Jumbo loans have historically been more expensive for borrowers than those the meet the "conforming" loan limit - which is currently set at $424,100. CoreLogic, in a new analysis, says that changed several years ago. Starting in mid-2013, borrowing through a jumbo loan has been cheaper than using a conforming one. In the first quarter of 2017, the difference averaged 21 basis points.

Many jumbo loans are, in a sense, conforming as well, falling within those special loan limits set on a county by county basis for GSE and FHA lending in higher cost areas. By their nature these jumbos are not available to borrowers in many markets. It is unclear whether jumbo loans from private lenders are included in the analysis.

Archana Pradhan, senior professional economist, writes in the CoreLogic Insights blog that mortgage rates fluctuate not only with other interest rates but can vary by loan product, term, and size. In Figure 1, she illustrates the average interest rate expressed as the difference between the loan amount and the local-market conforming loan limit. The lines compare loans originated in 2009 compared to the first quarter 2017 vintage. In 2009 the interest rate declined gradually as the loan amount increased until the conforming limit was reached when the rate rose abruptly by 82 basis points. The 2017 line again shows the downward trend in interest rates until the conforming limit is reached, then a sudden 20 basis point drop before rates resume their gradual decline.

Pradhan says the general trend reflects the various fixed costs of originating a loan. In other words, the fixed cost per loan declines as the loan size increases. Both in 2009 and the first quarter of this year the interest rates declined as the loan size rose to the conforming limit. Now the historical trend of mortgages spiking above that limit has reversed, making a jumbo loan less expensive.

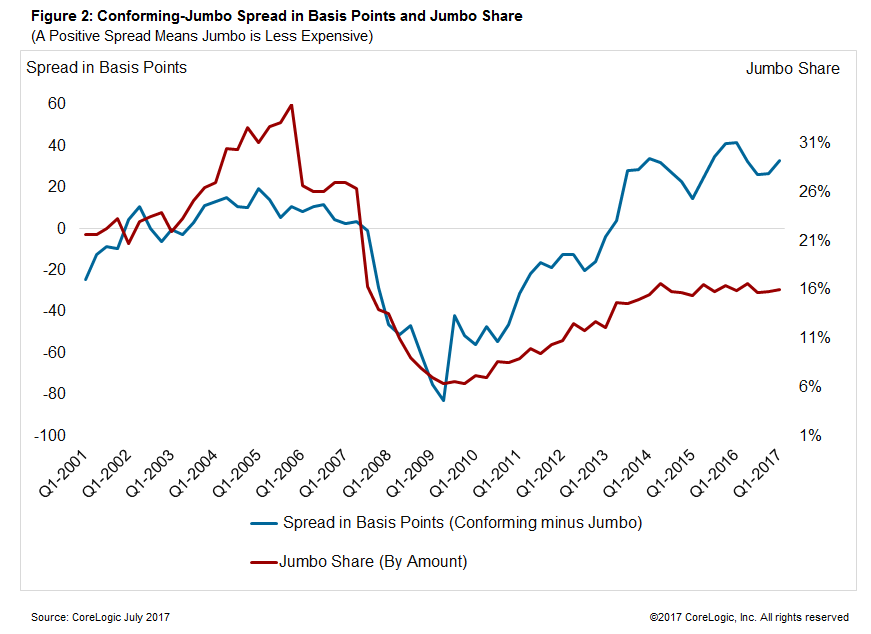

The blue line in Figure 2 shows the spread between the average rate for conforming loans and jumbo loans (left axis) with a positive spread indicating the jumbo loan was cheaper. The red line is the share of jumbo loans originated. Conforming loans were cheaper from the second quarter of 2007 until the first quarter of 2013 with the spread reaching its bottom in the second quarter of 2009. This made conforming loans cheaper by more than 80 basis points. The spread reversed to favor jumbo loans in 2013.

Pradhan doesn't draw any cause and effect conclusions from the increase in jumbo lending, however that path does somewhat echo the trend of the spread. The share of jumbo loans has reached its highest since 2009 at about 16 percent of home-purchase originations (in dollars); in 2009 the jumbo share was just 6 percent.