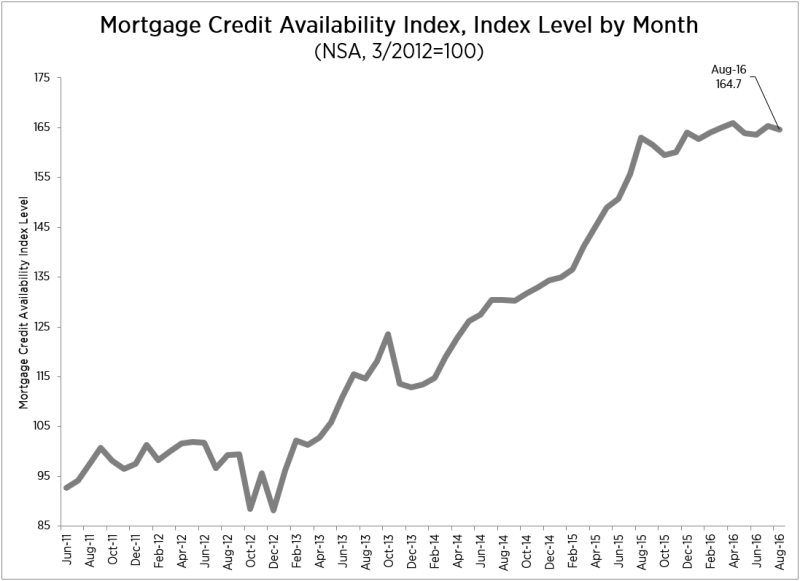

The Mortgage Bankers Association's (MBA's) Mortgage Credit Availability Index (MCAI) ticked down in August, indicating a slight and largely operational tightening of mortgage credit. The index lost 0.4 percent to a reading of 164.7.

Lynn Fisher, MBA's Vice President of Research and Economics explained, "Credit availability decreased slightly over the month, driven by one mid-sized investor closing their correspondent operations. Despite the loss of all of the programs associated with this investor, the Jumbo MCAI increased by 0.5 percent, indicating that credit conditions continue to ease among jumbo loan programs."

Of the four components of the MCAI the Conforming MCAI had the largest decrease, falling 0.9 percent, followed by the Government MCAI which lost 0.5 percent. The Conventional MCAI eased back by 0.2 percent while the Jumbo index, as Fisher said, was up 0.5 percent.

MBA constructs its index monthly using data from Ellie Mae's AllrRegs® Market Clarity® tool. The index was benchmarked to 100 in March 2012. The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The Conforming and Jumbo indices have the same "base levels" as the Total MCAI (March 2012=100) while the Conventional and Government indices have adjusted "base levels" in March 2012.