A current post in Freddie Mac's Insight blog looks again at the decline in homeownership among young adults and tries to determine the role played by rising housing costs. The post is based on recent research by the company's Economic and Housing Research Group headed by Chief Economist Sam Khater.

Adults in the age group usually categorized as Millennials (25 to 34) have deferred homebuying as higher prices push it further into the future. The weakening affordability is particularly hard on first-time homebuyers because prices increase the fastest among the lower-priced homes they would typically buy.

At the same time, these young adults, who comprise a large share of first-time buyers, are excluded from the benefits of rapidly rising home values. "Unable to buy, many young adults have continued to rent, and rising rents have made it more difficult to save for a down payment." Many young households also prefer the flexibility and convenience of renting and currently don't plan to buy a home.

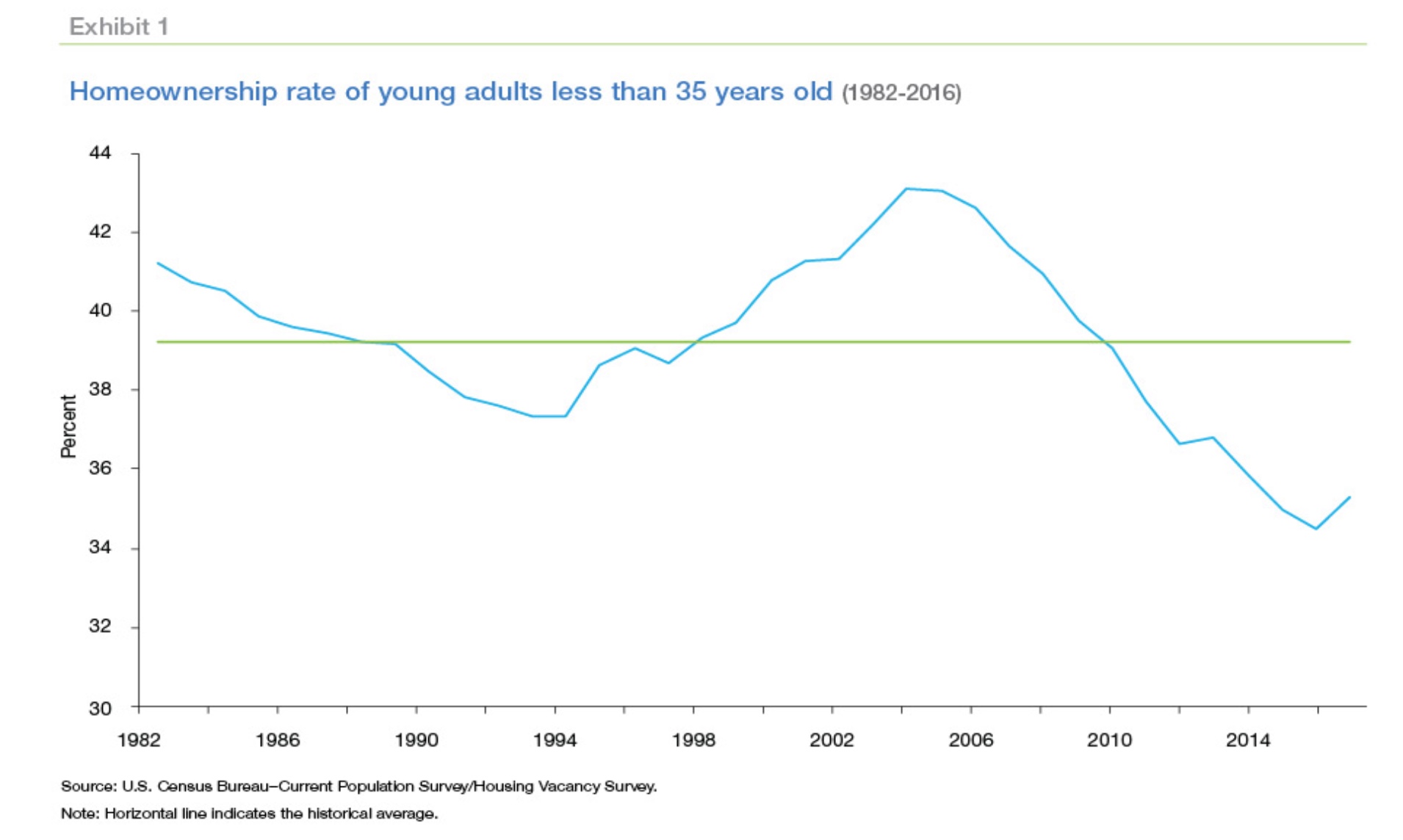

Homeownership rates for young adult households peaked - along with most other age groups - in 2004. Since then the rate has declined 8 percentage points. Despite recent improvement, the rate still remains about 3 points lower than the historical average.

