Analysts from the Urban Institute recently put a hard number on tight credit. The company says that lenders failed to make about 5.2 million mortgages between 2009 to 2014 because of rigid underwriting standards. An additional 1.1 million mortgages could have been processed in 2015 "if reasonable lending standards had been in place." All in all, 6.3 million mortgages that might have been disappeared over that six-year period.

UI says that since the 2008 housing crisis, borrowers with less than stellar credit have found it hard to obtain a mortgage. Purchase mortgages declined from 4.6 million in 2001 to 3.5 million in 2015 because of exceptionally high standards. Among the strictures facing less creditworthy borrowers are:

- "Overlays" or additional restrictions, above and beyond FHA and GSE requirements, that lenders put on borrowing because of concerns they may be forced to repurchase failed loans from guarantors.

- The high cost of servicing delinquent loans

- Concerns about potential litigation over imperfect loans.

UI says tight credit continues to frustrate borrowers, lenders, and policymakers, but modest progress has been made. The Federal Housing Finance Agency (FHFA) has taken many steps to address overlays, as has, to a far lesser extent, the FHA. The numbers of 2015 loans that "went missing" however, "supports the urgency of continuing regulatory and other reforms that will make mortgages more accessible to all creditworthy borrowers."

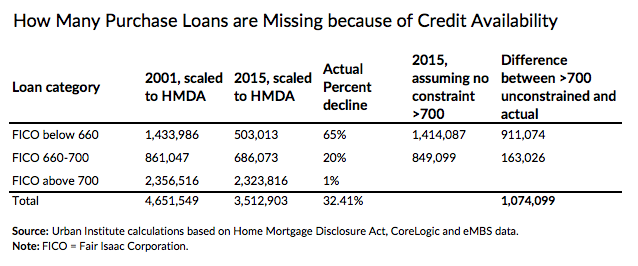

UI calculated how many mortgage originations there would have been if borrowers of all credit levels faced the same mortgage market in 2015 as they did in 2001. The table below shows that, across those years the number of new-purchase borrowers with FICO scores above 700 dropped 1.4 percent from 2.35 million to 2.32 million. New-purchase borrowers with scores between 660 and 700 declined by 20 percent and those with scores below 660 fell 65 percent.

UI says it believes that the above-700 bucket was unconstrained by credit availability and, contracted only 1.4 percent. The assumption is that, absent the issue of credit availability, the other two buckets would have contracted by the same amount resulting in 1.4 million loans in the below-660 bucket rather than 503,000. Roughly 911,000 loans that might have been made, were not. In the middle bucket a 1.4 percent contraction would have resulted in 849,000 originations for borrowers with scores of 660 to 700 rather than the actual figure of 686,000. Another 163,000 loans that evaporated.

While the tight credit standards appear to have reduced lending, they also apparently led to a higher share of all-cash sales. There were 5.8 million new and existing home sales in 2001, a number that increased to 8.2 million by 2005, dropped to 4.2 million by 2011 and climbed back to 5.6 million in 2015. "Despite the roller coaster ride," UI says, "home sales are now only 4 percent lower than they were in 2001".

But purchase mortgages have dropped dramatically over that time. There were 3.5 million first-lien purchase mortgages in 2015, compared to 4.7 million purchase mortgages taken out in 2001, a 32 percent decline. Making up the difference between the modest negative change in home sales and the dramatic decrease in purchase mortgage lending was a growth in cash sales. Their share increased from 18 percent in 2001 to 39 percent in 2012, edging back to 33 percent in 2015. Many cash buyers are investors, a situation the tight credit box has encouraged. With the delays and uncertainty created by a tight credit environment, sellers often take a cash offer rather than waiting on approval of a buyer's mortgage application.

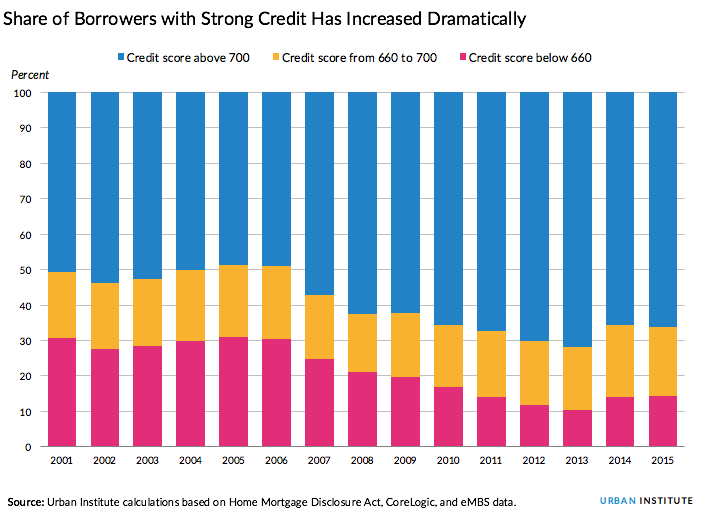

Figure 2 shows how tight credit has become and how many fewer borrowers there are with decent but lower credit. Even as the number of loans decreased there was still a drop in the share of borrowers with FICO scores below 660; from 31 percent to 14 percent from 2001 to 2015. The share of borrowers with FICO scores between 660 and 700 remained around 19 percent but the share with FICO scores above 700 increased from 51 percent to 66 percent.

UI concludes that, while recent FHFA and FHA policy adjustments have helped modestly to expand the credit box, their recent analysis shows there is still much to be done. "These missing loans don't just mean 1.1 million families are deprived of sharing in the critical wealth-building opportunity of homeownership. Fewer home sales also mean fewer construction jobs and lower sales of consumer goods that homebuyers purchase when they move into their new residence. Ultimately, this loss slows the entire US economy." They say the impact of this tight credit environment will reverberate for years to come.