Isn't it amazing that, after the near-decade of turmoil we have just gone through, that CoreLogic is calling the housing market "an oasis of stability?" Maybe more surprising that those long-lamented tight inventories could be, in one respect, a good thing?

According to the company's Deputy Chief Economist Sam Khater, June's vote on Brexit caused the most volatile day in the history of foreign exchange markets and in the aftermath, a influx of global investment pushed long term Treasury notes to record lows. "But one market seems to have escaped these gyrations: U.S. housing."

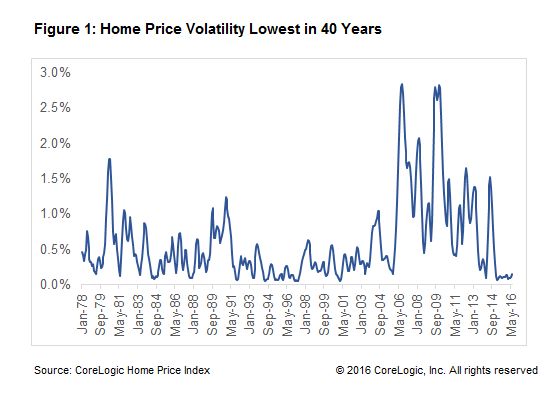

Khater, writing in the company's Insights blog, says the most common way to measure volatility is the standard deviation in the metric of interest. In the case of housing prices, that means the degree to which the year-over-year change in monthly housing prices fluctuates in relation to its average over time.

While the 2000s were rocky, historically home prices have not been particularly volatile. Going back 40 years he finds that price volatility has averaged 60 basis points but over the last two years the mean has been 20 points and in the most recent year only 10.

The last such placid period was 1994 to 1997 and though even then the volatility was greater than in the recent period, that stable mid-90s market helped anchor the economy during the recession of 2001. Khater says the dot-com downturn was and still is the mildest post-war recession because, in part, the real estate market served to "buffet declines in economic growth and equities."

Of course like everything related to real estate, location is paramount, and some markets, particularly San Francisco, have been very volatile. Home prices in that metro area were up 4 percent year-over-year in June, but had risen 12 percent on an annual basis only six months earlier. Markets with a mix of healthy economies, steady demand, and low inventories, he specifically mentions Phoenix, Raleigh, Tampa, Denver, and LA, have been very stable.

Due to very tight inventory of unsold homes and rising purchase demand, Khater expects stability in real estate prices to persist in the short term, even as other asset classes remain turbulent. This, he says is important because volatility is usually an indicator of risk. "Just like the 1990s, a stable home price environment is a very good sign for the housing market and will help anchor the economy if it encounters rough patches in the future," he says.