Appraised values are key in underwriting a mortgage loan and CoreLogic says one of the challenges is to make sure the information an appraisal provides is valid. Appraisers are supposed to use current or recent transactions within the same market with similar physical and economic characteristics. These comparable sales serve as the baseline information on which the appraisal is developed.

Yanling Mayer, writing in the CoreLogic Insights blog says that, "In a demanding regulatory environment, appraisal reviewers and underwriters have increasingly incorporated automated appraisal review technology for faster and more cost-effective collateral underwriting and process control ─ while ensuring the appraisal report reflects industry's best practices, standards and guidelines, as well as requirements from Fannie Mae, Freddie Mac, FHA, and VA, and providing lenders with confidence in the value of the collateral supporting their credit decisions."

Appraisers are expected to use care and due diligence to ensure that the data on comparable sales they receive from third party sources are accurate. The sources are most commonly multiple listing services or county recorders (public record data). Mayer says MLS data are particularly important in providing the most up-to-date information on the local market. He found that, in a national sample of about two million single-family home appraisals, nearly nine out of ten of the comparable sales used by appraisers contained a direct reference to the local MLS as the source of data.

This reliance on MLS data presupposes the accuracy of MLS information, so CoreLogic checked those prices against public records data. To avoid potential confounding effects of regional differences in the quality and availability of public records data (for example, caused by state disclosure laws), the analysis shown here is based on a single state, California, and examines only purchase transactions in 2015 and 2016. The research involved 156,000 comparable sales.

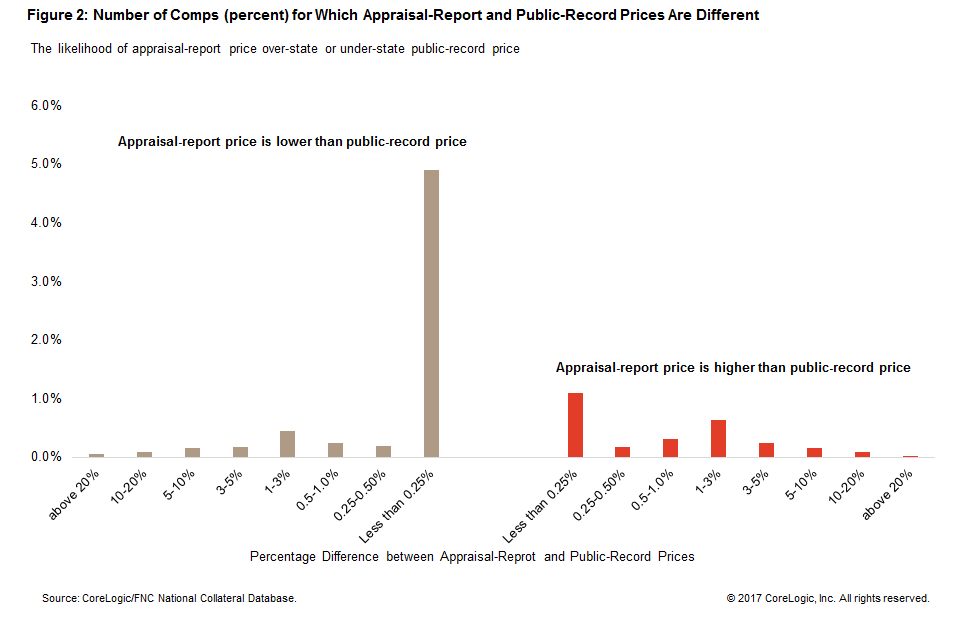

The company found an overwhelming level of agreement between the public records data and MLS information. In 91percent of the sample the appraisal-report price was identical to what was capture by county recorders. Where there was a difference, it was minimal, and the MLS-derived price tended to be lower. Six percent showed a price difference of less than 0.25 percent. In dollar terms that was less than $1,000 on a property appraised at $400,000. Only about 2.1 percent of comps had a discrepancy in price of 1 percent or more.

Across the sample, the MLS price was higher than the public records data in 2.7% of the cases. Looking at the 9 percent of cases where there was disagreement, the MLS prices averaged about $605 (0.085%) lower than the public records data.

Mayer says that, in those few cases where the two data sources did not exactly match, it was difficult to identify which source might have erred. For this reason, automated appraisal review tools will typically send a message to alert appraisal reviewers and underwriters when detecting a material discrepancy between the appraisal report and the validating data source.

He notes that an earlier study at Florida Gulf Coast University, using a much smaller sample taken from appraisals completed from 2004 to 2008, found a similar number of MLS/public records matches, 91.2 percent. In contrast to the CoreLogic analysis however, that study found where the sources disagreed, the MLS price was more likely to be higher by about 4 percent. He notes the differences could reflect different location, time period and data source.