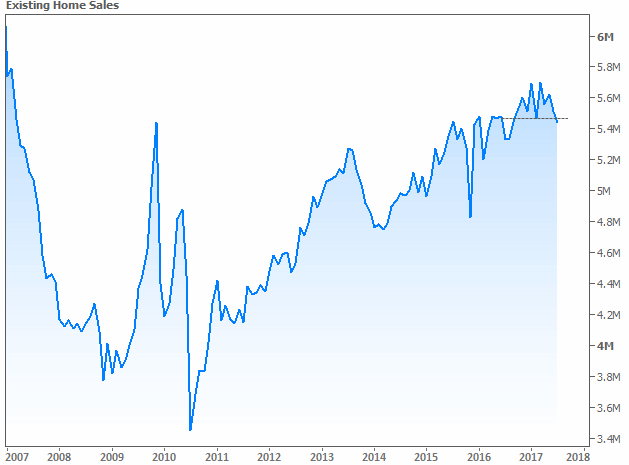

Sales of existing homes, like those for newly constructed ones, performed poorly in July. The National Association of Realtors® (NAR) said today that those sales of existing single-family houses, townhouses, condos, and cooperative apartments slipped 1.3 percent from their June level to a seasonally adjusted annual rate of 5.44 million units, the lowest sales rate thus far in 2017. In addition, June sales, originally reported at 5.520 million, a decline of 1.8 percent from May, were revised down to 5.510 million. Despite the declines, sales in July were still running 2.1 percent ahead of last year.

Analysts had expected sales to increase, largely because of an uptick in the June pending sales report. Results however were at the low end of their projections, which ranged from 5.410 to 5.650 million. The consensus among those polled by Econoday was 5.565 million

Single-family home sales decreased 0.8 percent to a seasonally adjusted annual rate of 4.84 million from 4.88 million in June and were 1.7 percent above the 4.76 million pace a year ago. Existing condominium and co-op sales fell 4.8 percent to a seasonally adjusted annual rate of 600,000 units in July, but are still 5.3 percent higher than a year ago.

Lawrence Yun, NAR chief economist, says the second half of the year got off on a somewhat sour note as existing sales in July inched backward. "Buyer interest in most of the country has held up strongly this summer and homes are selling fast, but the negative effect of not enough inventory to choose from and its pressure on overall affordability put the brakes on what should've been a higher sales pace," he said. "Contract activity has mostly trended downward since February and ultimately put a large dent on closings last month."

The median existing-home price for all housing types was $258,300, up 6.2 percent from $243,200 in July 2016. July's price increase marks the 65th straight month of year-over-year gains. The median existing single-family home price rose 6.3 percent to $260,600 and the median existing condo price was $239,800, a 5.3 percent annual increase.

"Home prices are still rising above incomes and way too fast in many markets," said Yun. "Realtors continue to say prospective buyers are frustrated by how quickly prices are rising for the minimal selection of homes that fit buyers' budget and wish list."

Total housing inventory at the end of July another declined 1.0 percent to 1.92 million existing homes available for sale, and is now 9.0 percent lower than a year ago when the inventory stood at 2.11 million. The number of available homes for sale has fallen year-over-year for 26 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, down from 4.8 months a year ago.

Marketing typically took 30 days, an additional two days than was typical in June. Fifty-one percent of homes sold in July were on the market for less than a month. "July was the fourth consecutive month that the typical listing went under contract in under one month," said Yun. "This speaks to the significant pent-up demand for buying rather than any perceived loss of interest. The frustrating inability for new home construction to pick up means inadequate supply levels will keep markets competitive heading into the fall."

First-time buyers accounted for 33 percent of sales in July, up from 32 percent both in June and a year ago. NAR President William E. Brown said this may be due in part to a prominent misconception - especially among non-homeowners - that a down payment of at least 20 percent is needed to buy a home. "Every month this year, roughly 60 percent of buyers who financed their purchase with a mortgage made a down payment that was 6 percent or less," he said. "Potential buyers with solid employment and manageable levels of debt will find that there are mortgage options available."

Nineteen percent of transactions in July were all-cash sales compared to 21 percent a year ago. Individual investors, who account for many cash sales, purchased 13 percent of homes in July, unchanged from June and down from 11 percent a year ago. Five percent of sales were distressed properties, up slightly from June.

Existing home sales in the Northeast fared worst during the month, down 14.5 percent to an annual rate of 650,000, 1.5 percent lower than a year earlier. The median price in the Northeast was $290,000, a 4.1 percent increase from July 2016.

In the Midwest, sales fell 5.3 percent to 1.25 million, and are now 1.6 percent below a year ago. The median price in the Midwest was $205,400, up 5.9 percent on an annual basis.

Existing-home sales in the South increased by 2.2 percent from June and 3.6 percent from July 2016 to an annual rate of 2.28 million. The median price in the South was $227,700, a 6.7 percent annual gain.

Existing-home sales in the West jumped 5.0 percent to an annual rate of 1.26 million in July, and are 5.0 percent above a year ago. The median price in the West was $373,000, up 7.6 percent year-over-year.