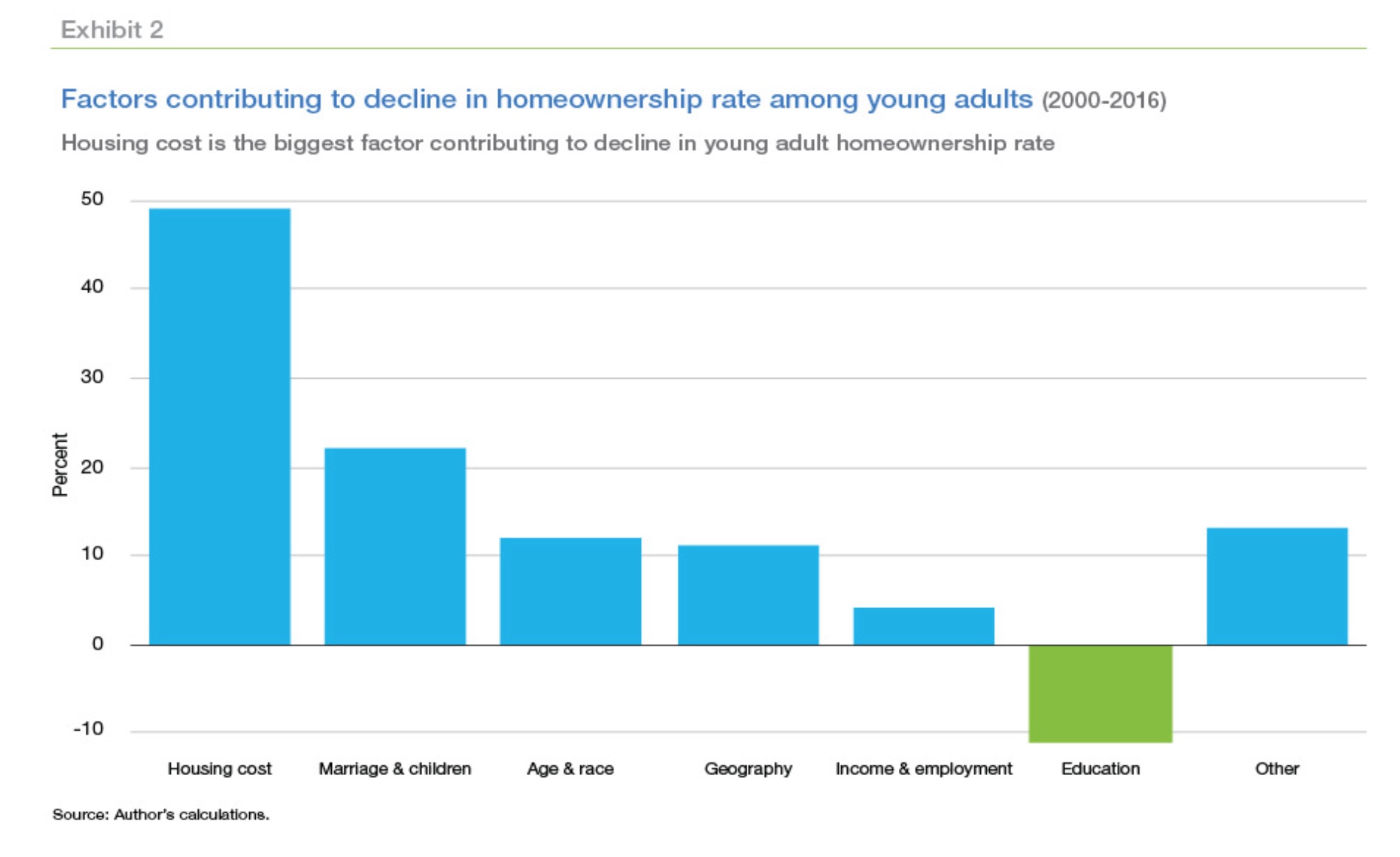

While none of this is stunning information, there is extensive literature on the relationship of young adult homeownership and socioeconomic and demographic characteristics, Freddie Mac's economists built a statistical model to estimate the relationship of homeownership to a variety of economic and demographic factors using the Census Bureau's 2016 American Community Survey (ACS) data. They found almost 50 percent of the homeownership gap between young adults in 2000 versus 2016. is caused by high housing costs, as measured by average home prices and rents, but other factors played a role as well, as shown in Exhibit 2.

None of these conclusions are a surprise either. As people get older, get married, and have children the likelihood of homeownership increases. Higher income increases it further; a 1 percent increase in income results in an 11 percent increase in that likelihood; a 1 percent decline in income depresses it by 11 percent as well.

Where that home is located matters as well. Young adults living in metro areas - where employment opportunities and amenities abound-are 5 percent less likely to become homeowners compared to young adults living outside metro areas. That unemployed young adults are less likely to become homeowners seems almost a given, but the study found that self-employed young adults are 5 percent more likely to become homeowners than young adults working for wages.

Non-Hispanic white young adults are more likely to become homeowners than minorities, and nativity is predictive as well. A foreign-born young adult is 11 percent less likely to become a homeowner compared to an otherwise similar young adult born in the United States, but the effect fades away as the length of US residency increases. There was also an impact from living in a multigenerational household, i.e. one containing three or more generations. Young adults who do so are 5 percent more likely to become a homeowner.

