Home owners who have needed help from someone in the trades in the recent past will probably agree with a report from the National Association of Home Builders (NAHB) noting the serious shortages of labor faced by remodelers. Paul Emrath, writing in the NAHB Eye-on-Housing blog says 91 percent of remodelers responding to an Association survey said they had encountered shortages of labor available to perform carpentry work. Forty percent called the shortages serious.

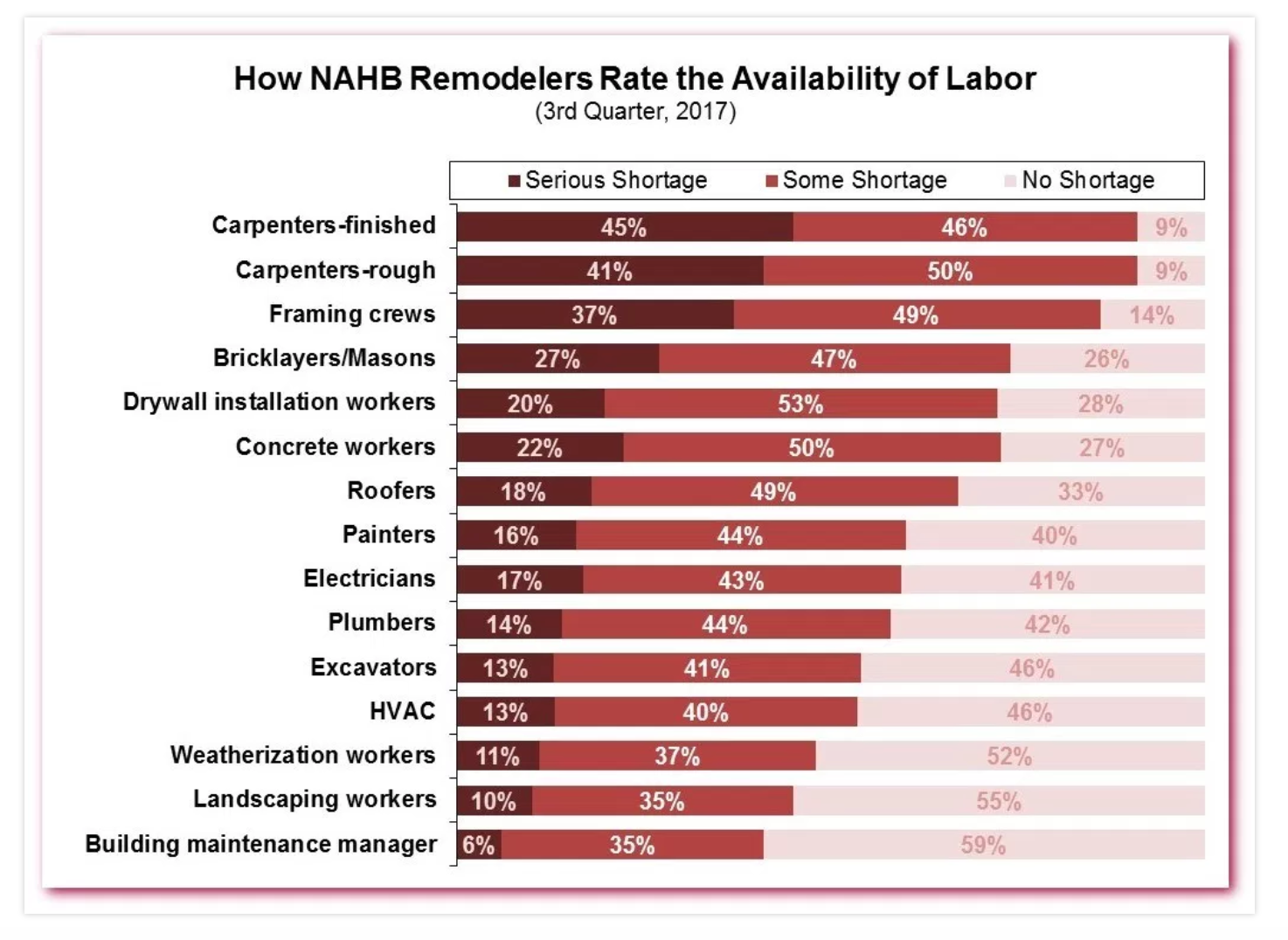

NAHB's third quarter 2017 Remodeling Market Index (RMI) included special questions about the availability of labor in 15 specific trades. Shortages were most widespread for the three categories of carpenters, finished, rough, and framing crews, but over half of the respondents noted labor shortfalls in 12 of the 15 categories. Even the remaining three were cited by at least 40 percent of respondents as having some lack of available labor.

Remodelers generally noted larger shortfalls among subcontractors than among their own employees and the order of trades by degree of severity varied, but the three carpentry trades remained at the top of both lists.

