The Urban Institute (UI) is asking "What has happened to black homeownership?" It has "declined to levels not seen since the 1960s when private race-based discrimination was legal." Like most demographic groups, black Americans saw homeownership gains evaporate during the housing crisis, but that community was hit harder than other groups and have not benefitted as fully from the recovery.

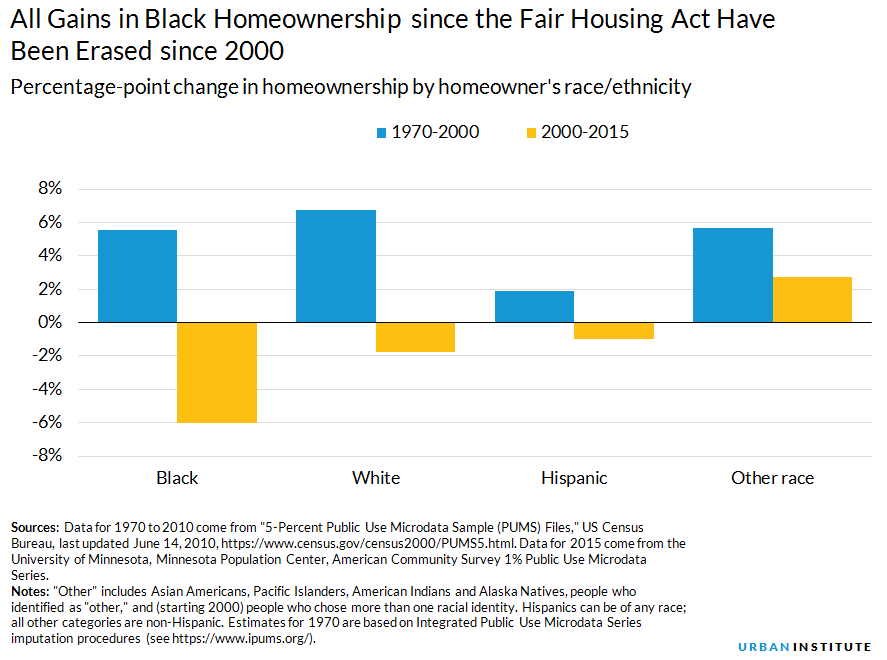

The authors* of a new UI blog research piece say that, in the three decades following passage of the Fair Housing Act, black homeownership rose by almost 6 percentage points, reaching 47.3 percent, but from 2000 to 2015 the rate dropped to 41.2 percent. This happened through forces both within and beyond the housing market. Black homebuyers bought homes at the peak of the bubble at higher rates than whites and Asians and often did so using subprime loans even though they qualified for prime loans. Two percentage points of the 6 percentage point slide happened from 2000 to 2010, the remainder happened in the following five years, three of them while the recovery was underway. White and Hispanic homeownership dropped less from 2000 to 2015, and homeownership rose for people in other racial groups (mainly Asian Americans).

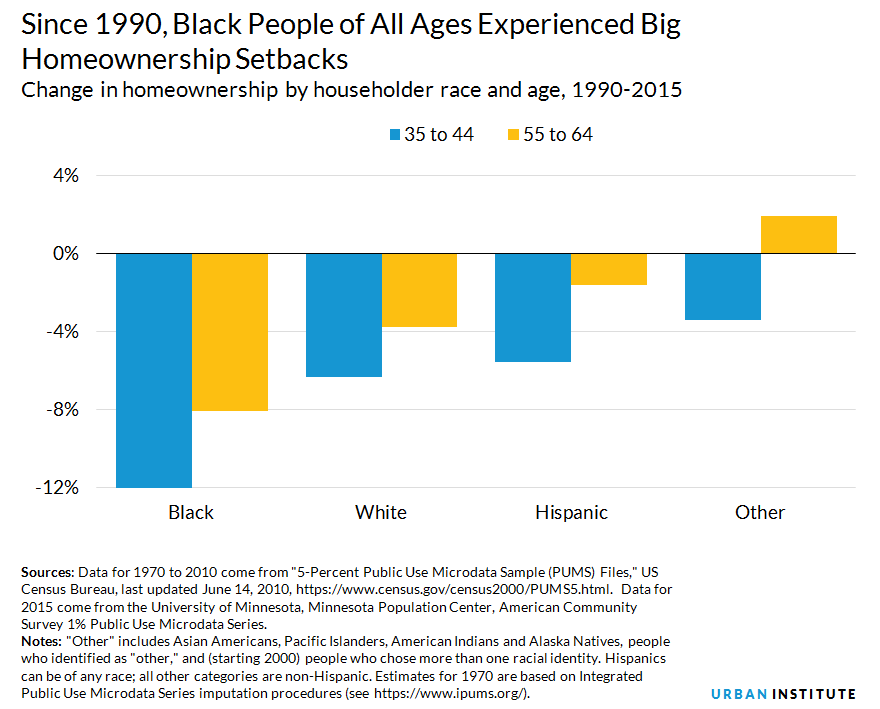

Black homeownership has declined most markedly among younger groups. For 35 to 44 year-olds it fell from 45 percent in 1900 to 33 percent in 2015, half the level for whites of the same age and lower than the black homeownership rate in 1960. Homeownership for the same age group also fell younger groups also fell during that 25-year period for whites, Hispanics, and other groups, but much less dramatically. Among 55- to 64-year-olds, black homeownership fell 8.1 percent, while homeownership for white and Hispanic households of the same age fell 3.7 and 2.1 percent, respectively.

UI calls the generational history particularly troubling, showing that "the prospects for black homeownership have gone from hopeful to pessimistic in only 15 years. Black Americans who were born in the last ten years of the baby boom (1956 to 1965) had a homeownership rate of about 50 percent by the time they turned 50. Early gen Xers, those born from 1966 to 1975 had an even higher rate in 2000, when they were in their late 20s and early 30s than the generation before them, but their transition to homeownership slowed over the next ten years. Then more of them lost their homes after 2010 than became homeowners. The late gen Xers and early millennials, those born from 1976 to 1985, are getting an even slower start than the two generations that preceded them.

UI says if these recent trends continue, black families will rent for more years before homeownership than they did a few years ago, shrinking housing choices, increasing their exposure to displacement, and delaying or closing off a key pathway to building wealth. Without reform black ,persons born between 1965 and 1975 will likely become part of the first generation born after 1900 to reach retirement age with more renters than homeowners among their community. This also threatens to exacerbate racial inequality for decades to come.

Reforms are needed to avert further declines; provide more affordable rental housing and more plentiful and secure access to homeownership. But reforms need to go beyond just housing. They need to address safe and healthy neighborhoods, high-quality education, fair credit scoring, access to good jobs and affordable healthcare, and measures to build and protect financial health. Such reforms will affect whether today's youngest generations will become homeowners before they retire.

*Authors were Laurie Goodman, Coordinator, Jun Zhu, Sr. Research Associate, both of the Housing Finance Center, and Rolf Pendall, Co-Director, Metropolitan Housing and Community Policy Center.