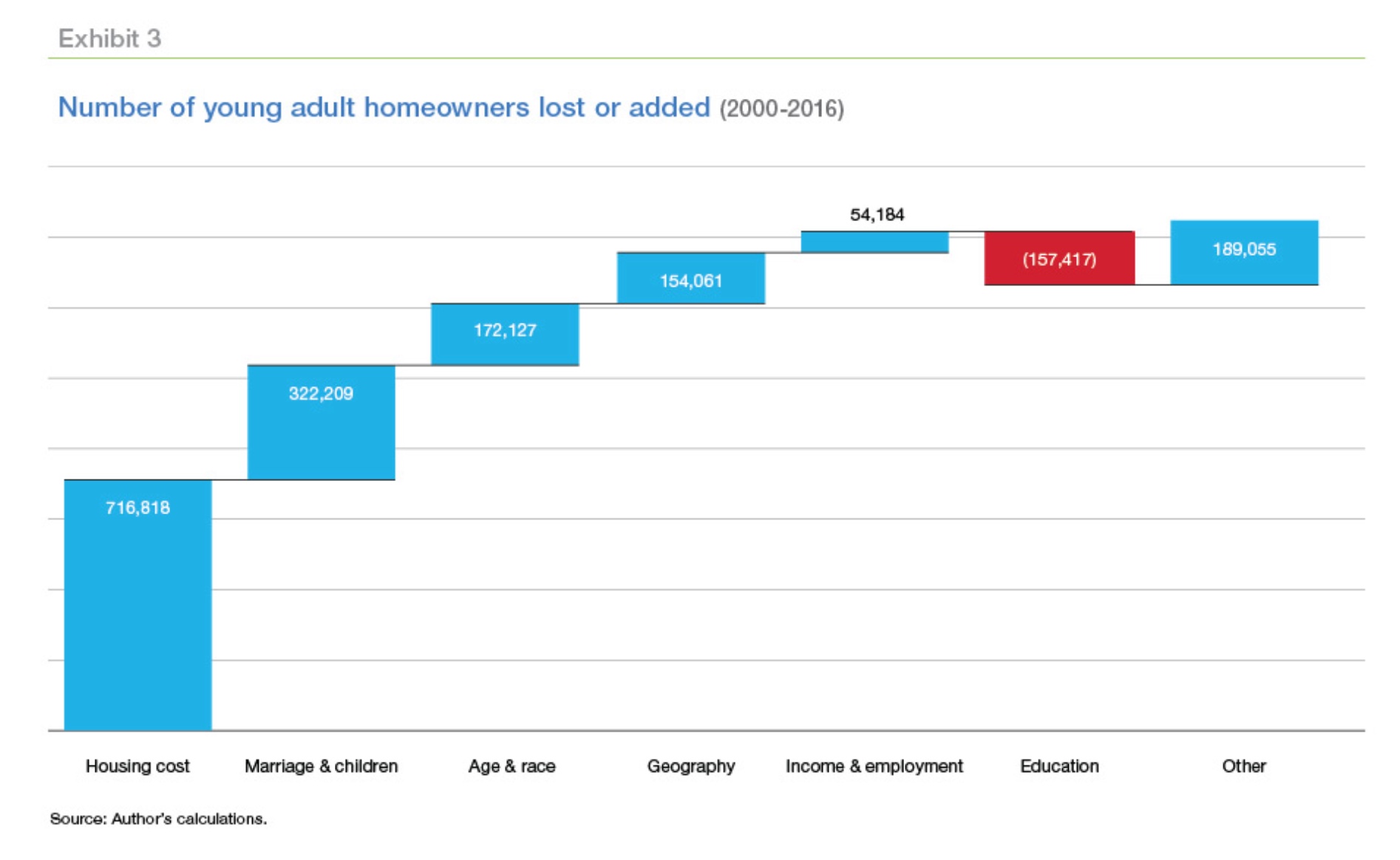

What do these factors mean in real-life terms? Freddie Mac says the first factor, the increase in inflation-adjusted home prices and rent meant around 700,000 young adults did not buy a home between 2000 and 2016. The second most important factors are age and fertility rates which caused a decrease of about 300,000 homeowners. Young adults in 2016 are more racially diverse and are skewed younger than young adults in 2000, increasing the gap by another 12 percent, or 170,000. Incomes among young adults have grown only modestly since 2000, there are fewer young adults in the labor force and more living in densely populated and expensive metro areas, all of which widened the gap. Higher education levels in 2016 is the only factor that reduced the gap in the homeownership rate for young adults.

About 13 percent of the gap cannot be explained by differences in demographic variables, housing costs and other observable factors. This may be due to unmeasured characteristics such as preferences, creditworthiness, borrowing constraints, disparity in financial wealth across groups and student debt.