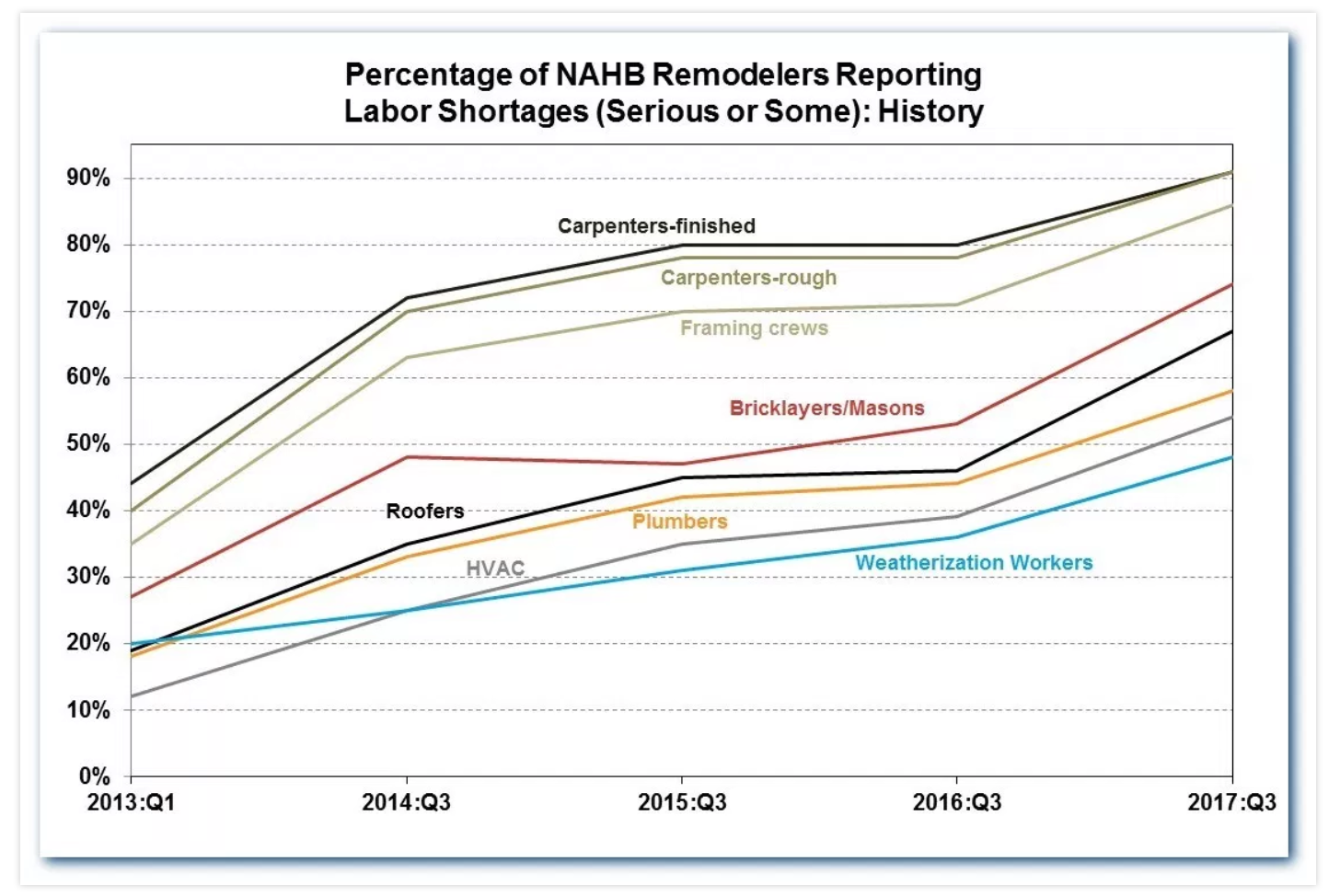

NAHB has asked its remodeler members about labor availability since 2013, initially inquiring about 12 occupations. Emrath says many of the original 12 have followed a similar pattern since then, with percentages about perceived problems that skyrocketed between 2013 and 2014 and plateaued somewhere between 2014 and 2016, before resuming an upward, worsening trend.

For example, the reported shortage of rough carpenters increased from 40 percent in 2013 to 78 percent in 2015, remained unchanged in 2016, but then increased again in 2017. Over the same period, the percentages for finished carpenters, framing crews and roofers followed similar-and almost perfectly parallel-trend lines. For bricklayers & masons, the incidence of shortages plateaued a year earlier, at a little under 50 percent in 2014 and 2015, but then resumed its upward trend in both 2016 and 2017.

Many of the trades that initially were perceived to have adequate supplies of labor have now become a concern. The share of remodelers reporting a need for more weatherization workers increased regularly from 20 percent in 2013 to 48 percent in 2017. For HVAC workers, the trend has been even steeper, climbing from being named as a problem by 12 percent of remodelers to 54 percent over the four-year period.

The bottom line is that, for every one of the 12 trades covered by NAHB's RMI survey in both years, the share of remodelers reporting a shortage jumped by more than 10 percentage points between 2016 and 2017. The most common effects of the shortages have been higher labor costs for the available help, higher prices being passed through to customers, and difficulties and delays in completing projects. These are the same effects mentioned most often by single-family builders.

Emrath concludes that home owners who are thinking about substantial projects should understand that labor shortages are, in part, behind the higher than anticipated estimates they may be receiving. Recent increases in building material costs, especially lumber and drywall, are playing a part as well.

NAHB conducted its third-quarter 2017 RMI among over 2,000 of its remodeler members, primarily by electronic mail. The response rate was 12 percent.