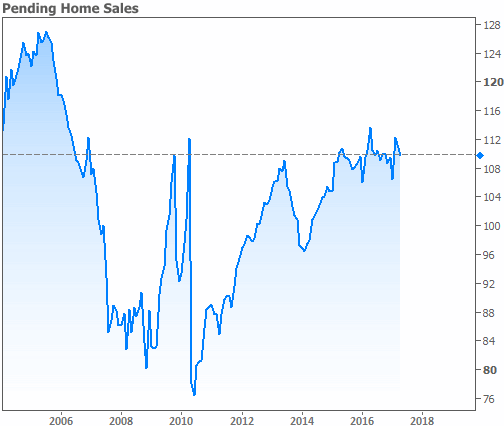

Pending home sales had been expected to rise slightly in April after declining 0.8 percent in March. Instead, the National Association of Realtors'® (NAR's) Pending Home Sale Index (PHSI) slumped for the second straight month, dropping 1.3 percent. The PHSI, based on contracts signed for existing home purchases, fell from 111.3 (revised from 111.4) in March to 109.8.

The April dip put the Index 3.3 percent below its level in April 2016. This was the first year-over-year decline since last December and the largest since the Index fell 7.1 percent in June 2014.

Analysts polled by Econoday had expected sales to rebound from their March loss by 0.5 percent with some looking for a gain of as much as 1.4 percent. The actual results were well below the lowest estimates of -0.5 percent. Econoday noted that "This year's month-to-month path of existing home sales has been accurately telegraphed by the pending home sales index which tracks initial contract signings. This index fell 0.8 percent in March and was followed by an even more sizable decline in final sales."

Lawrence Yun, NAR chief economist, said the fading contract activity in the normally active spring market is due to significantly weak supply levels. These, in turn, are spurring deteriorating affordability conditions. "Much of the country for the second straight month saw a pullback in pending sales as the rate of new listings continues to lag the quicker pace of homes coming off the market," he said. "Realtors are indicating that foot traffic is higher than a year ago, but it's obviously not translating to more sales."

Yun added, "Prospective buyers are feeling the double whammy this spring of inventory that's down 9.0 percent from a year ago and price appreciation that's much faster than any rise they've likely seen in their income."

The economist sees little evidence that the record low levels of inventory will improve any time soon. Homebuilding activity remains below the necessary levels and too few homeowners are listing their home for sale.

"The unloading of single-family homes purchased by real estate investors during the downturn for rental purposes would also go a long way in helping relieve these inventory shortages," said Yun. "To date, there are no indications investors are ready to sell. However, they should be mindful of the fact that rental demand will soften as the overall population of young adults starts to shrink in roughly five years."

NAR expects that existing home sales will increase about 3.5 percent from 2016 to 5.64 million units and the national median existing-home price is expected to increase around 5 percent. In 2016, existing sales increased 3.8 percent and prices rose 5.1 percent.

The decline of sales was nearly nationwide in scope and all four regions are now running lower index numbers than the previous April. The West was the only region enjoying a month-over-main gain. The PHSI in the Northeast decreased 1.7 percent to an index of 97.2, now 0.6 percent lower than the previous April. In the Midwest, the index fell 4.7 percent to 104.4, a decline of 6.1 percent year-over-year.

Pending home sales in the South declined 2.7 percent to 125.9, and were 2.3 percent below the level in April 2016. The index in the West jumped 5.8 percent in April to 100.0, but is still 4.2 percent below a year ago.

The PHSI is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.