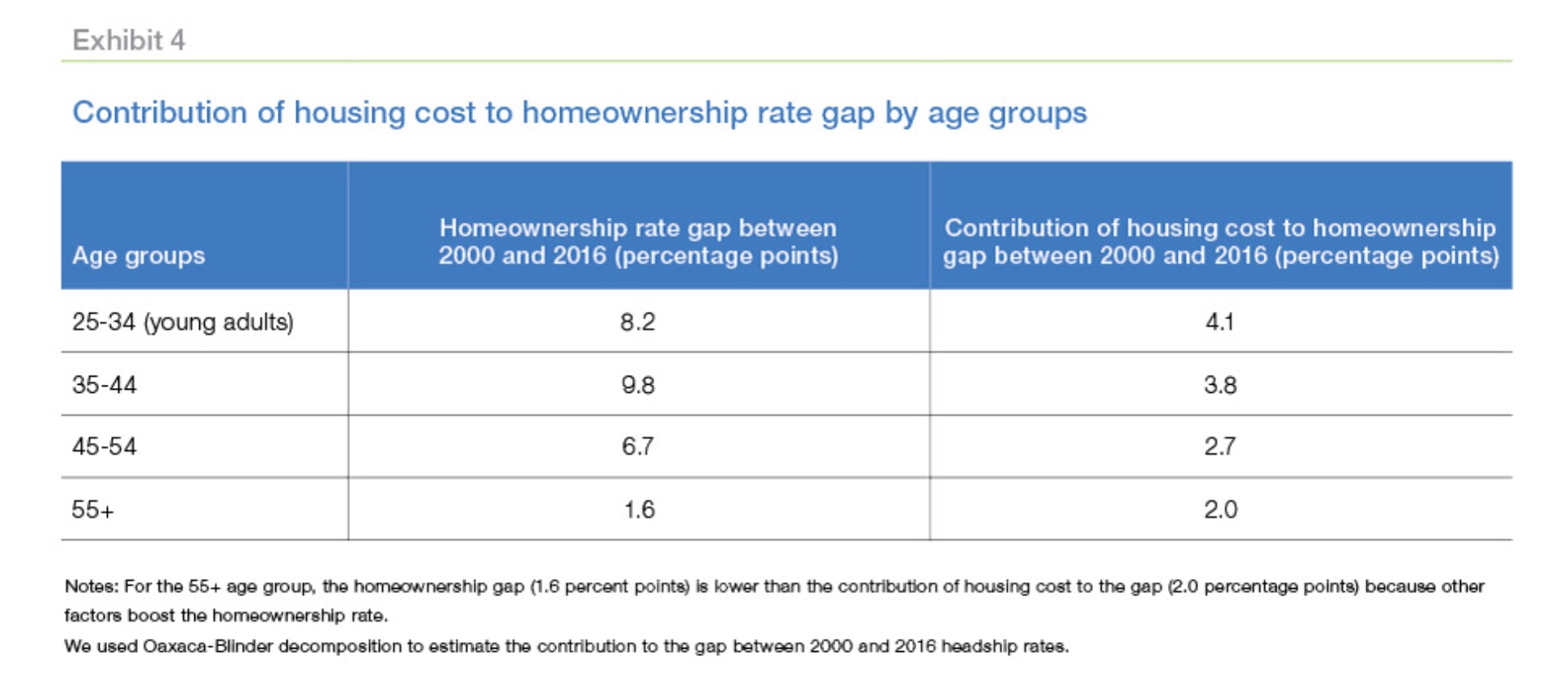

Because higher housing costs affect young adults more than the those who are older, Freddie Mac looked at other age groups and found that while housing costs lower the homeownership rate for all age groups, the contribution is less among older age groups.

