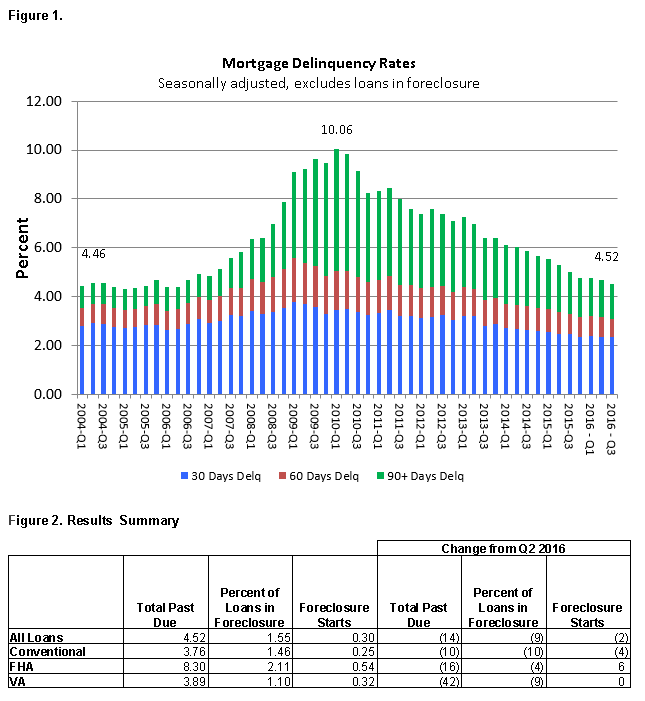

Mortgage delinquencies are now the lowest they have been since the second quarter of 2006, some two years before the housing crisis began and other mortgage performance metrics have reached similar or even historic lows. The quarterly National Delinquency Survey from the Mortgage Bankers Association (MBA) puts the rate at the end of the third quarter at a seasonally adjusted 4.52 percent of all outstanding loans. This is down 14 basis points (bps) from the second quarter of this year and 47 bps below the rate in the same quarter last year.

The delinquency rate includes loans that are one or more payments past due but not loans that have entered the foreclosure process. The serious delinquency rate includes loans that are 90 or more days past due and does include those in foreclosure, was 2.96 percent, a decrease of 15 bps from the second quarter and 61 bps year over year. This rate was at the lowest level since the third quarter of 2007.

The percentage of loans that were in foreclosure at the end of the quarter was 1.55 percent, 9 bps below the second quarter rate and down 33 bps year over year. This was the smallest foreclosure inventory since the second quarter of 2007. The foreclosure start rate was 0.30 percent, 2 bps and 8 bps below the two earlier periods. Foreclosure starts have not been at this low of a level since 2000.

Marina Walsh, MBA's Vice President of Industry Analysis, said, "Mortgage delinquency and foreclosure rates continued to decrease in the third quarter as sustained job growth and low unemployment helped more borrowers stay current with their mortgage payments. Monthly job growth averaged 206,000 jobs in the third quarter, making it the strongest quarter in 2016 thus far. The unemployment rate stayed just below 5 percent and wage growth continued to strengthen. These factors helped the mortgage delinquency rate improve to 4.52 percent in the third quarter. The delinquency rate has decreased in almost every quarter since the beginning of 2013 and is below its historical average of 5.36 percent for the period from 1979 to the present. Additionally, the 30-day delinquency rate decreased three basis points to 2.33 percent and the 60-day delinquency rate decreased four basis points to 0.77 percent from the previous quarter. Combined, the 30-day and 60-day delinquency rate was at its lowest level in the history of the survey dating back to 1979."

The delinquency rate was lower in the third quarter than the second for all loan types. The delinquency rate for conventional loans was 3.76 percent, a 10-bps decrease. The FHA rate was 8.30 percent, down 16 bps from the second quarter and the lowest rate since 1997. The VA rate was 3.89 percent, the lowest rate since MBA began the survey in 1979 and a quarter-over-quarter decline of 42 bps.

Foreclosure starts were down 4 bps for conventional loans and unchanged for VA mortgages but increased by 6 bps for FHA loans. MBA said even the resulting 0.54 rate was still below FHA's historical average of 0.60 percent.

The drop in the foreclosure inventory continues a trend that began in 2012. MBA says this rate continues to run higher in judicial than non-judicial states but does continue to shrink across the board. The rate in 48 states and the District of Columbia either saw declines or remained unchanged during the quarter. New Jersey and New York had the highest percentage of loans in foreclosure, at 5.79 and 4.32, respectively, but both states saw double digit basis point decreases from the previous quarter.