Mortgage rates have increased 49 basis points since the first of the year, with the 30-year fixed rate mortgage (FRM) standing at 4.44 percent on March 15 according to Freddie Mac's Primary Mortgage Market Survey. Given the robust economic fundamentals, Freddie Mac's economists expect the Federal Reserve to continue tightening short-term rates and long-term rates, including those for mortgages, should follow them higher, they predict to 4.9 percent in the fourth quarter of this year.

Writing in Freddie Mac's Outlook blog, Len Kiefer, the company's Deputy Chief Economist says, even with higher interest rates, his team expects that the housing market will post modest growth this year. The spring market looks like it will be a sellers' market in much of the country because of tight inventories which are pushing prices up, he says.

This is a mixed blessing. "Overall, U.S. housing markets have been on the upswing. While housing market trends have been generally favorable, not everyone has shared equally in the gains," Kiefer says. "Existing homeowners have largely seen their properties increase in value, helping to build equity. In many parts of the country, home values have more than recovered from the Great Recession, reaching new (nominal) peaks, and the share of underwater homeowners has dropped significantly. However, not every market has fully recovered. In addition, higher house prices are not universally good."

Kiefer outlines examples where rising prices can be a negative, and others where the positives are not universal.

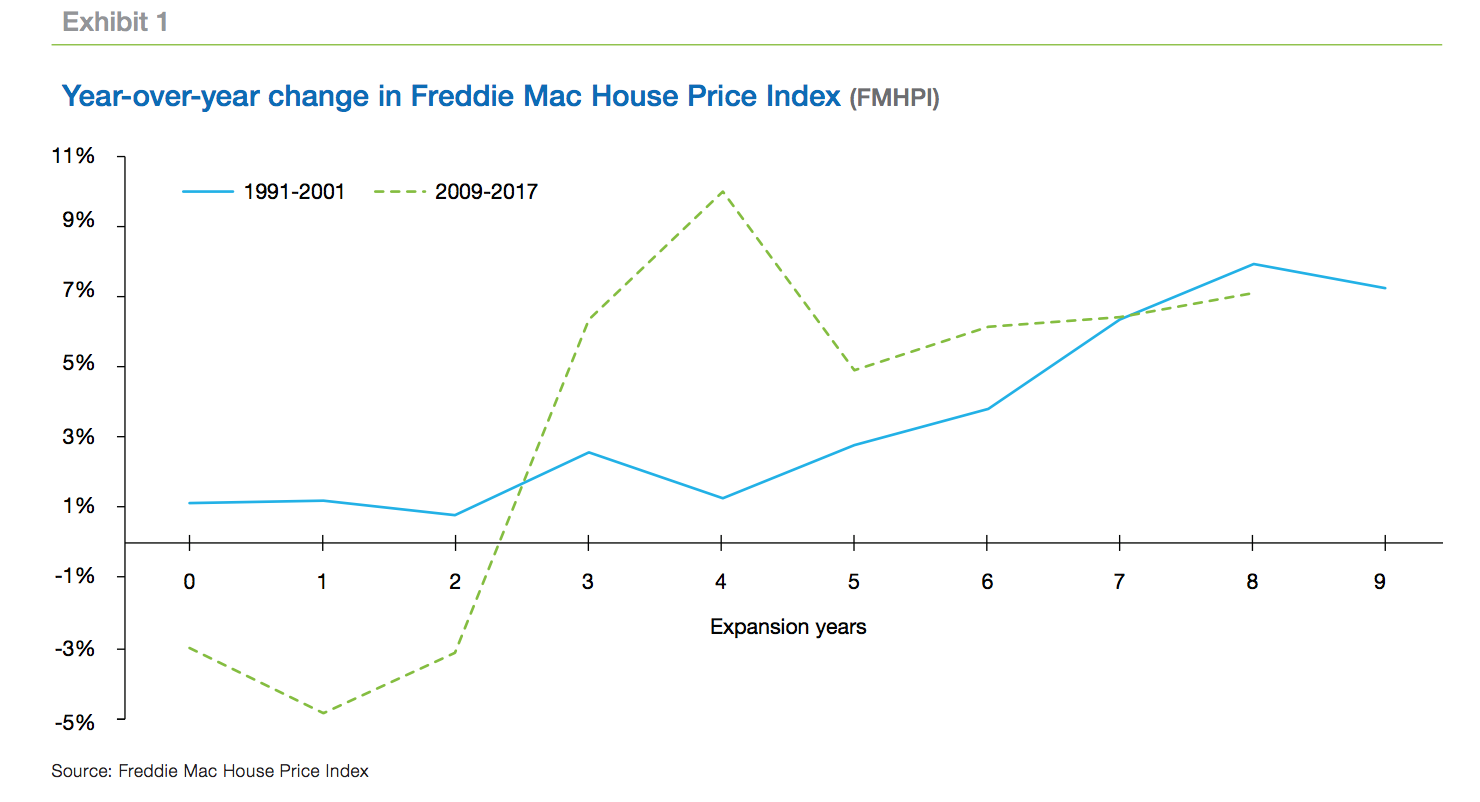

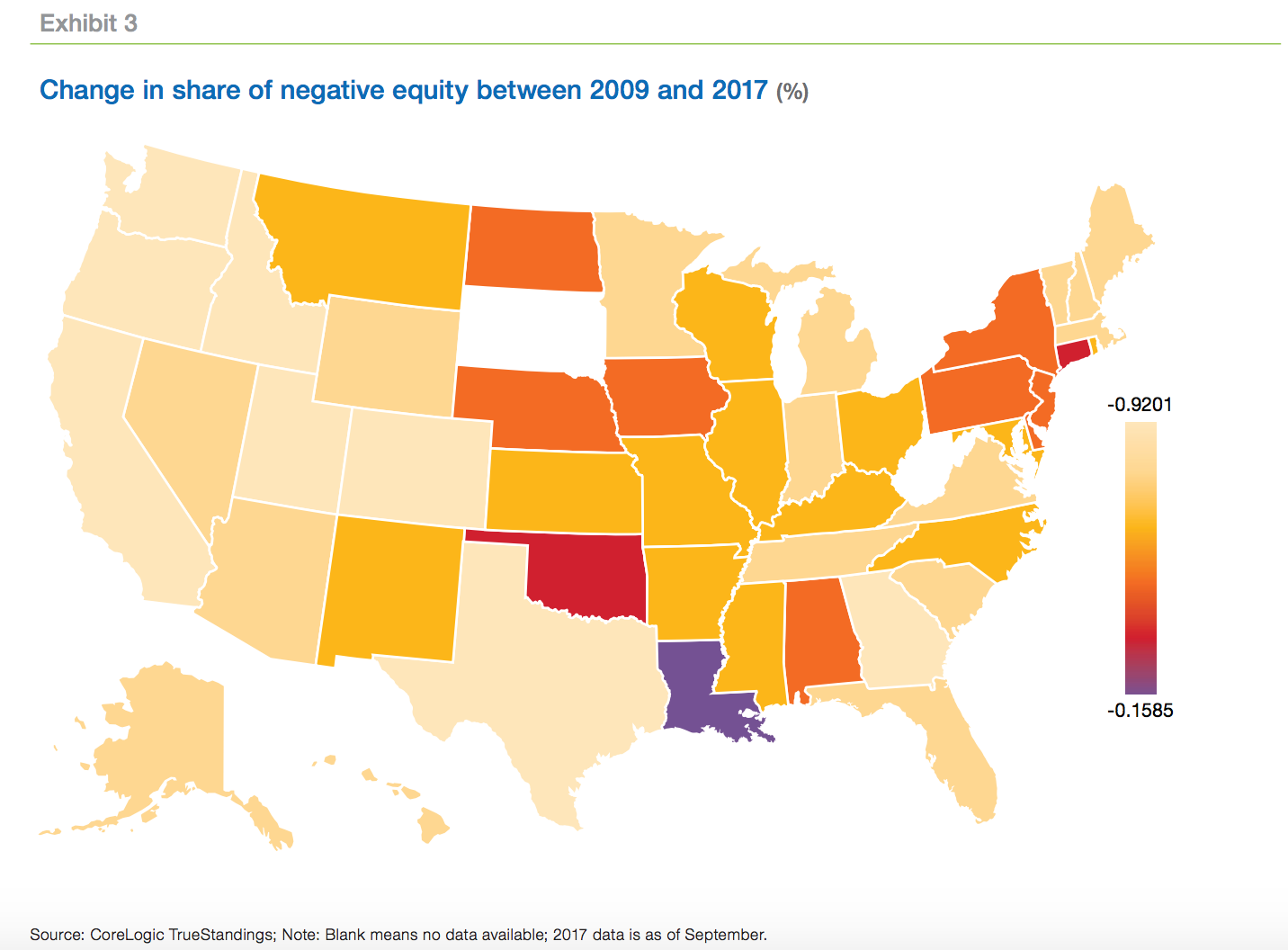

National home prices are up 37 percent since 2009, much faster year by year appreciation than in the 1990s expansion. But not all gains are equal - not by a long shot. For example, since 2009, homeowners in California and Colorado saw a more than 60 percent increase in their home prices while homeowners in Delaware saw only a 3 percent.