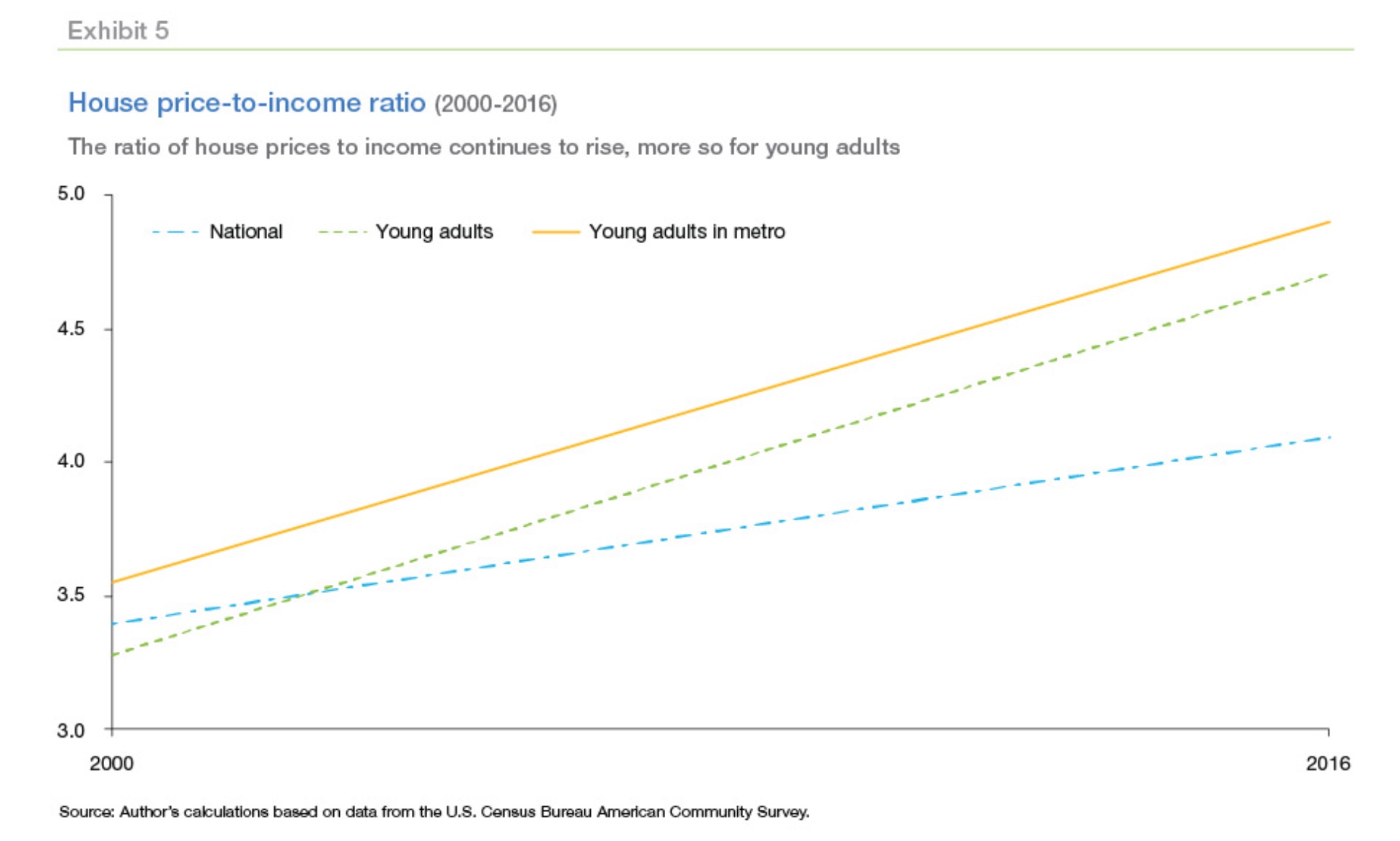

Rising housing costs and the resulting drop in affordability are a major concern for the US, especially as incomes have grown only modestly. If house prices continue to rise, and the ratio with income remains stable, homeownership won't be affected much. However, that's not the case. The ratio of house prices to income has increased substantially since 2000 and has grown more for young adults than the overall population. It has grown even more for young adults living in metro areas, and the share that do has grown from 63 percent in 2000 to 82 percent in 2016.

To estimate what that means for the future, Freddie Mac considered three scenarios for two age groups; those aged 25-34 in 2016 who will be 35-44 years old by 2025; and those aged 15-24 in 2016 who will be 25-34 years old by 2025. The homeownership rate in 2016 was 37.5 percent for the group aged 25-34, compared to 13.1 percent for the group aged 15-24 in 2016.

The baseline scenario assumes economic conditions in 2025 will be the same as today. The optimistic scenario assumes housing costs will remain at 2016 levels while incomes go up by 15 percent for all age and race/ethnicity groups. Labor force participation, self-employment and unemployment are pushed back to 2000 levels. The pessimistic scenario allows the housing supply to persist short of demand and real house prices and rent to rise an additional 20 percent.

Under the baseline scenario, the homeownership rate of young adults in 2016 increases from 2016/s rate of 37.5 percent to 58.1 percent by 2025, a little higher than the 57 percent rate for those 35 to 44 today. This change can be attributed to increased educational attainment, as well as decline in the foreign-born share of the population, particularly of Hispanics.

The 15 percent increase in income and 2000 labor force and unemployment levels pushes the homeownership rate to 60 percent in 2025. For today's 15-24-year-old cohort, their current homeownership rises to 38.3 percent.

In the pessimistic scenario, with 20 percent increase in house prices and rents, homeownership rates decline to 55.9 and 34.2 percent respectively for young adults in 2016 and 2025.

To put these results in a historical perspective, the homeownership rate of those aged 25-34 and 35-44 have been trending down since the 1980s except for an uptick during the early 2000's housing boom. It fell especially sharply after the Great Recession, but the continued decline after the crisis has left rates at levels not seen since the early 1980s. This decline has accumulated and continues into the forecast for 2025.