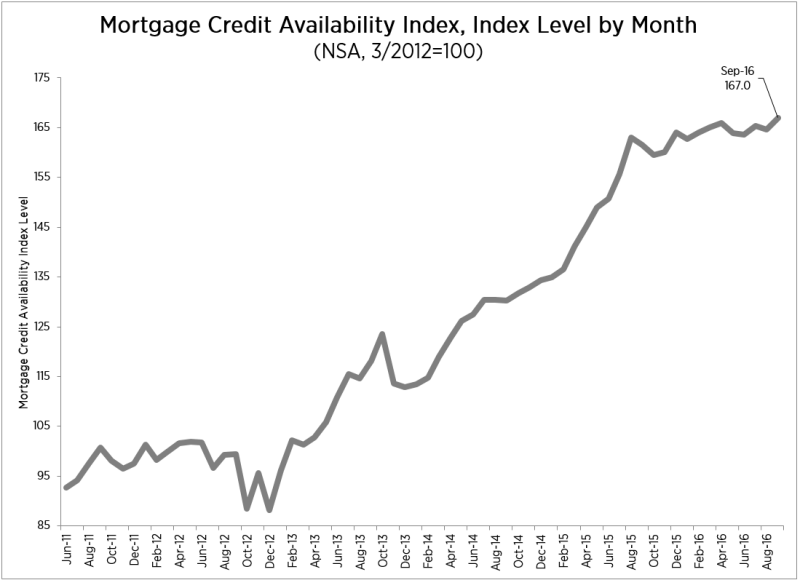

The Mortgage Bankers Association (MBA) said credit availability increased slightly in September. The Association's Mortgage Credit Availability Index (MCAI) gained 1.4 percent compared to August, rising to a reading of 167.0. A decline in the index indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

"The increase in credit availability in September was driven by more investors offering streamlined refinance programs to borrowers with USDA and FHA loans." said Lynn Fisher, MBA's Vice President of Research and Economics. "Streamline programs allow borrowers who have been consistently making their mortgage payments and meet other eligibility requirements, to refinance their existing mortgage into a lower interest rate with reduced documentation requirements. While these programs accounted for most of the increase, we also observed investors continuing their rollout of the new Fannie Mae and Freddie Mac low down payment (97 LTV) loan programs, and some increased availability of jumbo loans."

Of the four component indices, the Government MCAI saw the greatest increase in availability over the month (up 1.9 percent), followed by the Conventional MCAI (up 0.7 percent), the Conforming MCAI (up 0.7 percent), and the Jumbo MCAI (up 0.6 percent).

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via the AllRegs® Market Clarity® product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.