The price increases have led to a record gain in homeowner equity; the Federal Reserve says about $14.4 trillion in the fourth quarter of 2017 alone. Black Knight recently put "tappable equity," the amount of equity available for homeowners to borrow against before reaching a maximum 80 percent total loan to value ratio, at $5.5 trillion.

But equity gains are also disproportionately spread across the U.S. mostly along the same lines as the price gains. In some states borrowers are still struggling to recover from the housing crash, with many remaining in negative equity. Exhibit 3 shows the change in the share of negative equity in the U.S. by state between 2009 and 2017.

The new tax law will also affect homeowners and their home price appreciation in disproportionate ways. Beginning in 2018, taxpayers may only deduct interest on $750,000 of qualified home loans, or $375,000 for a married taxpayer filing a separate return. These are down from the prior limits of $1 million, or $500,000 for a married taxpayer filing a separate return. Coupled with new limits on the deduction of state and local taxes including property taxes, homeowners in states with high home prices will be the most negatively affected.

Home Equity Lines of Credit (HELOCs) are popular means to access those trillions of dollars of tappable equity. The new tax law ends the provision that allowed interest paid on HELOCs to be deductible no matter how the proceeds were spent. This will disadvantage homeowners who wish to use HELOCs on other expenses, such as student debt or credit card payments. The new tax law does not grandfather the deduction, so taxpayers that already have HELOCs outstanding also will be subject to the new deduction limitations. This change in the tax law could cost families thousands of dollars over the coming years.

