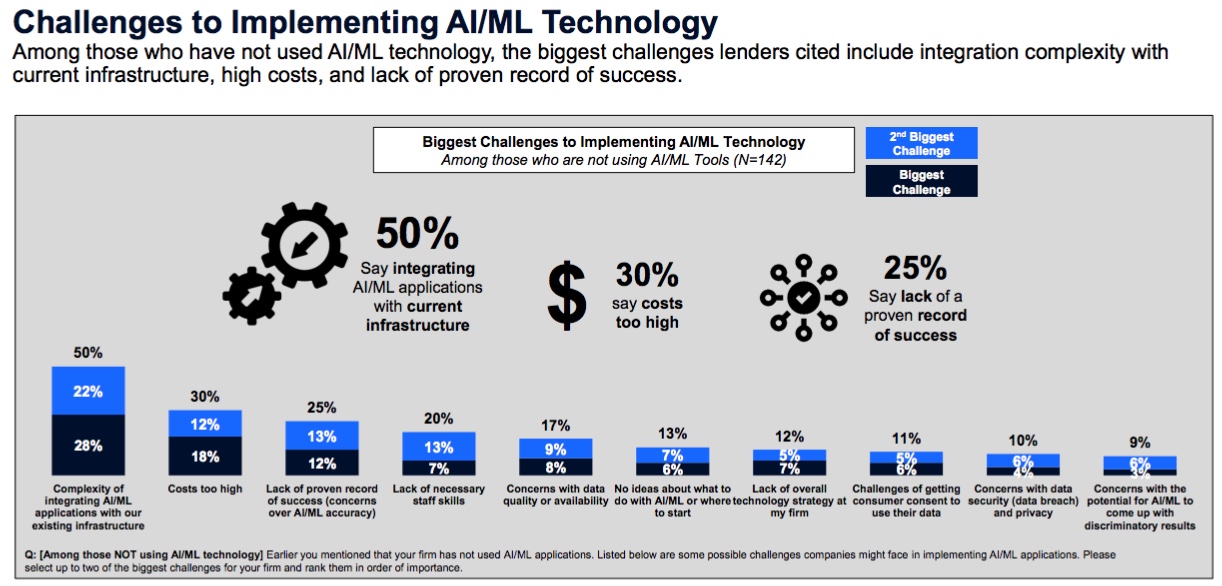

Among lenders who have not used AI/ML technology, the biggest challenges they see moving toward it include integrating the technology with their current infrastructure, high costs, and lack of proven record of success.