Rising home prices are generally a plus for homeowners, but there is a cost; higher property taxes. Most homebuyers chose a 30-year FRM, shielding themselves from payment shocks from higher home prices. What they are not shielded from is higher assessments on their homes and increased property taxes. This is particularly hard on those with fixed incomes.

Some states have laws restricting increases in property taxes; such restrictions, and differing tax rates among states result in considerable differences in property tax levels across the United States. States where property taxes are high are additionally penalized by the new tax law which also limits deductions on state income and property taxes.

Higher home prices have a greater impact on first-time homebuyers, mostly young adults, who may be pushed out of the market. Over the past year, home prices in the U.S. rose by more than seven percent on a national basis, pushing many first-time homebuyers out of the market. Certain individual markets saw even more house price growth. The lower price tiers have also seen the fastest appreciation rates. Some metro areas saw stunning rates of appreciation among median start home prices between the fourth quarters of 2016 and 2017. For example, 31 percent in Salt 9 percent in Salt Lake, 5 and 6 percent in the other three. Given that the median income grew only modestly in many of these markets, many first-time homebuyers were pushed out of the market.

And again, these higher prices create higher property tax obligations, which can be a challenge for homeowners with fixed incomes, and they make it more difficult for potential first-time buyers to enter the market. With construction ramping up slowly to meet housing demand, home prices are likely to continue rising above the rate of inflation, which would further widen the gap between housing market winners and losers.